1. Forex Market Insight

EUR/USD

EUR/USD closed down 1.52% on Tuesday, 13th September 2022, at 0.9967. EUR/USD touched a near one-month high of 1.0197 on Monday, 12th September 2022. In the past 17 trading days, the euro against the dollar has 16 trading days below parity.

The slowdown in the eurozone economy continues to be a major negative for the euro. Shortage of energy supply is expected to push up inflation, and a serious drag on European GDP, so that Europe into a serious recession.

The European Center for Economic Research in Germany released data at local time on 13th September 2022, showing that the eurozone economic sentiment index for September -60.7, down about 6 percentage points from the previous month, showing that the European economic community is generally pessimistic about the prospects for economic development in the eurozone.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.9999-line today. If EUR runs steadily below the 0.9999-line, then pay attention to the support strength of the two positions of 0.9999 and 0.9879. If the strength of EUR breaks above the 0.9999-line, then pay attention to the suppression strength of the two positions of 1.0116 and 1.0190.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound rose to a two-week high on Monday, 12th September 2022, as data showed the U.K. unemployment rate fell to its lowest level since 1974, while wages excluding bonuses rose 5.2 percent, the highest growth rate in the three months to August 2021.

GBP/USD retreated on Tuesday, 13th September 2022, closing down 1.62% at 1.1491.

The British economic slowdown and the Bank of England rate hike is expected to cool the pound under pressure. The UK unemployment rate will rise at the end of the year, but a sharp rise is unlikely.

Technical Analysis:

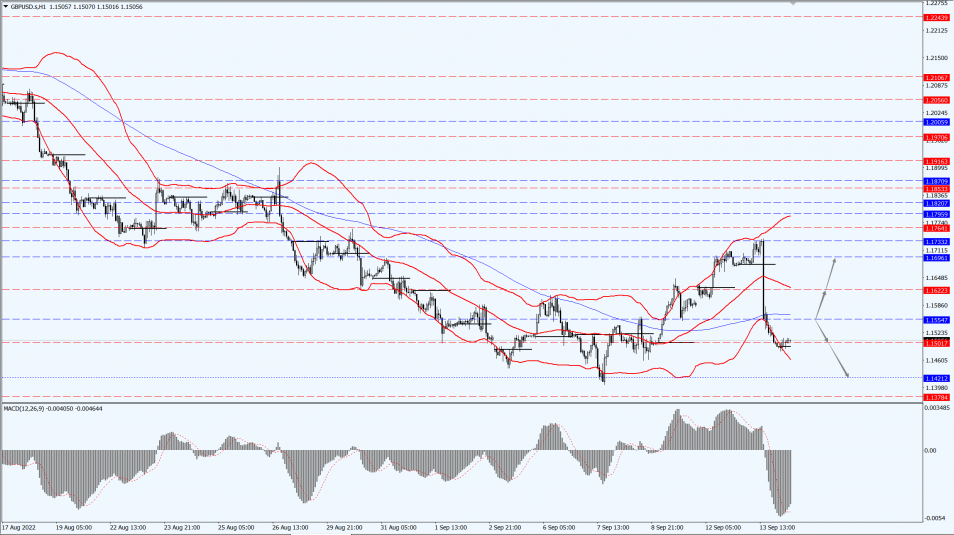

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1554-line today. If GBP runs below the 1.1554-line, it will pay attention to the suppression strength of the two positions of 1.1501 and 1.1421. If GBP runs above the 1.1554-line, then pay attention to the suppression strength of the two positions of 1.1622 and 1.1696.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell more than 1% on Tuesday, 13th September 2022, with the dollar jumping after an unexpected rise in consumer prices in August cemented bets on an aggressive Federal Reserve rate hike.

U.S. consumer prices rose unexpectedly in August, with core inflation accelerating amid climbing rent and health care prices.

The market now sees an 81% chance that the Fed will raise rates by 75 basis points at its Sept. 20-21 meeting.

Technical Analysis:

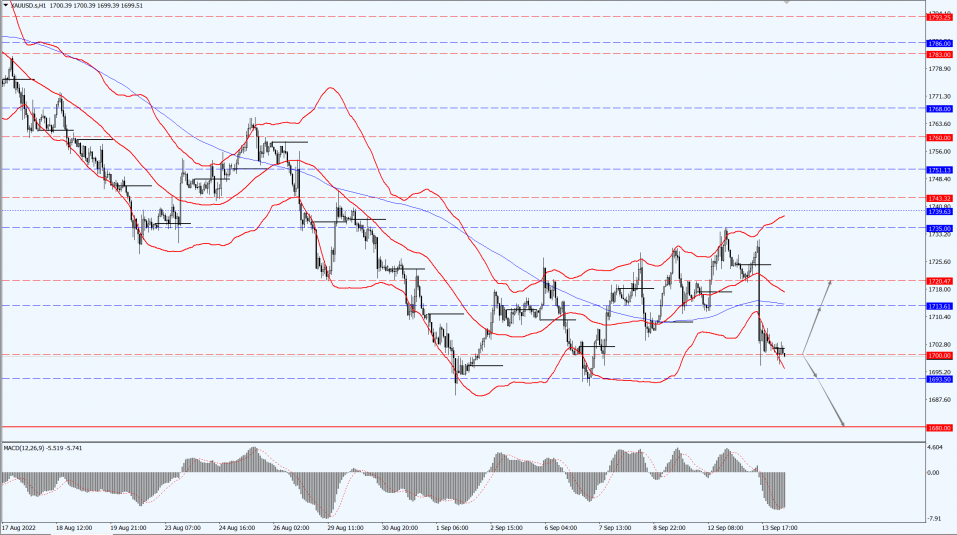

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1700-line today. If the gold price runs steadily below the 1700-line, then it will pay attention to the support strength of the 1693 and 1680 positions. If the gold price breaks above the 1700-line, then pay attention to the suppression strength of the two positions of the 1713 and 1720.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices closed nearly 1% lower on Tuesday, 13th September 2022, reversing earlier gains in the session, as U.S. consumer prices unexpectedly rose in August, providing the rationale for another sharp rate hike by the Federal Reserve next week.

The U.S. Labor Department said the Consumer Price Index (CPI) rose 0.1% in August after being flat in July.

Economists interviewed by Reuters forecast a 0.1 percent decline. Federal Reserve officials will meet next Tuesday and Wednesday, and inflation is currently well above the Fed’s 2% target.

Technical Analysis:

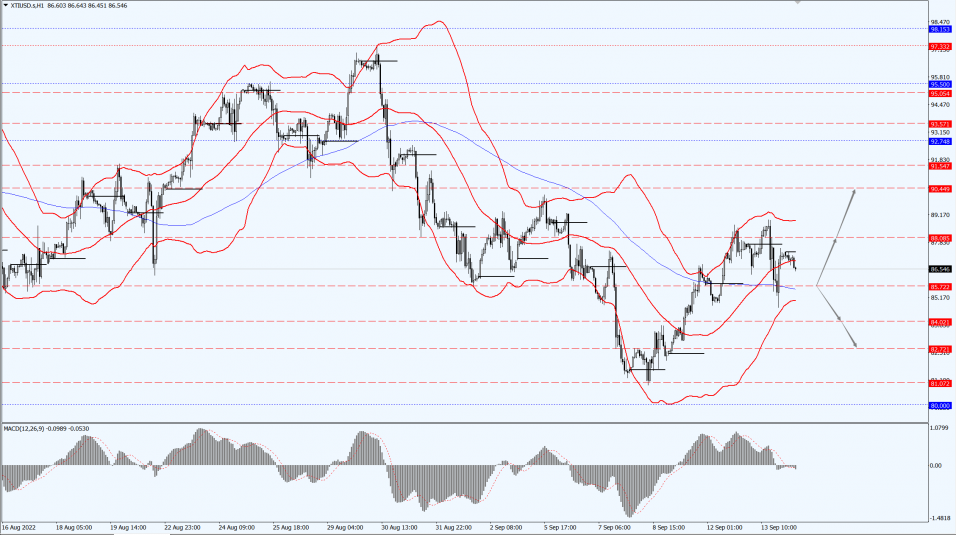

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 85.72-line today. If the oil price runs above the 85.72-line, then focus on the suppression strength of the two positions of 88.08 and 90.44. If the oil price runs below the 85.72-line, then pay attention to the support strength of the two positions of 84.02 and 82.72.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.