1. Forex Market Insight

EUR/USD

Last week, the dollar recorded its biggest weekly percentage decline in two months.

That’s because a rally in stocks helped weaken the appeal of the safe-haven dollar, while a 50 basis point rate hike by the European Central Bank (ECB) helped boost the euro to a two-week high.

The Ifo business sentiment survey showed Monday, 25th July 2022, that German business confidence fell more than expected in July to the lowest in more than two years.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0277-line today. If EUR runs steadily below the 1.0277-line, then pay attention to the support strength of the two positions of 1.0190 and 1.0116. If the strength of EUR breaks above the 1.0277-line, then pay attention to the suppression strength of the two positions of 1.0357 and 1.0529.

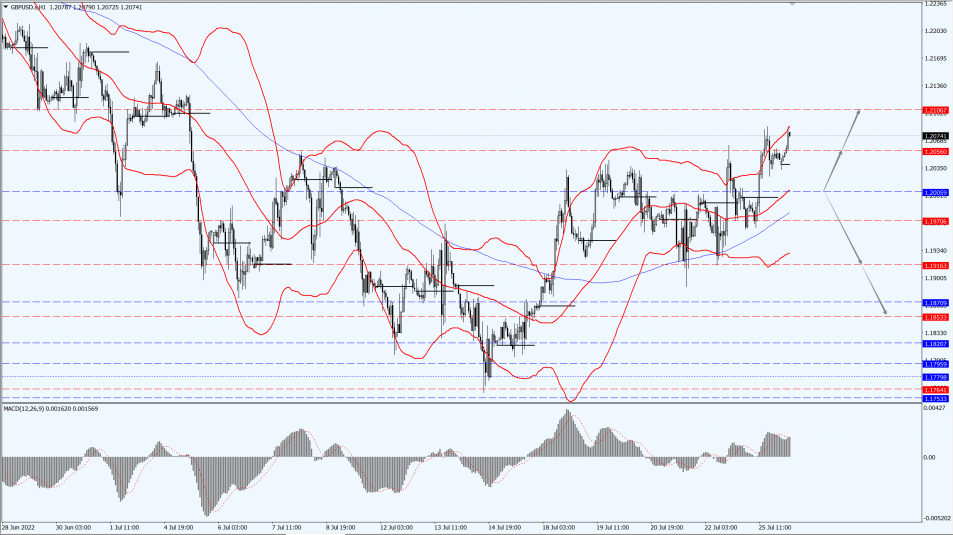

GBP Intraday Trend Analysis

Fundamental Analysis:

A survey by the Confederation of British Industry (CBI) on Monday showed that in the three months to July, British industrial output grew at its slowest pace in more than a year.

However, there are initial signs that some of the challenges around inflation and investment are easing.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2005-line today. If GBP runs below the 1.2005-line, it will pay attention to the suppression strength of the two positions of 1.1916 and 1.1853. If GBP runs above the 1.2005-line, then pay attention to the suppression strength of the two positions of 1.2056 and 1.2106.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices retraced earlier gains to fall on Monday, 25th July 2022, as U.S. Treasury yields rallied and the market braced for the Federal Reserve’s expected 75 basis point rate hike later this week.

The Federal Reserve is expected to raise its target overnight rate by another 75 basis points, rather than 100 basis points, at its July 26-27 meeting to curb stubbornly high inflation, according to a Reuters poll.

Meanwhile the likelihood of a recession in the coming year has risen to 40%. This is despite a falling dollar, which usually makes gold and silver more attractive to overseas buyers.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1713-line today. If the gold price runs steadily below the 1713-line, then it will pay attention to the support strength of the 1700 and 1680 positions. If the gold price breaks above the 1713-line, then pay attention to the suppression strength of the two positions of the 1736 and 1751.

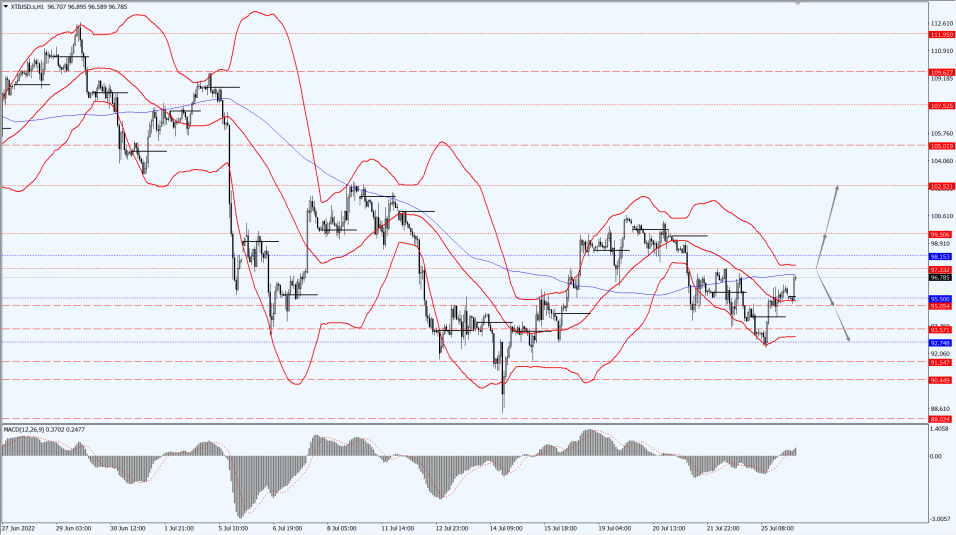

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose about $2 on Monday, 25th July 2022, helped by supply concerns and a falling dollar, but were in a sawing trend during the session, with some concerned that fuel demand could weaken if the Federal Reserve is too aggressive in raising U.S. interest rates.

The EU previously said it would allow Russian state-owned companies to ship oil to Libya’s national oil company said it aims to restore production to 1.2 million bpd from about 860,000 bpd within two weeks.

However, Libya’s output will remain volatile, with tensions remaining after clashes between rival political factions over the weekend.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 97.33-line today. If the oil price runs above the 97.33-line, then focus on the suppression strength of the two positions of 99.50 and 102.52. If the oil price runs below the 97.33-line, then pay attention to the support strength of the two positions of 95.05 and 92.74.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.