1. Forex Market Insight

EUR/USD

A member of the European Central Bank’s (ECB) Executive Committee reiterated that inflationary pressures are expected to weaken next year. The current levels suggest that there will be no changes in the monetary policy stance. The statement does not support a significant appreciation of the euro, which to some extent, follows the depreciation trend of other major currencies.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, on the top of the euro, focus on the suppressing strength at the 1.1820-line. Once the strength of the euro drops below the 1.1795-line, it will open up a further downside potential. Then pay attention to the support strength of the three positions at 1.1779, 1.1753, and 1.1727 in turn.

GBP Intraday Trend Analysis

Fundamental Analysis:

The main market concern currently is the spread of the new Delta variant on a global scale. The outbreak is bound to have an impact on the upcoming European manufacturing survey data.

While the Delta variant virus may boost the dollar’s safe-haven appeal, it could also derail the Fed’s plan to scale back its pandemic stimulus measures by year-end.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

Today, the pound is focused on the 1.3801-line. If the pound meets resistance and falls at the 1.3801 line, then it will focus on the support at the 1.3771 and 1.3721 positions. If the pound rises above the 1.3801-line, it will open up further upside potential. At that time, pay attention to the 1.3841 line.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

On Friday,27th August 2021, the price of gold surged 1.4%, as Powell’s speech at the Jackson Hole Fed’s 2021 Annual Economic Policy Symposium, and the weak performance in the number of U.S., data-supported gains.

However, the general risk sentiment shown by the rising stock market limited the price of gold increase.

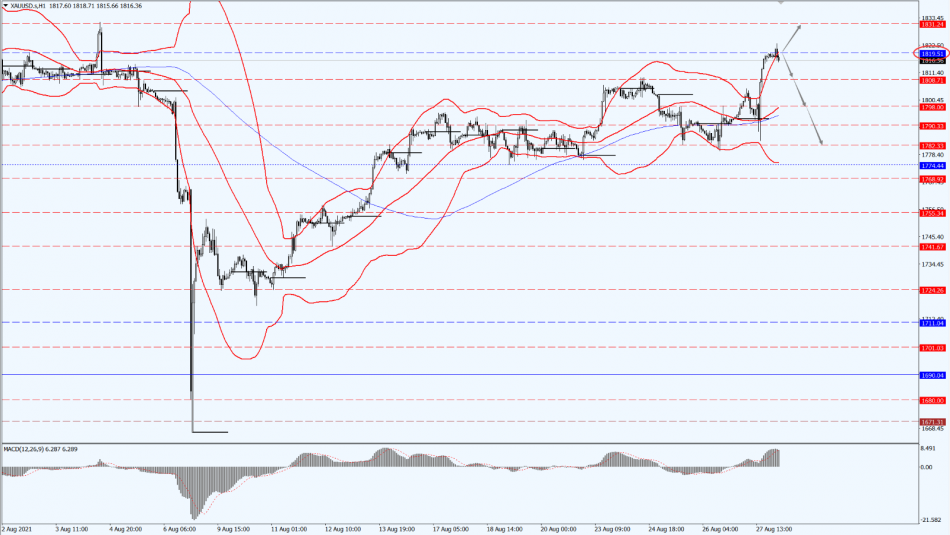

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Today, pay attention to the 1819-line on gold. If the gold price rises above the 1819-line again, it could possibly test the 1831-line. If it rises and falls, the gold price will have a phased peak signal. At that time, the gold price will follow the two positions of 1808 and 1798 in turn.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose by 2% on Friday, 27th August 2021, the biggest weekly increase in more than a year. Oil companies began to shut down the U.S. Gulf of Mexico’s production capacity as Hurricane Ida moved towards New Orleans, after crossing through Gulf of Mexico. Thus, this has created a huge impact on the U.S. energy supply.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, on oil prices, pay attention to the 69.07-line. If the oil price runs below the 69.07-line, pay attention to the support of the middle track of the Bollinger band. Once it falls below the middle track of the Bollinger band, oil prices will open up a greater downside potential. At that time, pay attention to the 66.83 first-line of support. If oil prices rise once again above the 69.07-line, it will open up a greater upside potential. At that time, pay attention to the suppression of the 69.75 and 70.49 positions in turn.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.