US Stocks

Fundamental Analysis:

There is an increasing number of forecasts that indicates the stock market will pull back. Although it has not yet been shown in some of the largest indices, it is safe to say that a lot of market strength has been exhausted.

Big rallies are a thing of the past. The S&P 500 has gone 34 days without rising 1% in any of them, the longest in 20 months. And the pool of companies feeling significant price pressure keeps expanding.

The data compiled by Morgan Stanley shows that more than half of the index’s members have suffered peak-to-trough declines of at least 10% since May. Meanwhile, the S&P 500 managed to fall five straight days without straying more than 2% from its all-time high. Yet, some see the stage is being set for a more meaningful dip.

Strategists from the Goldman Sachs Group and Citigroup have issued fresh warnings on the potential for negative shocks to upend the rally. What the market is most worried about is in the next six weeks, including the Fed’s planned reduction in stimulus measures and possible tax increases.

Stocks fell for the first week in three as mixed economic data kept investors on edge about the timing of stimulus tapering. The S&P 500 declined by 1.7% while the Nasdaq 100 fared better, owing to gains in tech megacaps such as Facebook.

Technical Analysis:

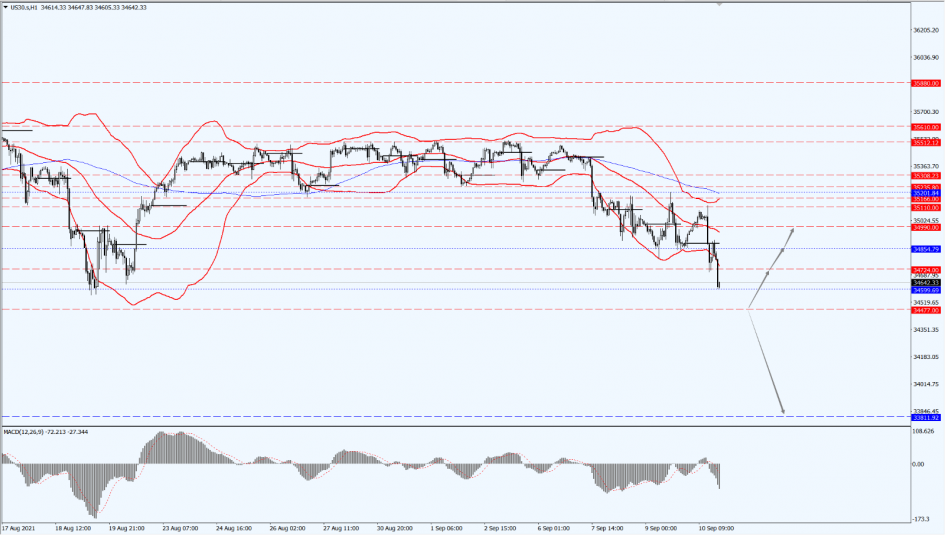

(Dow30,1-hour chart)

Execution Insight:

Today, pay attention to the direction of the Dow on the 34477 line. Once the Dow falls below the 34477 line, it will open up further downward revision. At that time, pay attention to the support strength of the 33811 line.

Once the Dow gains the support from the 34477 line, divert your attention to the suppression strength of the two positions 34724 and 34990 above. Overall, the Dow continues to have a bumpy ride.

Hong Kong Stocks

Fundamental Analysis:

There are two keys to the long-term attractiveness of the Hong Kong stock market. First, the premium from the A+H shares, usually calculating its shear difference. Second, there are indeed some good technology, pharmaceutical, and financial assets in the Hong Kong stock market. From the latest situation, taking into account the current state of global economic recovery, it is expected that there will be further room for growth in finance, energy, and other sectors in Hong Kong stocks in the future.

Technical Analysis:

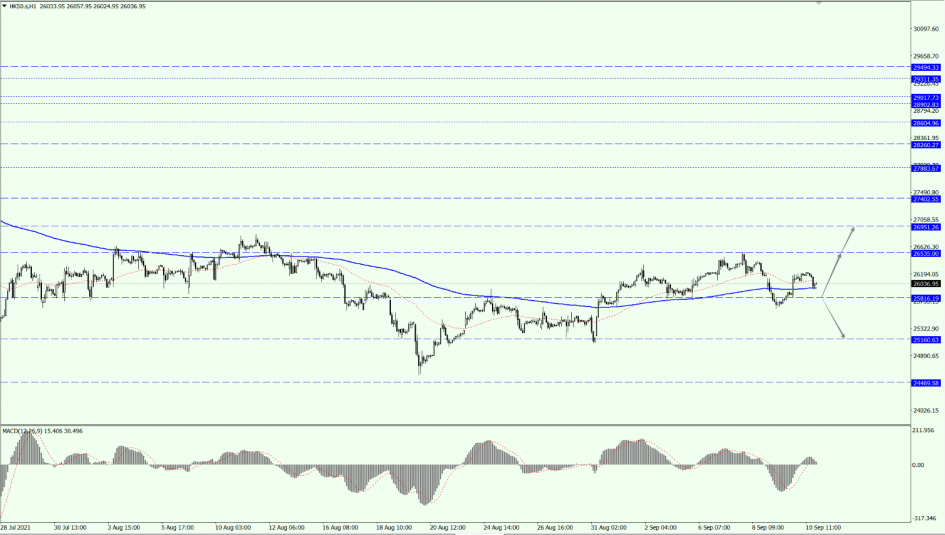

(HK50,1-hour chart)

Execution Insight:

On HK50 today, continue to pay attention to the support of the 25816 line. There is an uptrend line above 25816, and focus on the suppression strength of the two positions of 26535 and 26951 above. If HK50 falls below the 25816 line, then it will test the support of the 25160 line again.

FTSE China A50 Index

Technical Analysis:

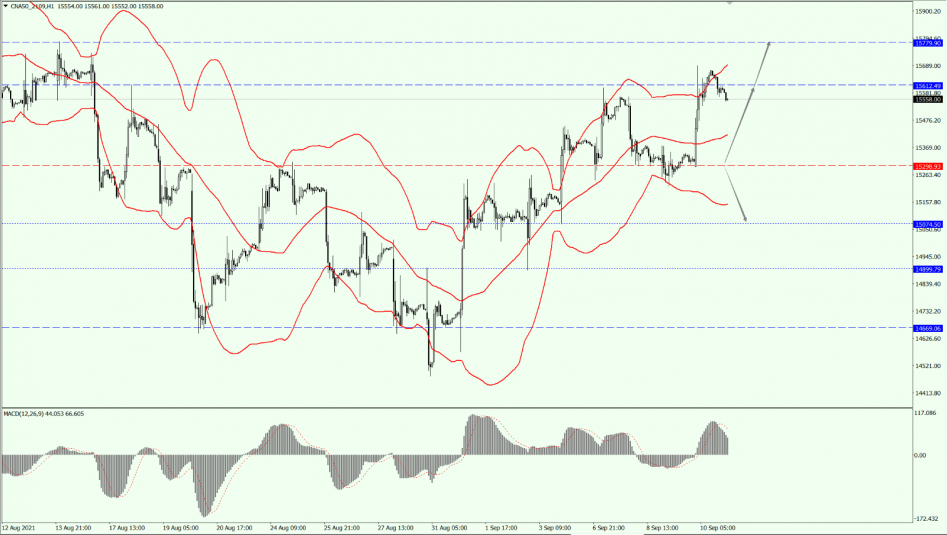

(A50,1-hour chart)

Execution Insight:

Today, on A50, pay attention to the support of the 15298 line. As long as A50 runs stably above the 15298 line, focus on the suppression strength of the 15612 line. At that time, pay attention to the support of the 15074 and 14899 lines below.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.