U.S Stocks

Fundamental Analysis:

The Dow and S&P 500 Index hit record closing highs as U.S. Senate passes the infrastructure bill.

The U.S. stock market rose on Tuesday,10th August,2021 with the Dow Jones Industrial Average and the S&P 500 both closing at record highs. This comes after the U.S. Senate passed a $1 trillion bipartisan infrastructure bill to push economically sensitive value stocks higher.

The bill has now been submitted to the United States House of Representatives for a vote. The bill could be the largest U.S. investment in roads, bridges, airports and waterways in decades. Senators have also begun their debate on a subsequent $3.5 trillion spending plan, which the Democrats are trying to get passed without the Republican’s support.

Kenny Polcari, founder and managing partner of Kace Capital Advisors, said, “The market believes that the first part has been nailed down and the market is fine with that.”

“I think the market will not be uncomfortable with the US$3.5 trillion spending plan, but it’s still possible that lawmakers could block the plan or delay its approval process, and conduct more consultations. Therefore, the market will not pay attention to this aspect yet.”

The Dow closed by 0.46% higher, the S&P 500 closed by 0.10% higher, while the Nasdaq closed by 0.49% lower.

As new cases in the U.S. increase, progress in the infrastructure bill should support the economic recovery.

Investors will also be watching this week’s inflation data to gain more insight on the Federal Reserve’s monetary policy plans. In addition, two of the Fed’s officials said Monday that the level of inflation has met one of the key criteria for rates to start rising.

Technical Analysis:

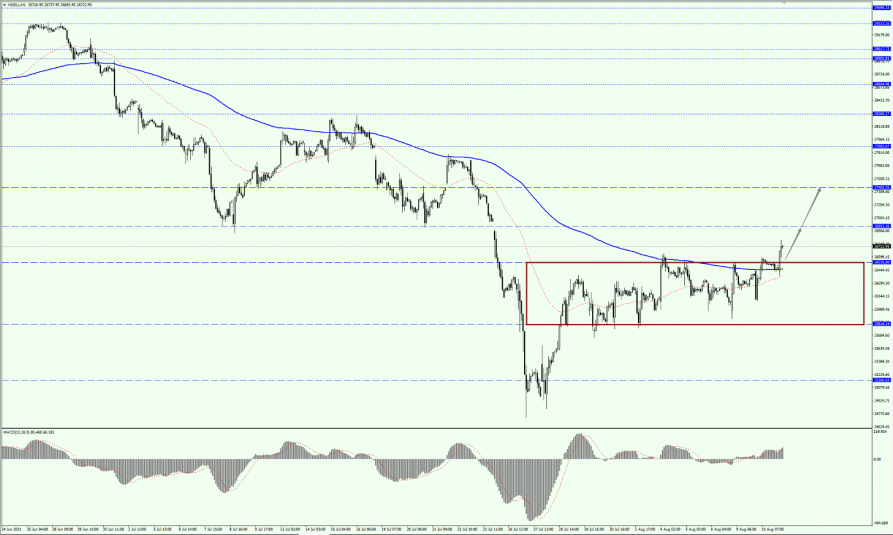

(Dow30,1-hour chart)

Execution Insight:

On Dow today, continue to pay attention to the 35110-line. When the Dow once again falls below the 35110-line, it will open up further room for retreat. At that time, pay attention to the support between the 34870 and 34724 positions. If the Dow is above the 35110-line, it should still maintain the trend. The idea of seeing more is key.

Hong Kong Stocks

Fundamental Analysis:

The Hong Kong’s three major stock indexes opened lower. The Hang Seng Index fell by 0.43% to 26,491-points, the Hang Seng China Enterprises Index (HSCEI) fell by 0.53% to 9,449-points, while the Hang Seng Technology Index fell by 0.47% to 6,798-points.

On the market, Evergrande Group confirmed that it will sell its assets to save itself. Evergrande concept stocks continued yesterday’s gains. China Evergrande and Evergrande Property all opened higher than 4%.

Industry stocks including housing, dairy products, photovoltaic, gaming, and pharmaceuticals generally rose, with Lizhu Pharmaceuticals jumped by nearly 7%.

Large science network industry’s stocks were mixed, as Tencent, and Xiaomi opened higher by nearly 1%, while Alibaba, Meituan, and Baidu rose more than 1%.

Other industries such as beer, telecommunications, sporting goods, and most of the auto stocks were lower.

Technical Analysis:

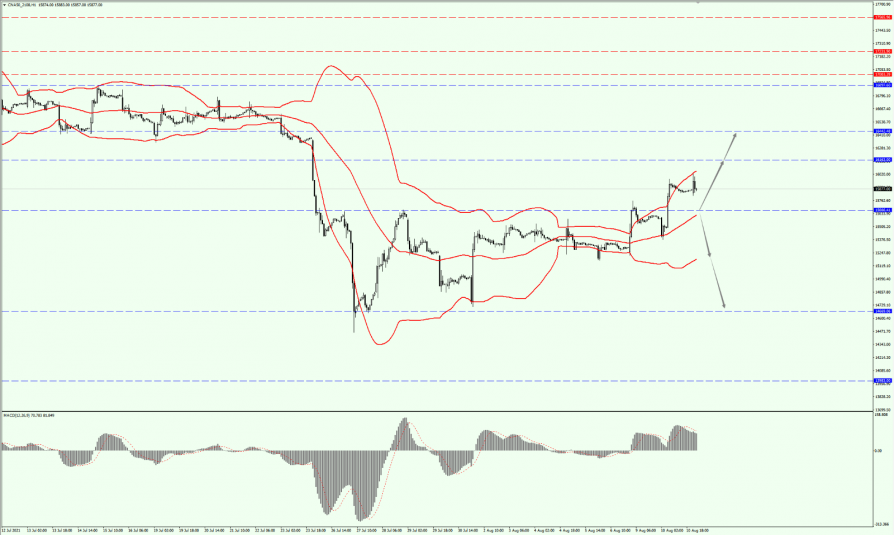

(HK50,1-hour chart)

Execution Insight:

After HK50 broke through the 26535-line yesterday, it opened up further upside potential. With that, we will pay attention to the suppression of the 26951 and 27402 position today.

FTSE China A50 Index

Technical Analysis:

(A50,1-hour chart)

Execution Insight:

On A50 today, pay attention to the 15666-line. When the A50 is above the 15666-line, the main idea is to keep the bullish trend. At that time, pay attention to the suppression between the 16163 and 16442 positions. If the A50 falls below the 15666-line, then pay attention to the lower track of the Bollinger band.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.