US Stocks

Fundamental Analysis:

Global stock markets rose for the seventh consecutive day, and US stock index futures rose as investors bet that a slowdown in hiring in the world’s largest economy could delay the Federal Reserve’s tapering of stimulus measures. Although the US market is closed for Labor Day, the MSCI World Index increased for the fourth consecutive day.

Technical Analysis:

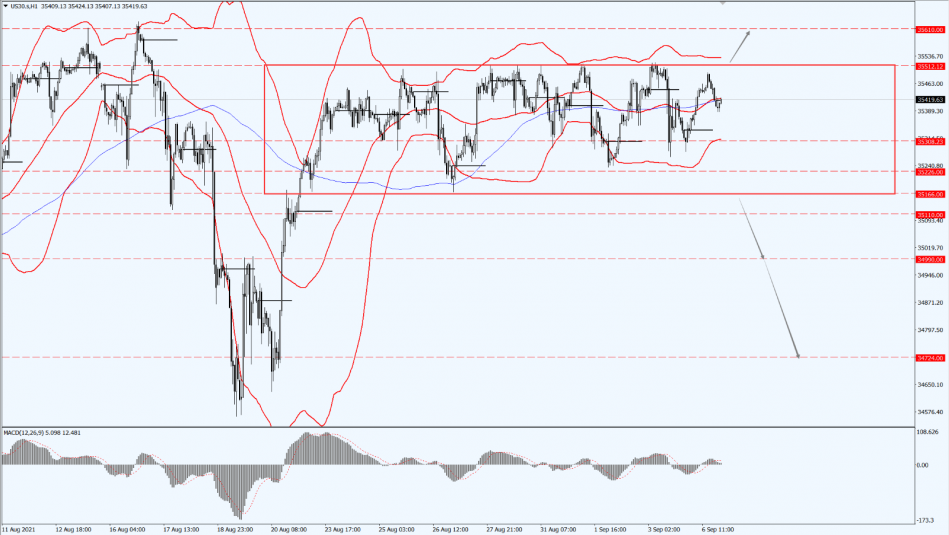

(Dow30,1-hour chart)

Execution Insight:

Today, continue to pay attention to the direction of the Dow’s breakthrough in the expanded shock range. If it falls below the 35166 line, it will open up further downward revision. Then focus on the support of the 34990 line, if it breaks through the 35512 line, it will open up further upward revision. At that time, divert your attention to the suppression strength of the 35610 line.

Hong Kong Stocks

Fundamental Analysis:

The three major Hong Kong stock indices collectively opened higher today. The Hang Seng Index rose by 0.17%, to 26,207 points; Hang Seng China Enterprises Index gained 0.16%, to 9,386 points; and the Hang Seng Technology Index added 0.52%, to 6,814 points.

On the intraday market, domestic coal futures rose sharply at the opening. China Coal Energy increased by 1.75% higher, China Shenhua rose by 0.9%; domestic housing stocks and aluminum stocks performed strongly. Aluminum Corporation of China Limited rose by more than 2%, Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation Zone expanded greatly, Shenzhen International Holdings added nearly 4%, Shenzhen Investment gained more than 3%; large technology stocks rose in general.

Meituan and Baidu rose by 1.4%, Tencent rose by 1%, Alibaba and Jingdong opened slightly higher. Biomedicine fell significantly, while power stocks and beer stocks weakened.

Technical Analysis:

(HK50,1-hour chart)

Execution Insight:

On HK50, pay attention to the support of the 25816 line. If HK50 runs above this line, it will maintain a bullish trend. Then, focus on the suppression strength of the two positions of 26535 and 26951 above. If HK50 falls below the 25816 line, then it will test the support of the 25160 line again.

FTSE China A50 Index

Technical Analysis:

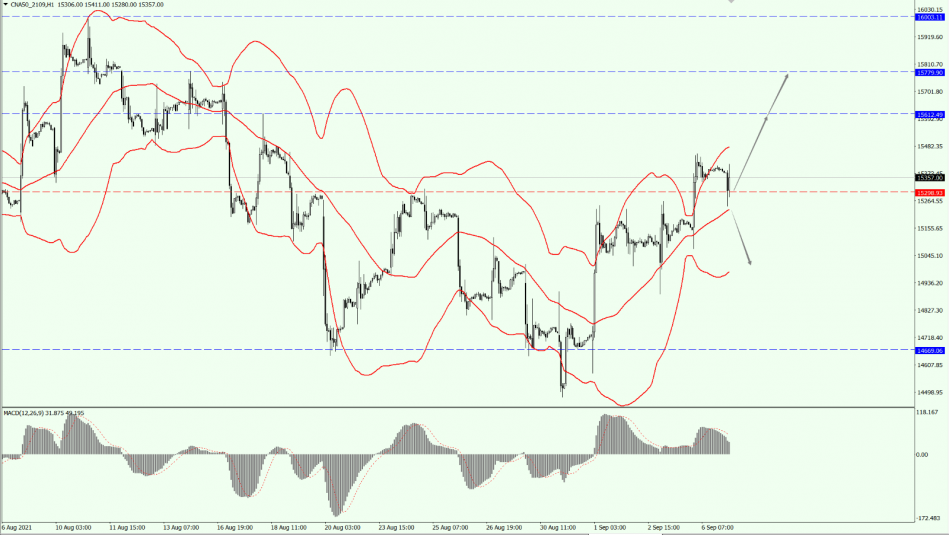

(A50,1-hour chart)

Execution Insight:

Today, on A50, pay attention to the support of the 15298 line. As long as A50 runs stably above the 15298 line, pay attention to the suppression strength of the 15612 line. Then, focus on the support of the middle Bollinger Band below, as long as it does not fall below the middle Bollinger Band, it will remain a bullish trend. However, if A50 falls below the middle Bollinger Band, then look at the support at the lower Bollinger Band.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.