U.S. Stocks

Fundamental Analysis:

The S&P 500 index of U.S. stocks rebounded Wednesday, 15th June 2022, ending a five-day losing streak, after the Federal Reserve announced a policy to raise interest rates to levels expected by the market.

The Fed seeks to fight rising inflation without triggering a recession. The Fed raised its target interest rate by three-quarters of a percentage point, the largest increase since 1994, and expects the economy to slow and the unemployment rate to rise in the coming months.

Stocks were volatile after the statement was released, and stocks turned decisively higher after Chairman Powell said at a press conference that a 50 basis point or 75 basis point hike was most likely at the next meeting in July, but he does not expect a 75 basis point hike to be uncommon.

By the close, the Dow Jones Industrial Average rose 303.7 points, or 1%, to 30,668.53, the S&P 500 rose 54.51 points, or 1.46%, to 3,789.99, and the Nasdaq gained 270.81 points, or 2.5%, to 11,099.16.

The S&P 500’s previous five-day losing streak was its longest since early January.

Ultimately, growing concerns about surging inflation, higher borrowing costs, slowing economic growth and corporate earnings have kept stocks under pressure for much of the year.

Technical Analysis:

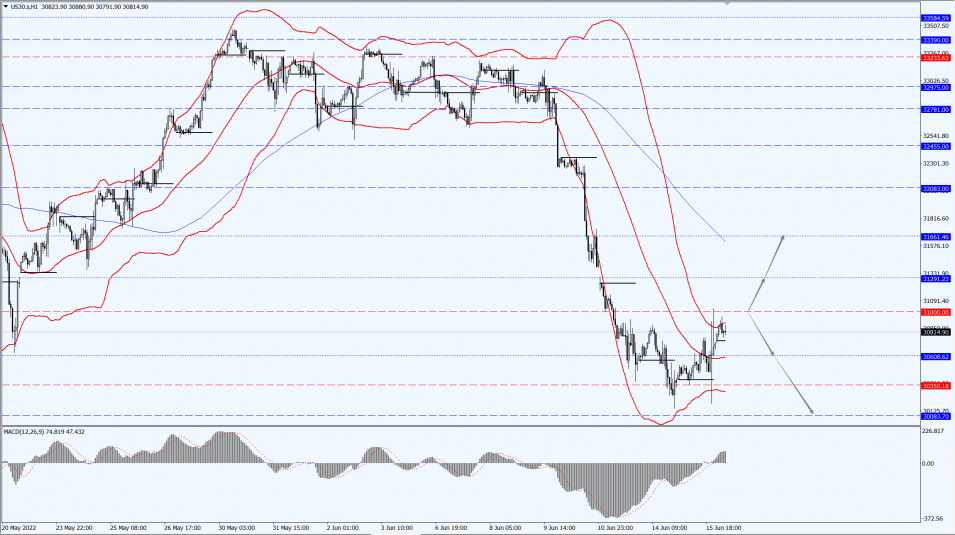

(Dow 30, 1-hour chart)

Execution Insight:

The Dow focuses on the 31,000-line today. If the Dow runs steadily below the 31,000-line, it will pay attention to the support strength of 30608 and 30083. If the Dow rises above the 31,000-line, it will pay attention to the suppression of 31291 and 31661.

Hong Kong Stocks

Fundamental Analysis:

Global financial markets rose collectively as the U.S. rate hike landed and Powell said 75 basis points would not be the norm.

Hong Kong stocks opened higher, the Hang Seng Index (HSI) rose 1.14%, the Hang Seng China Enterprises Index (HSCEI) rose 1%, the Hang Seng TECH Index (HSTECH) rose 1.29%.

On the board, most large technology stocks were stronger, with JD.com, Inc. (9618.HK), Alibaba Group Holding Limited (9988.HK) and Baidu, Inc. (9888.HK) up over 3%, Meituan (3690.HK) up 2.8%, Xiaomi Corporation (1810.HK) up about 2%, and Kuaishou Technology (1024.HK) down over 2%.

Sporting goods stocks rose significantly, Chinese brokerage stocks continued to move higher, and auto stocks, biotech stocks and real estate stocks generally rose.

On the other hand, e-cigarette concept stocks moved significantly lower, and port shipping stocks, gas stocks, and oil stocks generally fell. Koolearn Technology Holding Limited (1797.HK) opened nearly 15% higher, rising for the 9th consecutive day.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 21450-line today. If HK50 can run stably above the 21450-line, then pay attention to the suppression strength of 22127 and 22785. If HK50 runs below the 21450-line, then pay attention to the support strength of 20467 and 19517.

FTSE China A50 Index

Technical Analysis:

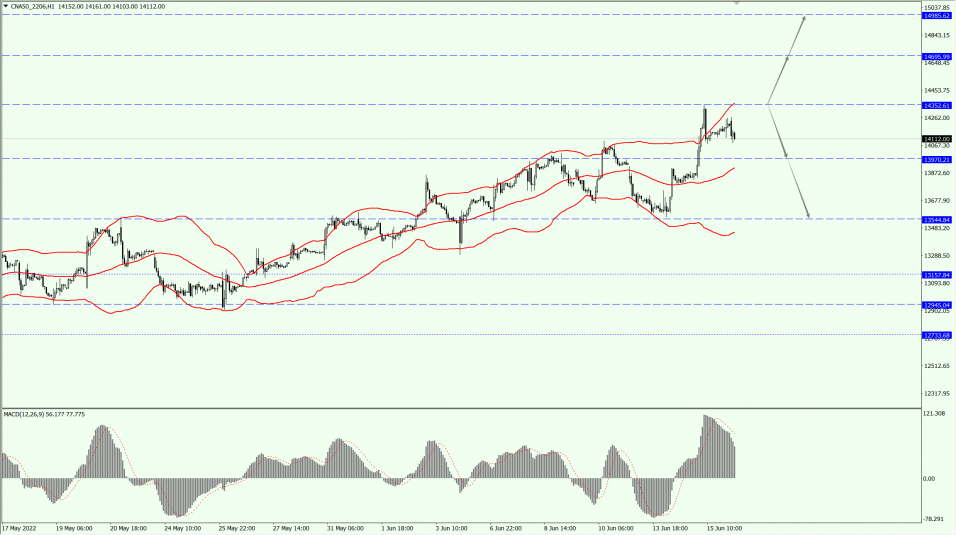

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 focuses on the 14352-line today. If the A50 runs steadily below the 14352-line, it will pay attention to the support strength of the two positions of 13970 and 13544. If the A50 runs above the 14352-line, it will open up further upward space. At that time, pay attention to the two positions of 14695 and 14985.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand the any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.