U.S. Stocks

Fundamental Analysis:

Trading was light on Monday, 30th May 2022, as U.S. stock and bond markets were closed for the Memorial Day public holiday.

The data released on Friday, 27th May 2022 showed that the U.S. consumer spending rose more than expected in April as households increased their purchases of goods and services, and inflation rose at a slower pace.

Analysts said the encouraging economic data, coupled with market bets that the Federal Reserve will take a more cautious approach to tightening, is weakening the dollar.

During this interval, global stocks rose on Monday as Asian powerhouses eased Covid-19 restrictions and introduced new stimulus measures to help sustain last week’s rally.

Technical Analysis:

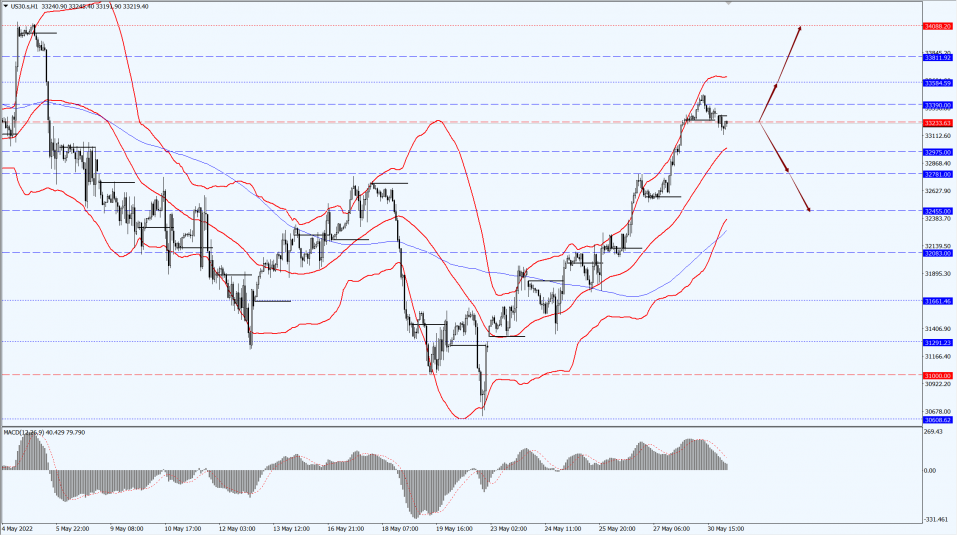

(Dow 30, 1-hour chart)

Execution Insight:

The Dow focuses on the 33233-line today. If the Dow runs stably above the 33233-line, it will pay attention to the suppression strength of the 33584 and 34088 positions. If the Dow falls below the 33233-line, it will pay attention to the support strength of the 32781 and 32455 positions.

Hong Kong Stocks

Fundamental Analysis:

Stock indexes of the two cities fell in early trading, and then shocked upward. Growth Enterprise (GME) Index once fell more than 1% during the day, and then turned red.

By midday close, the Shanghai Stock Exchange Index rose 0.75% to 3172.73 points. The Shenzhen Stock Exchange index rose 1.21%, at 11,447.31 points, while the GEM index rose 1.23% to 2379.35 points.

On the board, plantation and forestry, food concepts, corn and other sectors led the two markets. Coal mining and processing, new urbanization, water conservancy and other sectors were the top decliners.

Up to now, the ratio of all trading stocks in Shanghai and Shenzhen stock exchanges is 2708:1833, with 77 daily limit and 12 down limit.

In terms of northward capital, northward capital net inflow of more than 6.1 billion In terms of northbound funds, the net inflow of northbound funds exceeded 6.1 billion yuan in the morning, of which the inflow of Shanghai Stock Connect exceeded 3.4 billion yuan, and the inflow of Shenzhen Stock Connect exceeded 2.7 billion yuan.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 20467-line today. If HK50 can run stably above the 20467-line, then pay attention to the suppression strength of 21450 and 22127. If HK50 runs below the 20467-line, then pay attention to the support strength of 19517 and 18606.

FTSE China A50 Index

Technical Analysis:

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 pays attention to the 13157-line today. If the A50 runs steadily below the 13157-line, pay attention to the support strength of the two positions of 12945 and 12733. If the A50 runs above the 13157-line, it will open up further upward space. At that time, pay attention to the two positions of 13544 and 13970.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand the any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.