U.S. Stocks

Fundamental Analysis:

Major U.S. stock indexes closed higher Tuesday, 15th November 2022, shrugging off volatility triggered by unconfirmed reports that a Russian missile flew into Polish territory causing an explosion.

Investors focused on weaker-than-expected U.S. inflation data, which raised hopes that the Federal Reserve would slow the pace of interest rate hikes.

Stocks were boosted by inflation data released on Tuesday that showed the producer price index (PPI) rose 8% in the 12 months to October, compared with an estimated 8.3% gain.

Wal-Mart, the largest U.S. retailer, rose 6.5% after the company raised its annual sales and profit forecasts, thanks to steady demand for daily necessities, despite higher prices. Other retailers followed Wal-Mart in gains.

Target, which will report results on Wednesday, rose 3.9%, and Open Market rose 3.3%.

Home improvement chain Home Depot rose 1.6% after results showed the company used higher prices in the third quarter to overcome the impact of lower customer transaction volumes.

Technical Analysis:

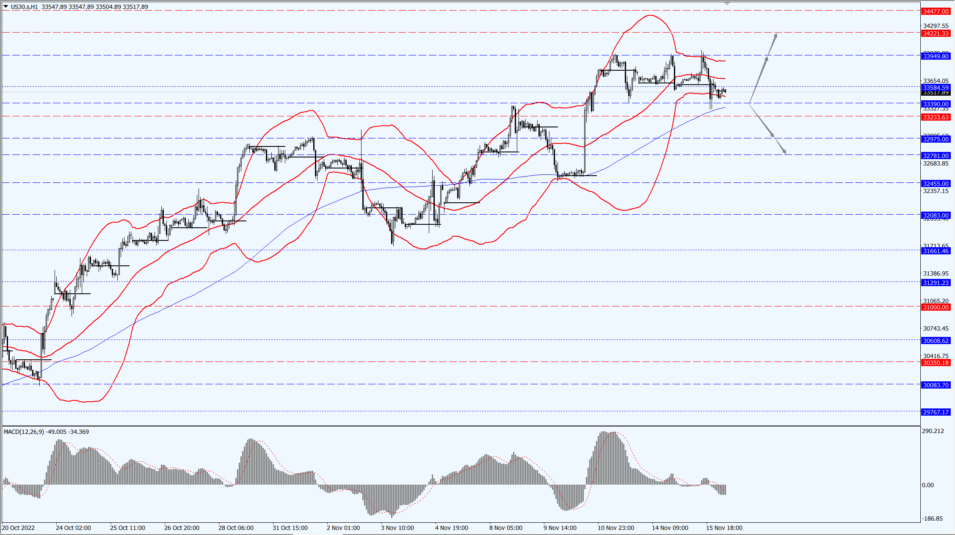

(Dow 30, 1-hour chart)

Execution Insight:

The Dow pays attention to the 33390-line today. If the Dow runs stably above the 33390-line, then pay attention to the suppression strength of the 33949 and 34221 positions.

Hong Kong Stocks

Fundamental Analysis:

After days of strong rebound, today’s market has been tangled repeatedly.

The Hong Kong A-share index once turned red and then turned green, as of press time, the Shanghai Stock Exchange Composite Index fell slightly by 0.22%, the Growth Enterprise Index fell slightly by 0.59%, the Hang Seng Index (HSI) fell 0.81%, and the Hang Seng TECH Index (HSTECH) fell 1%.

In general, the weak adjustment of Hong Kong A-shares today is due to the fact that after the market has rebounded for several days, some funds have chosen to take profits in advance.

On the other hand, the geopolitical “headwinds” reared their ugly head as the Polish Prime Minister announced that he would raise the operational readiness of the Polish army after news that a missile had exploded in the territory of NATO member Poland, killing two people.

This incident has reduced investors’ risk appetite.

From the current overall performance, it can be seen that the main logic of the market is still moving in the direction of high cost performance and high odds, so undervalued sectors with fundamental support continue to rotate.

In this case, after a period of market rebound, funds choose to take profits, and rest adjustments are also normal operations.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 pays attention to the 17535-line today. If HK50 can run stably above the 17535-line, then pay attention to the suppression strength of the two positions of 18606 and 19517.

FTSE China A50 Index

Technical Analysis:

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 pays attention to the 12273-line today. If A50 runs stably below the 12273-line, then pay attention to the support strength of the two positions of 11955 and 11665. If A50 runs above the 12273-line, it will open up further upside space.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.