U.S. Stocks

Fundamental Analysis:

Major U.S. stock indexes closed lower on Thursday, 6th September 2022, as concerns grew that the Federal Reserve’s aggressive rate-hike interest rate stance would lead the economy into recession ahead of Friday’s much-anticipated monthly nonfarm payrolls data.

The market briefly took comfort from the data, which showed that initial jobless claims rose the most in four months last week, offering a glimmer of hope that the Fed may slow down the fastest and most aggressive round of rate hikes in decades, which began in March.

The stock market has been slow to recognize the consistent message from Fed officials that interest rates will remain high for a long time until the pace of inflation slows significantly.

Federal Reserve Bank of Chicago President Evans was the latest policymaker to spell out the Fed’s rate hike outlook on Thursday, saying policymakers expect to raise rates another 125 basis points before the end of the year.

Ten of the S&P 500’s 11 major sectors closed lower, led by real estate stocks, which fell as much as 3.3%.

Stock indexes such as the Philadelphia Semiconductor Index, the Small Cap Index and the Dow Jones Transportation Index also fell.

The Growth Stock Index fell 0.76%, while the Value Stock Index lost 1.18%. Energy stocks were the only sector to gain, up 1.8%.

Oil prices rose about 1% on Thursday, holding at a three-week high, after the OPEC+ coalition of the Organization of Petroleum Exporting Countries (OPEC) and allies agreed to cut oil production by 2 million barrels per day, the deepest cut since 2020.

Technical Analysis:

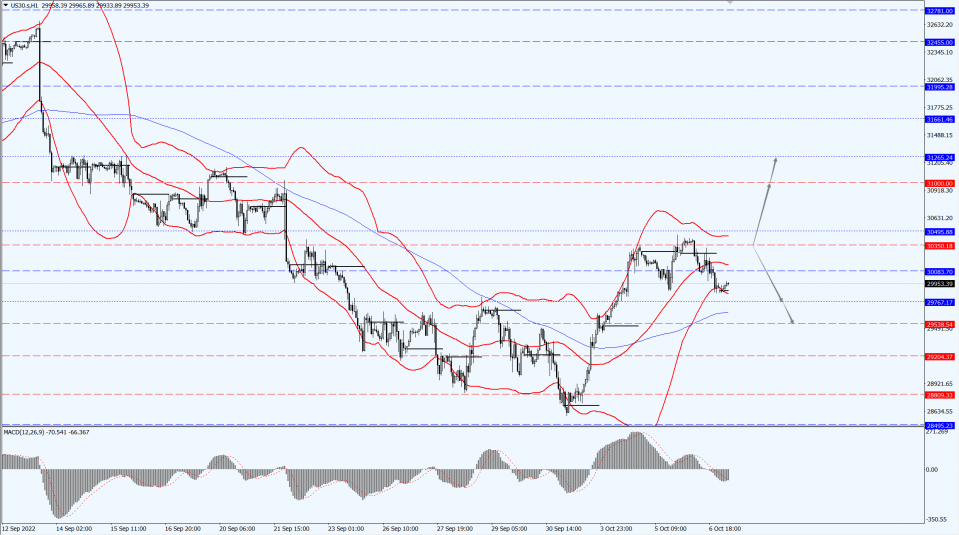

(Dow 30, 1-hour chart)

Execution Insight:

The Dow focuses on the 30350-line today. If the Dow runs steadily above the 30350-line, it will pay attention to the suppression strength of the 31000 and 31265 positions. If the Dow runs steadily below the 30350-line, it will pay attention to the support strength of the 29767 and 29538 positions.

Hong Kong Stocks

Fundamental Analysis:

Hong Kong stocks opened lower, the Hang Seng Index (HSI) fell 0.89%, the Hang Seng TECH Index (HSTECH) opened lower by 1.42%, and then the decline expanded.

The current Hang Seng Index plate expanded to 1%, the Hang Seng Technology Index fell to 2%.

Hong Kong shares of new energy stocks fell hard, Li Auto Inc. (2015.HK) fell more than 15%, NIO Inc. (9866.HK) fell more than 7%.

Overnight, Li Auto Inc. (LI) U.S. shares closed down 12.3% after the company’s Q3 2022 deliveries were above its latest guidance of around 25,500 units but below its initial guidance of 27-29,000 units, up 6% year-over-year to 26,524 units.

In other stocks, Tencent Holdings Limited (0700.HK) fell 1.44%, Baidu, Inc. (9888.HK) dropped 1.39%, while Geely Automobile Holdings Limited (0175.HK) and Xiaomi Corporation (1810.HK) fell more than 1%.

Domestic housing stocks were lower, with CIFI Holdings (Group) Co. Ltd. (0884.HK) down 7% and Longfor Group Holdings Limited (0960.HK) and Times China Holdings Limited (1233.HK) down more than 3%.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 18606-line today. If HK50 can run stably above the 18606-line, then pay attention to the suppression strength of the 19517 and 20467 positions. If the HK50 runs below the 18606-line, then pay attention to the support strength of the 17535 and 16664 positions.

FTSE China A50 Index

Technical Analysis:

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 focuses on the 12945-line today. If the A50 runs stably below the 12945-line, pay attention to the support strength of the two positions of 12733 and 12533. If the A50 runs above the 12945-line, it will open up further upward space. At that time, pay attention to the two positions of 13157 and 13344.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.