U.S. Stocks

Fundamental Analysis:

Major U.S. stock indexes closed lower on Monday, 21st November 2022 amid thin trading volume and growing concerns about the outbreak, with volume likely to shrink further ahead of the Thanksgiving holiday on Thursday, making the market more prone to volatility.

About 9.43 billion shares changed hands on U.S. exchanges, compared with the 11.88 billion daily average over the past 20 sessions.

Stocks pared some losses in the afternoon after San Francisco Federal Reserve President Daly said officials needed to proceed with caution to avoid a “painful recession.”

Cleveland Fed President Loretta Mester echoed Daly’s sentiments, saying she supports a smaller rate hike in December.

The S&P 500 energy index fell nearly 3% on Monday, hitting its lowest level in four weeks, as oil prices plunged more than 5% on reports that Saudi Arabia and other OPEC producers were discussing increasing production.

However, the energy index pared losses after Saudi Arabia denied the reports.

Energy is the only major sector in the S&P 500 on track for gains this year, up about 63% so far.

Disney rose 6.30%, and the S&P 500 extended losses from the previous week, when several Fed officials reiterated that they would continue to raise interest rates until inflation is under control.

Investors await the release of minutes from the Federal Reserve’s November meeting on Wednesday.

Technical Analysis:

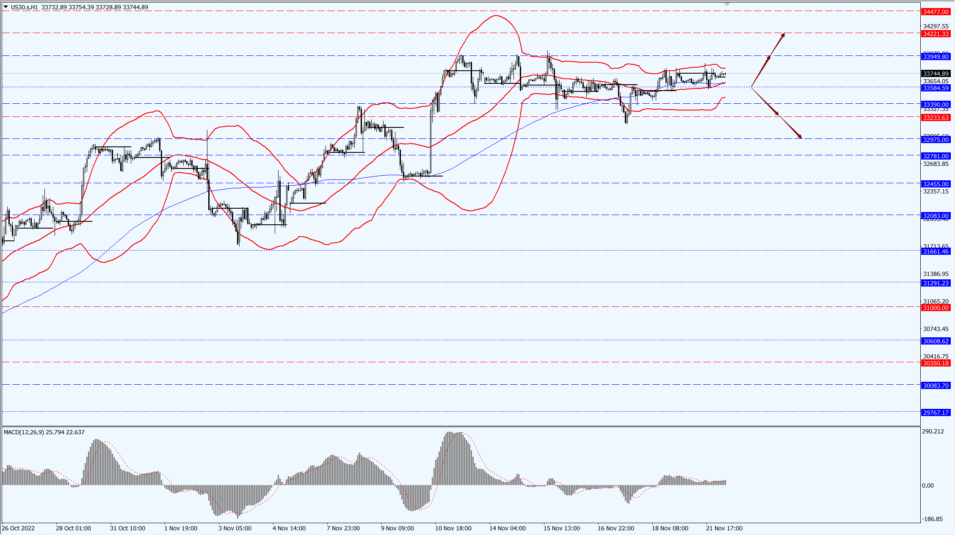

(Dow 30, 1-hour chart)

Execution Insight:

The Dow today pays attention to the 33584-line. If the Dow runs stably above the 33584-line, then pay attention to the suppression strength of the 33949 and 34221 positions.

Hong Kong Stocks

Fundamental Analysis:

The Hang Seng Index (HSI) opened 0.17% lower, and the Hang Seng TECH Index (HSTECH) opened 0.61% lower.

Hotel catering sector rebounded, science network stocks fell more or less, insurance, Internet medical sector continued yesterday’s decline.

Most of the mainland real estate sector opened higher, Country Garden Holdings Company Limited (2007.HK) opened nearly 4% higher, Longfor Group Holdings Limited (0960.HK) opened more than 3% higher.

Hong Kong stocks rebounded sharply by about 26% in mid-to-early November, and the oversold has been fully repaired.

The low-level sharp rise stage has passed, and short-term adjustments have entered, but the undertaking is still active, and it may enter the process of range shocks.

In terms of operation, anti-expectation difference trading can be adopted, that is, enter the market when expectations are overly pessimistic, and reduce positions when overly optimistic

Focus on low valuation, growth, financial stability of the species, or the emergence of policy upward inflection point of the industry stocks, guard the main position, part of the high throw low suction.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 pays attention to the 17535-line today. If HK50 can run stably above the 17535-line, then pay attention to the suppression strength of the two positions of 18606 and 19517.

FTSE China A50 Index

Technical Analysis:

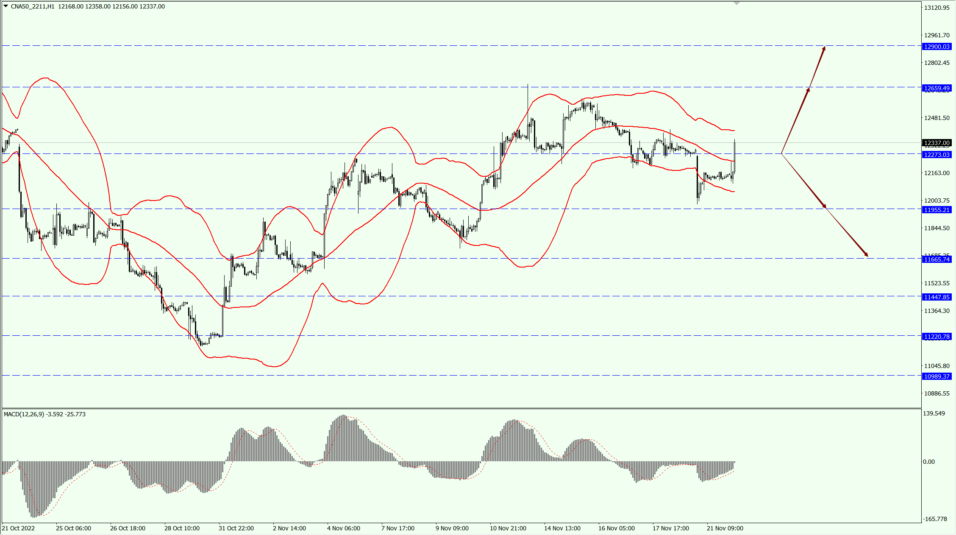

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 pays attention to the 12273-line today. If A50 runs stably below the 12273-line, then pay attention to the support strength of the two positions of 11955 and 11665. If A50 runs above the 12273-line, it will open up further upside space.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.