U.S. Stocks

Fundamental Analysis:

Major U.S. stock indexes extended losses on Friday, 6th May 2022 as investors worried that the Federal Reserve will need to raise interest rates more aggressively than expected to fight inflation.

The technology-dominated Nasdaq hit its lowest closing level since 2020 and fell for a fifth straight week, the longest-lasting weekly decline since the fourth quarter of 2012.

The S&P 500 also fell for a fifth straight week, the longest-lasting weekly decline since the second quarter of 2011.

The U.S. Labor Department released stronger-than-expected employment data, with nonfarm payrolls rising by 428,000 jobs in April, compared with an estimate of 391,000, underscoring strong economic fundamentals, despite a decline in output in the first quarter.

The unemployment rate was unchanged at 3.6% and average hourly earnings rose 0.3%, compared with an expected 0.4% gain.

Nine of the 11 major sectors in the S&P 500 fell. Energy stocks rose 2.9 percent as oil prices climbed on supply concerns.

Large growth stocks fell, with a few exceptions, including Apple, which rose 0.5%. Wells Fargo fell 0.5%, leading declines among large banks.

By Friday’s close, the S&P 500 was down 0.6% at 4123.34, the Dow Jones Industrial Average was down 0.3% at 32,899.37 and the Nasdaq Composite was down 1.4% at 12,144.66.

Technical Analysis:

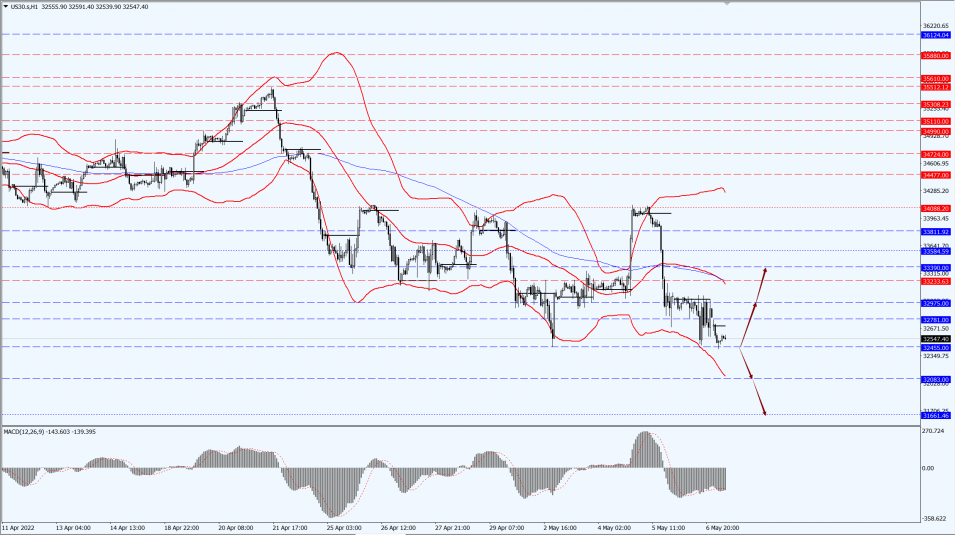

(Dow 30, 1-hour chart)

Execution Insight:

The Dow focuses on the 32455-line today. If the Dow runs steadily above the 32455-line, it will pay attention to the suppression strength of the 32975 and 33390 positions. If the Dow falls below the 32455-line, it will pay attention to the support strength of the 32083 and 31661 positions.

Hong Kong Stocks

Fundamental Analysis:

The Hong Kong stock market retreated significantly as global equity markets fell in general, with health care seeing the deepest decline.

Last week, all Hong Kong stock sectors closed lower. The health care industry fell the most, with a weekly gain or loss of -11.81%.

Meanwhile, information technology, raw materials, consumer necessity, non-essential consumer industry fell more than 5%, with a weekly gain or loss of -8.86%, -8.27%, -7.22% and -5.90%.

Other industries have fallen to varying degrees, down more than 1%, of which the energy industry fell the least, with a weekly gain or loss of -1.36%.

Overall, the Hong Kong stock market retreated significantly last week under the influence of factors such as the expected acceleration of Fed tightening and the recurring epidemic in China.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 19517-line today. If HK50 can run stably above the 19517-line, then pay attention to the suppression of the 20467 and 21450 positions. If the HK50 runs below the 19517-line, then pay attention to the support of the 18606-line.

FTSE China A50 Index

Technical Analysis:

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 pays attention to the 13157-line today. If the A50 runs steadily below the 13157-line, pay attention to the support strength of the two positions of 12733 and 12328. If the A50 runs above the 13157-line, it will open up further upward space. At that time, pay attention to the suppression strength of the 13496-line.

Risk Disclosure

Trading in financial instruments involves a high degree of risk due to fluctuations in the value and price of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with us. You should seek independent professional advice if you do not understand the risks disclosed by us herein.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.