U.S. Stocks

Fundamental Analysis:

The U.S. stock market Nasdaq and S&P 500 retreated to close lower on Thursday, 11th August 2022, as the market realized that despite new evidence of cooling inflation, the Federal Reserve still needs to aggressively raise interest rates to fully tame rising consumer prices.

The S&P 500 closed slightly lower after earlier hitting a three-month high following the release of data showing that the U.S. producer price index (PPI) unexpectedly fell in July from a year earlier.

The PPI decline raised futures market bets that the Fed will raise rates by 50 basis points in September instead of the 75 basis points expected earlier in the week.

The S&P 500 and Nasdaq jumped more than 2% on Wednesday as consumer prices rose less than expected.

But policymakers have been outspoken in saying they will still tighten monetary policy until inflationary pressures recede across the board.

The labor market showed signs of weakness as initial jobless claims rose for a second straight week and the Nasdaq turned lower as investors questioned the strength of the economy.

The U.S. stock exchanges traded a cumulative 12.36 billion shares, compared with a daily average of 11.06 billion shares over the past 20 trading days.

Six of the 11 major sectors in the S&P 500 fell, with health care stocks higher and energy stocks up 3.2%, leading the sectors and helping value stocks rise 0.4% and growth stocks fell 0.5%.

Bank stock gains continued, with Goldman Sachs and JPMorgan Chase up 1.1% and 1.5%, respectively.

High-growth stocks that surged on Wednesday fell, with Tesla down 2.6% and Amazon retreating 1.5%.

Despite a recent rebound from lows hit in mid-June, the tech-dominated Nasdaq has fallen about 18% so far this year as concerns about aggressive monetary policy have weakened the appetite for stocks, especially high-growth stocks.

Technical Analysis:

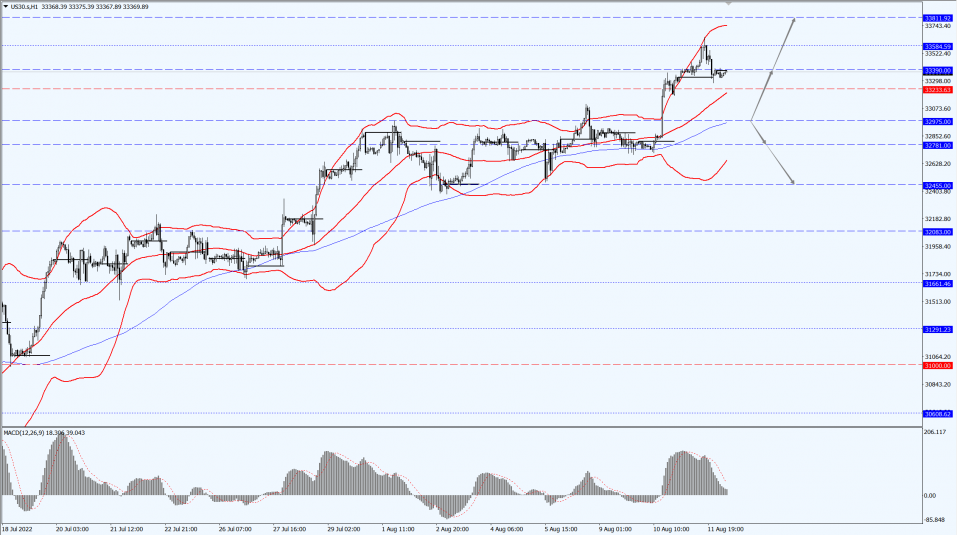

(Dow 30, 1-hour chart)

Execution Insight:

The Dow is focused on the 32975-line today. If the Dow runs stably above the 32975-line, then it will pay attention to the suppression strength of the two positions of 33390 and 33811. If the Dow runs steadily below the 32975-line, it will pay attention to the support strength of the two positions of 32781 and 32455.

Hong Kong Stocks

Fundamental Analysis:

The three major indices of Hong Kong stocks rose in the morning session, with the Hang Seng Index (HSI) up 0.32%, the Hang Seng China Enterprises Index (HSCEI) up 0.47% and the Hang Seng TECH Index (HSTECH) up 0.53%.

Half-day net inflow of the southbound capital funds was 1.851 billion Hong Kong dollars, the market turnover of 39.2 billion Hong Kong dollars.

On the market, large technology stocks were mixed, Alibaba Group Holding Limited (9988.HK), Xiaomi Corporation (1810.HK), JD.com, Inc. (9618.HK), Meituan (3690.HK) rose 1%, Baidu, Inc. (9888.HK), NetEase, Inc. (9999.HK), Tencent Holdings Limited (0700.HK), Kuaishou Technology (1024.HK) fell slightly.

The electricity sector led the rise, the National Film Bureau issued 100 million yuan consumption vouchers to boost the film market rebound, film and media stocks rose generally, Linmon Pictures hit a new high on the market.

Sporting goods stocks, coal stocks, telecommunications stocks, gold stocks have risen.

The institutions generally believe that the international oil prices will be pushed up again at the end of the year, “three barrels of oil” collectively higher.

On the other hand, online education stocks and photovoltaic stocks were weaker. Domestic housing stocks and property management stocks fell more than the trend, dairy stocks, military stocks, biotechnology stocks fell in general.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 20467-line today. If HK50 can run stably above the 20467-line, then pay attention to the suppression strength of 21450 and 22127. If HK50 runs below the 20467-line, then pay attention to the support strength of 19517 and 18606.

FTSE China A50 Index

Technical Analysis:

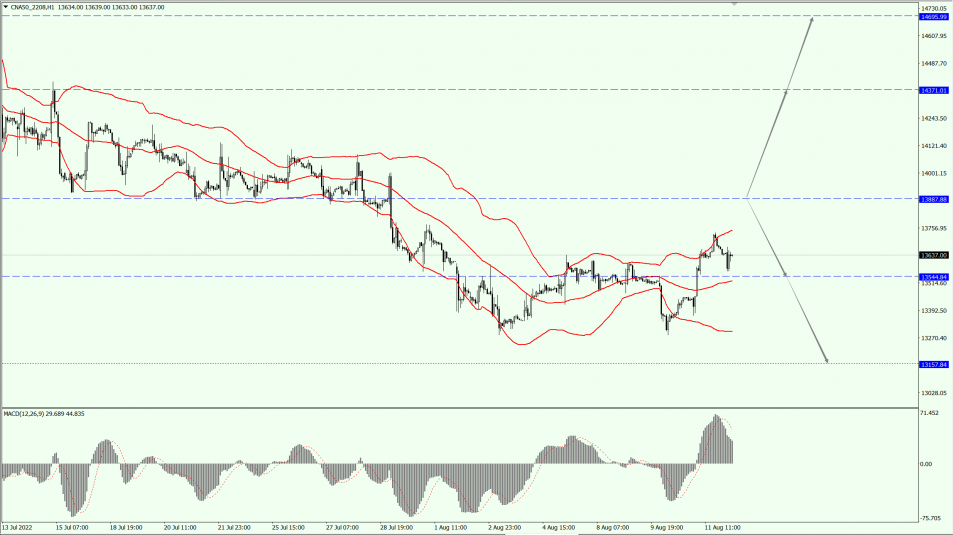

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 focuses on the 13887-line today. If the A50 runs steadily below the 13887-line, it will pay attention to the support strength of the two positions of 13544 and 13157. If the A50 runs above the 13887-line, it will open up further upward space. At that time, pay attention to the two positions of 14371 and 14695.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.