U.S. Stocks

Fundamental Analysis:

The three major U.S. stock indexes closed up collectively, with Nasdaq up more than 1% leading the gains, the S&P 500 rose 0.7%, and the Dow rose 0.56%. The three stock indexes hit a new high of nearly four weeks.

Most of the large technology stocks closed higher. Apple rose 0.45%, Microsoft rose 0.76%, Google rose 0.5%, and General Motors, Ford, and Google promoted the “virtual” power plant.

Amazon rose 2.87%, with a plan to close three U.K. warehouses, a move that will affect 1,200 jobs.

Tesla fell 0.77%, with a plan to invest more than $700 million to expand its Texas factory. According to the China Passenger Car Association (CPCA), Tesla sold 55,796 China-made vehicles in December, down 44.4% from a year earlier.

Powell stated that the Fed is firmly committed to lowering inflation, although raising interest rates to curb economic growth could trigger a political shock.

Powell’s prepared remarks did not comment on the Fed’s upcoming interest rate decision but emphasized the importance of the central bank’s independence and the steps needed to maintain autonomy in policymaking.

On the same day, Fed governor Bowman said that although there are encouraging signs that inflation is falling, there is still a lot of work to be done and the need to continue to raise interest rates to achieve the 2% inflation target.

For the size of future rate hikes and the eventual interest rate peak, Bowman said it will depend on upcoming data releases and their impact on inflation and the economic outlook.

Technical Analysis:

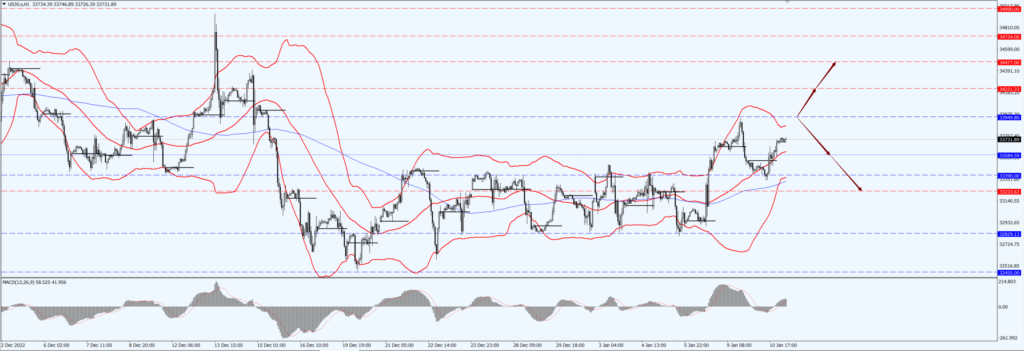

(Dow 30, 1-hour chart)

Execution Insight:

The Dow pays attention to the 33949-line today. If the Dow is running stably above the 33949-line, then pay attention to the suppression strength of the 34221 and 34477 positions.

Hong Kong Stocks

Fundamental Analysis:

As of midday close, the Hang Seng TECH Index (HSTECH) rose 1.08%, the Hang Seng China Enterprises Index (HSCEI) rose 1.12%, the Hang Seng Index (HSI) rose 1.02%.

On the market, technology stocks strengthened collectively, Alibaba Group Holding Limited (9988.HK), Baidu, Inc. (9888.HK) rose more than 3%, Tencent Holdings Limited (0700.HK), Bilibili Inc. (9626.HK) rose more than 2%.

On the whole, since January, Hong Kong stocks have started to recover. The Hang Seng TECH Index (HSTECH) rose nearly 12%, Hang Seng China Enterprises Index (HSCEI) rose more than 10%, the Hang Seng Index (HSI) rose nearly 9%, technology stocks have also been steadily rising across the board.

With the full liberalization of domestic epidemic prevention and control, along with the accelerated recovery of the economy, investment banks are also starting to sing the praises of Chinese assets, and report heavy hopes for Internet stocks in the capital market.

As macro factors restore, the importance of examining individual companies will also become increasingly important.

Due to the resonance of internal and external factors such as regulation, delisting concerns, the epidemic, weak consumption, U.S. interest rate hikes, and the withdrawal of foreign capital, the Internet sector experienced a significant decline in the first three quarters of 2022.

However, various factors have gradually improved recently, especially the epidemic policy. Continuous optimization is expected to bring about the recovery of industries such as e-commerce and advertising, driving a more obvious rebound in the sector.

Looking forward to 2023, the focus of attention is still on the restoration of many major factors at the macro level on the one hand, and on the other hand, what changes have taken place in the internal competitiveness of enterprises in the past two years.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 pays attention to the 20467-line today. If HK50 can run stably above the 20467-line, then pay attention to the suppression strength of the two positions of 21450 and 22127.

FTSE China A50 Index

Technical Analysis:

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 pays attention to the 13339-line today. If A50 runs stably below the 13339-line, pay attention to the support strength of the 12900 and 12659 positions. If the A50 runs above the 13339-line, it will open up further upside space.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.