U.S. Stocks

Fundamental Analysis:

U.S. stocks closed sharply lower on Wednesday, 2nd November 2022, after Fed Chairman Jerome Powell’s speech broke the optimism sparked by the initial Fed policy statement, which announced a 75 basis point increase in interest rates but hinted that a rate hike may be forthcoming.

Trading was choppy during the session, with stocks initially rising after the Fed announced a rate hike, its fourth consecutive 75 basis point increase as it tries to reduce stubbornly high inflation.

The Fed’s decision to raise the federal funds target rate range to 3.75%-4.00% was initially tempered by new language indicating that the Fed was mindful of the economic impact of the extraordinarily large rate hike.

The market had previously been widely expected to raise rates by 75 basis points, while hoping the Fed would hint at a willingness to start slowing the pace of rate hikes at the December meeting.

However, Powell said that it was “far too early” to consider suspending interest rate hikes, which sent stocks sharply lower. U.S. stocks rebounded strongly in October, with the Dow posting its biggest monthly percentage gain since 1976 and the S&P 500 also rallying about 8%.

All three major stock indexes closed lower in the first three trading days of the week. The S&P 500 hit its biggest percentage drop since 7th October 2022 on Wednesday.

The S&P 500 has edged lower ahead of the Fed’s policy announcement, with the ADP National Employment Report showing that U.S. private is increased more than expected in October, giving the Fed more justification to continue its aggressive rate hike;

Tuesday’s data showed that U.S. job openings jumped in September, indicating that labor demand remains strong.

The market will learn more about the labor market through Thursday’s weekly initial jobless claims report and Friday’s October nonfarm payrolls report, which will help drive rate hike expectations.

A total of 12.80 billion shares were traded on U.S. exchanges, with average daily volume of 11.57 billion shares over the past 20 full trading days.

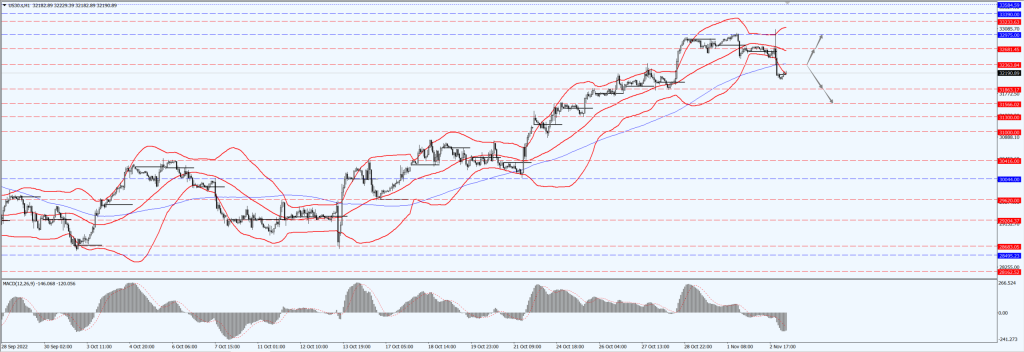

Technical Analysis:

(Dow 30, 1-hour chart)

Execution Insight:

The Dow focuses on the 32363-line today. If the Dow runs steadily above the 32363-line, it will pay attention to the suppression strength of the two positions of 32681 and 32975. If the Dow runs steadily below the 32363-line, it will pay attention to the support strength of the two positions of 31863 and 31566.

Hong Kong Stocks

Fundamental Analysis:

Last night, the Federal Reserve announced a 75 basis point rate hike, followed by Fed Chairman Jerome Powell’s rate path teaser that brought the market back to panic, with U.S. stocks plunging overnight, including the Nasdaq, which was most affected by interest rates, plunging more than 3%.

Powell said he would continue to raise interest rates, and the probability of a soft landing for the U.S. economy became smaller.

As a result, Hong Kong stocks opened lower collectively today, with the Hang Seng Index (HSI) opening 2.21% lower and the Hang Seng TECH Index (HSTECH) opening 3.05% lower.

On the market, large technology stocks continued to sink, with Alibaba Group Holding Limited (9988.HK) down 5.6%, Baidu, Inc. (9888.HK) down 5%, Meituan (3690.HK), Xiaomi Corporation (1810.HK), NetEase, Inc. (9999.HK) and JD.com, Inc. (9618.HK) all down over 3%.

Biomedical stocks, which rose sharply yesterday, pulled back across the board, with CanSino Biologics Inc. (6185.HK) and Shanghai Junshi Biosciences Co., Ltd. (1877.HK) plunging nearly 15%.

Meanwhile gambling stocks, sporting goods stocks, restaurants, movie entertainment stocks and auto stocks fell.

On the other hand, gas stocks and power stocks partially rose. The current Hong Kong stock market already has several advantages, such as the current market has fallen to several years low, the valuation is already at a historical low, overlaid with the continued inflow of southbound funds under the Mainland’s easing policy.

This means that overseas Chinese stocks may show greater resilience. If the internal and external environment improves, the Hong Kong stock market is expected to rebound more in the future.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 15136-line today. If HK50 can run stably above the 15136-line, then pay attention to the suppression strength of the 15995 and 16964 positions. If the HK50 runs below the 15136-line, then pay attention to the support strength of the 14309 and 13611 positions.

FTSE China A50 Index

Technical Analysis:

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 pays attention to the 11447-line today. If the A50 runs steadily below the 11447-line, it will pay attention to the support strength of the two positions of 11220 and 10989. If the A50 runs above the 11447-line, it will open up further upward space. At that time, pay attention to the two positions of 11955 and 12336.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.