U.S. Stocks

Fundamental Analysis:

The S&P 500 closed lower on Friday, 5th August 2022, dragged down by Tesla and other tech-related stocks, after a strong jobs report dampened recent optimism that the Federal Reserve might ease its aggressive pace.

The data showed that the U.S. jobs rose much more than expected in July, the 19th consecutive month of gains, and the unemployment rate fell to a pre-pandemic low of 3.5%.

The report, along with some other recent data, depicts an optimistic picture of the world’s largest economy after experiencing a contraction in the first half of the year, which dampened investor expectations that the Federal Reserve may slow the pace of interest rate hikes.

The Fed has recently implemented a series of interest rate hikes to cool the economy.

Tesla plunged 6.6%, causing a major drag on the S&P 500 and Nasdaq. Facebook parent Meta Platforms fell 2% and Amazon dropped 1.2%, also causing a drag on the index.

The U.S. Treasury yields climbed as the likelihood of a 75 basis point rate hike in September increased.

That helped bank stocks, with JPMorgan Chase up 3%, and helped keep the Dow Jones Industrial Average above flat.

The focus now turns to this week’s inflation data, with U.S. consumer prices expected to rise at an annual rate of 8.7% in July after rising 9.1% in June.

Several policymakers this week said they want to stick with their aggressive tightening stance until they see strong, enduring evidence that inflation is falling back toward the Fed’s 2% target.

Technical Analysis:

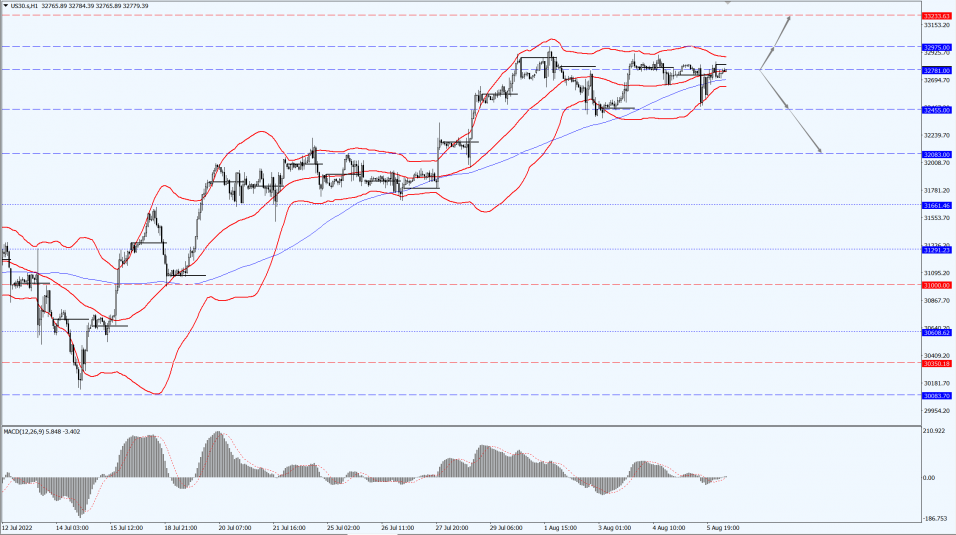

(Dow 30, 1-hour chart)

Execution Insight:

The Dow is focused on the 32781-line today. If the Dow runs steadily above the 32781-line, it will pay attention to the suppression strength of the two positions of 32975 and 33233. If the Dow runs steadily below the 32781-line, it will pay attention to the support strength of the two positions of 32455 and 32083.

Hong Kong Stocks

Fundamental Analysis:

Hong Kong stocks were weak in morning trading, the Hang Seng Index (HSI) fell 0.75% narrowly defending the 20,000-point barrier, the Hang Seng China Enterprises Index (HSCEI) fell 1.09%, the Hang Seng TECH Index (HSTECH) fell 1.69% again lost 4400 points.

The southbound capital inflow bucked the trend with a net inflow of HK$1.102 billion in half a day, and the market turnover was HK$41.6 billion.

On the market, large technology stocks fell in general, Alibaba Group Holding Limited (9988.HK) fell by nearly 4%, Xiaomi Corporation (1810.HK), Tencent Holdings Limited (0700.HK), JD.com, Inc. (9618.HK), Kuaishou Technology (1024.HK), and Meituan (3690.HK) are down more than 2%, but NetEase, Inc. (9999.HK) counter-trend rose more than 2%.

Online education stocks fell in front, Koolearn Technology Holding Limited (1797.HK) fell the most.

Sanya and a number of popular summer tourist destinations suffered an epidemic attack, and restaurants and other consumer stocks fell significantly.

Tesla concept stocks, auto stocks, mobile game stocks, power stocks, and domestic insurance stocks have lower.

On the other hand, due to geopolitical tensions, military stocks continued to be active, with CSSC Offshore & Marine Engineering (Group) Company Limited (0317.HK) rising strongly by over 9%, while coal stocks, steel stocks, biotechnology stocks, paper and a few other sectors strengthened.

HG Semiconductor Limited (6908.HK) resumed trading and soared over 24%, and it plans to place up to 30 million shares.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 20467-line today. If HK50 can run stably above the 20467-line, then pay attention to the suppression strength of 21450 and 22127. If HK50 runs below the 20467-line, then pay attention to the support strength of 19517 and 18606.

FTSE China A50 Index

Technical Analysis:

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 focuses on the 13887-line today. If the A50 runs stably below the 13887-line, pay attention to the support strength of the two positions of 13544 and 13157. If the A50 runs above the 13887-line, it will open up further upward space. At that time, pay attention to the two positions of 14371 and 14695.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand the any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.