U.S Stocks

Fundamental Analysis:

The S&P 500 Index closed with a new record high, while Apple and the health insurance industries’ stocks rose, crushing the concerns towards the Delta variant Covid-19 virus.

The U.S. stock market, S&P 500 closed with a record high on Tuesday,3rd August, 2021, boosted by the rise of Apple and healthcare industry stocks.

However, people continue to post concerns towards the surge in the Covid-19 virus cases caused by the Delta variant. Given this circumstance, investors have lost some of their optimism upon the reputable corporate earnings season.

Jamie Cox, managing partner of Harris Financial Group, said, “Although the pandemic is not over, and given the number of new cases has occasionally increased in some places, a large-scale economic shutdown will not happen. With that, I think this shows that the consumption pattern is super strong, and this is what it is. The fundamental factor that really keeps the market going.”

The shares of gaming companies listed in Europe and the U.S. fell after a severe sell-off in China’s social media and e-gaming giant, Tencent. Considering that, investors post amid fears that this industry will be the next target of Chinese regulators.

Back to the U.S. stock markets – the Dow closed up by 0.8%, the S&P 500 closed up by 0.82%, while the Nasdaq closed up by 0.55%.

On top of that, the U.S. Department of Commerce said on Tuesday that factory orders have increased by 1.5% in June, after an increase of 2.3% in May. The increase was more than predicted as the economists’ survey previously predicted a 1.0% increase in factory orders.

Moving on to later this week, investors’ focus will be diverted to the U.S. service industry data and July employment report.

Technical Analysis:

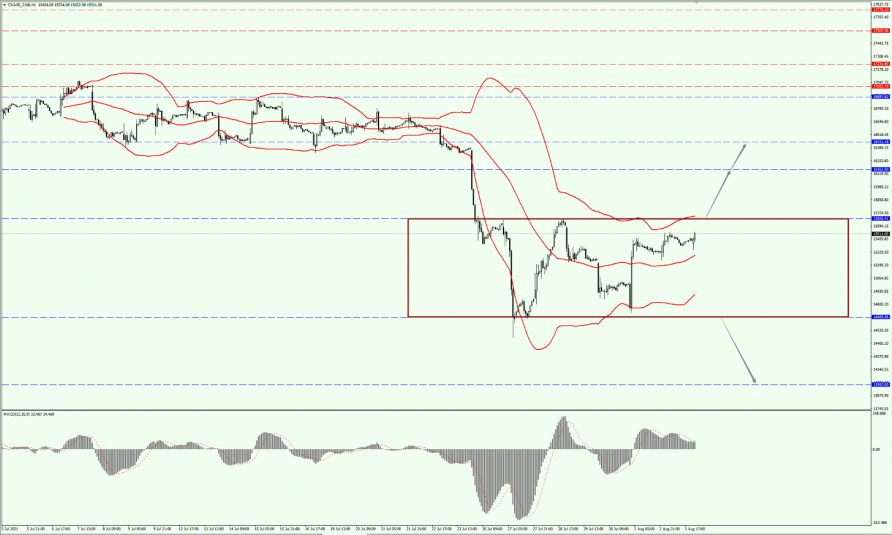

(Dow30,1-hour chart)

Execution Insight:

Yesterday, the Dow pierced through the bottom of the 34870-line and rose again into a range-bound market.

Today, we continue to pay attention towards the direction of the Dow’s breakthrough in the range between 34870 to 35161. In particular, pay attention to the possibility of it falling below the 34870-line.

If the Dow moves upward and breaks through the 35161-line, it will create a new record high. With that, pay attention to the possibility of it forming a “bullish trap” signal that can rise and fall.

Once the bullish trap signal is formed, it could be an opportunity to open a small position and possibly keeps its all-time high. If the strength drops below the 34870-line, it will create a downside potential.

Hong Kong Stocks

Fundamental Analysis:

Recently, industry regulations have been unfavorable, and market funds are struggling to cope. Hence, leading to an overall decline in risk appetite for the organizations.

In view of this, those with more funds in hand, will most likely stick to the rising varieties at the bottom.

It is expected that the new direction will be in the cloud computing industry, sporting goods, pharmaceutical, and warehousing & logistic services industries.

All in all, Hong Kong’s Hang Seng Index fell by 0.13% at the opening, while the Hang Seng TECH Index fell by 0.76%.

Seeing that, most of the game industry opened lower, with Tencent falling by more than 2%.

Technical Analysis:

(HK50,1-hour chart)

Execution Insight:

Today, on HK50, continue to pay attention to the support on the 25880-line.

If the HK50 runs above the 25880-line, it will maintain on a rebound trend. With that, pay attention to the suppression between the 26535 and 26951 positions.

If the HK50 market outlook falls below the 25880-line, it will open up the room for further correction after this wave of rebound. At that time, divert your attention to the support at the 25160-line.

FTSE China A50 Index

Technical Analysis:

(A50,1-hour chart)

Execution Insight:

Today, on A50, continue to focus on the direction of the 15666 to 14669 breakthrough. If it breaks above the 15666-line, it will open up further upside potential.

With that, pay attention to the suppression towards the 16163-line. If it falls below the 14669-line, it will open up further downside potential.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.