US Stocks

Fundamental Analysis:

Owing to the prospect of a reduced Fed stimulus and the growing risk aversion, the S&P 500 fell by 1.7% yesterday, its biggest decline since March and a new low in two months.

Recently, with the rapid spread of the Delta variant, the slowing pace of economic recovery in the United States, and the imminent reduction of the Federal Reserve’s bond purchases, the market believes that the rise of US stocks is at risk.

In addition, US stocks are currently facing potential seasonal weakness. Bank of America data shows that since 1928, September is the only month in which the S&P 500 index has risen less than half the time. Furthermore, according to the Dow Jones Industrial Average data, since 1928, the S&P 500 has fallen by an average of 0.99% in September.

Technical Analysis:

(Dow30,1-hour chart)

Execution Insight:

Today, on the Dow, focus on the 34477 line. As long as the Dow runs below the 34477 line, it will maintain a bearish trend. Only when the Dow rises again to the top of the 34477 line, there is a possibility of further upward movement. At that time, pay attention to the suppression of the two positions of 34724 and 34990.

Hong Kong Stocks

Fundamental Analysis:

US stocks tumbled overnight, dragging down the performance of Hong Kong stocks in early trading. The Hang Seng Index opened 0.96% lower at 23,867.16 points; Hang Seng China Enterprises Index opened 1.28% lower at 8,527.93 points; and the Hang Seng Technology Index opened 1.97% lower at 6,147.52 points.

On the market, the automotive, internet, and banking sectors were lower. Among the Chinese blue chips, Anta Sports opened 3.7% lower; Alibaba opened 3.63% lower; Geely opened 3.09% lower; and Sunny Optical Technology opened 2.33% lower. In addition, Shijiazhuang Pharma Group opened 2.77% higher. On to other sectors, Mengniu Dairy opened 2.03% higher, while CG Services opened 2% higher.

Technical Analysis:

(HK50,1-hour chart)

Execution Insight:

On HK50 today, we pay attention to the support of the 24469 line. Once the buy order is obtained, then focus on the suppression strength of the two positions of 25160 and 25816 above. If HK50 falls below the 24469 line, it will open up further downward revision.

FTSE China A50 Index

Technical Analysis:

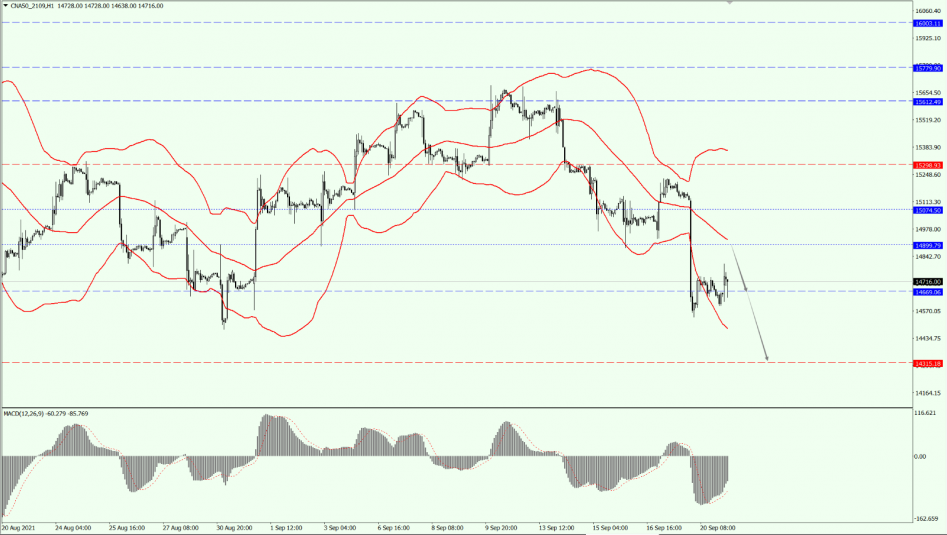

(A50,1-hour chart)

Execution Insight:

China A50 is still looking bearish today. Pay attention to the resistance of the two positions at 14899 and 14669 above, and the support of the 14315 line below.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.