U.S. Stocks

Fundamental Analysis:

The sell-off in U.S. stocks intensified after weak consumer spending data fueled recession fears, with the S&P 500 Index posting its worst first-half performance since Richard Nixon became president.

The benchmark S&P 500 index fell 21% in the first six months of the year. The U.S. consumer spending fell for the first time this year, indicating weaker economic conditions than previously expected against a backdrop of soaring inflation and Fed rate hikes.

The view that the Fed needs to act quickly to compensate for previous misjudgments on inflation hit the market hard, as traders are increasing their bets that the economy will fall into recession under aggressive tightening policies.

Technical Analysis:

(Dow 30, 1-hour chart)

Execution Insight:

The Dow is concerned about the 31000-line today. If the Dow runs stably above the 31000-line, then pay attention to the suppression strength of the two positions of 31291 and 31661. If the Dow is running steadily below the 31000-line, then pay attention to the support strength of the two positions of 30350 and 29767.

Hong Kong Stocks

Fundamental Analysis:

Hong Kong stocks were shocked to close lower, the Hang Seng Index (HSI) fell 0.62%, and the Hang Seng TECH Index (HSTECH) fell 1.36%.

In the first half of this year, Hong Kong stocks once fell below 18,000 points, a six-month decline of 6.57%.

CNOOC Limited (0883.HK) surged 42% in the first half of the year to lead the blue-chip gains, Sunny Optical Technology (Group) Company Limited (2382.HK) fell 48% to lead the blue-chip losses, and Tencent Holdings Limited (0700.HK) also fell by about 20%.

The Hang Seng TECH Index (HSTECH) fell 14.12% in the first half of the year, Sunny Optical Technology (Group) Company Limited (2382.HK), SenseTime Group Inc. (0020.HK), Bilibili Inc. (9626.HK), AAC Technologies Holdings Inc. (2018.HK), etc. fell more than 40%. Meanwhile, Li Auto Inc. (2015.HK), Kuaishou Technology (1024.HK), etc. rose more than 20%.

On 29th June 2022, the China Ministry of Industry and Information Technology announced an end to the Covid-19 risk indicator in its digital travel pass, removing a major barrier to domestic travel. The ministry said that the asterisk risk symbol would no longer appear in the travel pass of anyone who had recently traveled to cities with Covid-19 cases.

The change sparked concern from all walks of life, consumer stocks went higher, Yihai International Holding Ltd. (1579.HK) rose 10%, Helens International Holdings Company Limited (9869.HK) rose more than 7%, China Resources Beer (Holdings) Company Limited (0291.HK) rose 5%, Topsports International Holdings Limited (6110.HK), Beijing Capital International Airport Company Limited (0694.HK) rose nearly 5%.

New Oriental Education & Technology Group Inc. (9901.HK) rose 7.5%, and Koolearn Technology Holding Limited (1797.HK) rose 9.7%.

The number of fans of “Dongfang Selection” exceeded the 20 million mark, and the number of fans increased by 10 million again in the past 13 days. Previously, at around 14:15 on 16th June, the number of fans selected by the East exceeded 10 million. On 9th June, the total number of fans just exceeded 1 million.

SenseTime Group Inc. (0020.HK) plunged 46%, and market value evaporated over HK$80 billion. On 30th June, SenseTime ushered in the first unlocking day.

SenseTime pre-IPO investors and cornerstone investors are involved in 23.3 billion shares, accounting for 70% of the company’s total share capital. Before the listing, Softbank, Primavera Capital Group, Silver Lake, IDG, China Structural Reform Fund Co. Ltd., Shanghai International Group, Sailing Capital International, and CDH Investments are the shareholders of SenseTime.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 22127-line today. If HK50 can run stably above the 22127-line, then focus on the suppression strength of 22785 and 23294. If HK50 runs below the 22127-line, then pay attention to the support strength of 21450 and 20467.

FTSE China A50 Index

Technical Analysis:

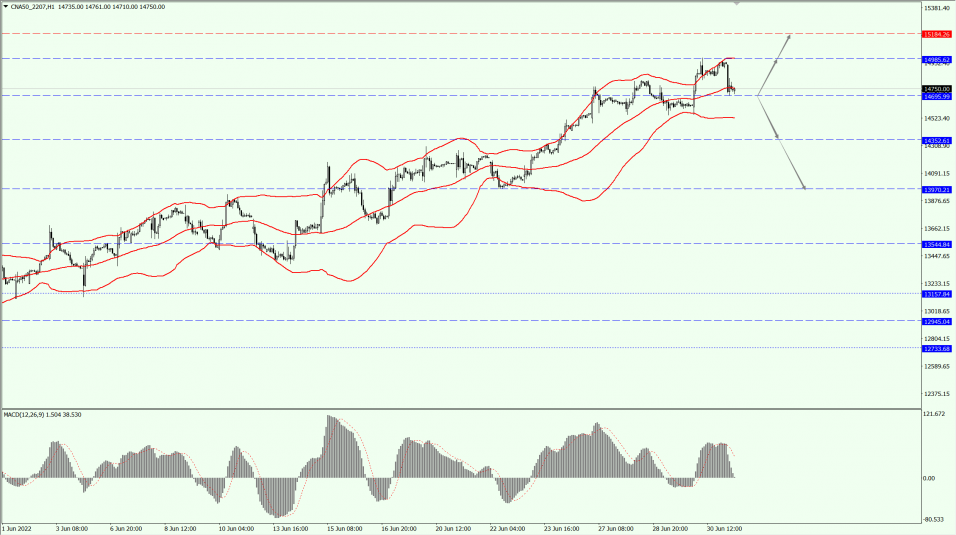

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 focuses on the 14695-line today. If the A50 runs stably below the 14695-line, pay attention to the support strength of the two positions of 14352 and 13970. If the A50 runs above the 14695-line, it will open up further upward space. At that time, pay attention to the two positions of 14985 and 15184.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand the any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.