U.S. Stocks

Fundamental Analysis:

U.S. stocks on the S&P 500 and Nasdaq closed lower yesterday, 11th October 2022, as the Bank of England said it would support the country’s bond market for just three more days, adding to jitters in late trading.

The market traded choppy, with investors trading cautiously ahead of key U.S. inflation data and the third-quarter earnings season, which begins later this week.

Growth and technology stocks underperformed as U.S. Treasury yields rose on concerns that this week’s U.S. inflation data will not prevent the Federal Reserve from quickly raising interest rates.

The S&P technology stock index fell 1.5%.

The Producer Price Index report will be released on Wednesday and the Consumer Price Index data will be released on Thursday.

The Federal Reserve has been aggressively raising interest rates to curb inflation and is expected to continue to do so next year.

Stocks have been battered in recent weeks by concerns about how much the Fed will continue to raise interest rates and the potential impact this will have on the economy.

The S&P bank stock index is down 2.6%, with some major banks set to report quarterly results later this week. This will open the third quarter earnings season for the S&P 500 component companies.

The International Monetary Fund (IMF) forecasts that the U.S. economy will grow by a modest 1.6% this year, which has fueled recent concerns about the U.S. economy.

The number of stocks down and up on the New York Stock Exchange was 1.50:1.

The Nasdaq exchange was 1.51:1. One S&P 500 component hit a new 52-week high and 104 new lows, while 33 Nasdaq components hit new highs and 590 new lows.

The U.S. exchanges traded a cumulative 11.65 billion shares, compared to a daily average of 11.73 billion shares over the past 20 full trading days.

Technical Analysis:

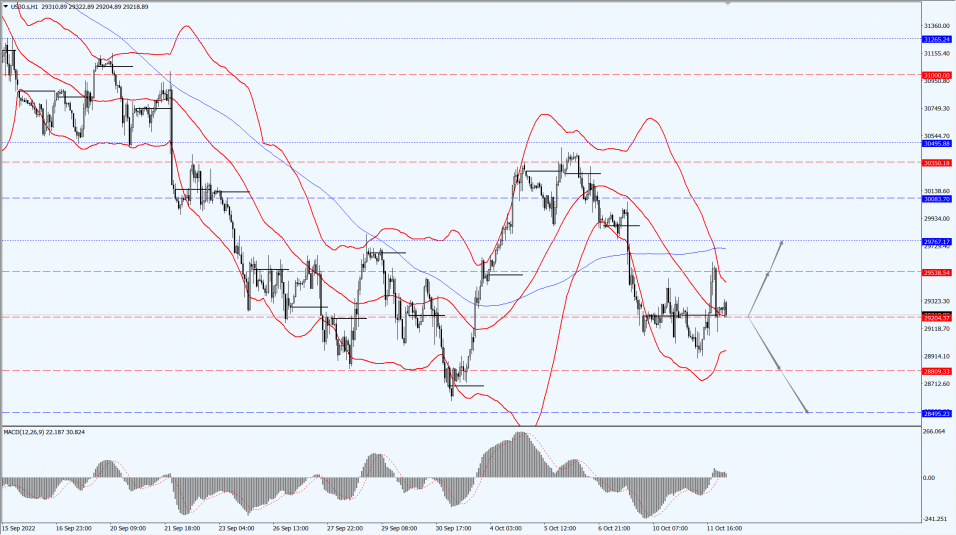

(Dow 30, 1-hour chart)

Execution Insight:

The Dow focuses on the 29204-line today. If the Dow runs steadily above the 29204-line, it will pay attention to the suppression strength of the two positions of 29538 and 29767. If the Dow runs steadily below the 29204-line, it will pay attention to the support strength of the two positions of 28809 and 28495.

Hong Kong Stocks

Fundamental Analysis:

Overnight, the U.S. S&P 500 and the Nasdaq fell for the fifth straight day as Chinese stocks continued to move lower.

Hong Kong stocks, which have fallen for four days in a row, continued to open lower, with the Hang Seng Index (HSI) down 0.44%, the Hang Seng China Enterprises Index (HSCEI) down 0.42%, and the Hang Seng TECH Index (HSTECH) down 0.85%, with all three brushing new adjusted lows again.

On the market, most of the large technology stocks continue to move lower, Baidu, Inc. (9888.HK) fell nearly 3%, Alibaba Group Holding Limited (9988.HK), Kuaishou Technology (1024.HK), Tencent Holdings Limited (0700.HK) are down, while Meituan (3690.HK), and JD.com, Inc. (9618.HK) were slightly higher.

Gas stocks, beer stocks, catering stocks, domestic banking stocks fell significantly, with China Merchants Bank Co., Ltd. (3968.HK) opened nearly 2% lower.

Catering stocks, oil stocks, building materials and cement stocks fell generally.

On the other hand, even read the decline in auto stocks partially rebounded, biomedical stocks, sporting goods stocks mostly rose.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 17535-line today. If HK50 can run stably above the 17535-line, then pay attention to the suppression strength of the 18606 and 19517 positions. If the HK50 runs below the 17535-line, then pay attention to the support strength of the 16664 and 15995 positions.

FTSE China A50 Index

Technical Analysis:

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 pays attention to the 12733-line today. If the A50 runs steadily below the 12733-line, it will pay attention to the support strength of the two positions of 12423 and 12260. If the A50 runs above the 12733-line, it will open up further upward space. At that time, pay attention to the two positions of 12945 and 13157.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.