U.S. Stocks

Fundamental Analysis:

U.S. stocks closed sharply lower on Monday, 29th November 2022, as concerns about economic growth increased and Apple slipped on fears of a hit to iPhone production.

With this, Apple stock fell 2.6%, putting a major drag on the index S&P 500.

All 11 sectors of the S&P 500 fell, with real estate stocks down 2.81% and energy stocks down 2.74%.

With two trading days left in November, the S&P 500 is on track for a monthly gain of 2.4%.

Amazon rose 0.6% after an industry report estimated spending on Cyber Monday, the largest online shopping day in the U.S., would rise to $11.6 billion.

Biogen fell after reports that a patient died in a clinical study of its experimental Alzheimer’s drug.

This week, investors will be closely watching the November U.S. consumer confidence data released on Tuesday, the U.S. government’s revised third-quarter gross domestic product (GDP) on Wednesday, and the November nonfarm payrolls data on Friday.

The U.S. exchanges traded a cumulative total of about 9.3 billion shares in relatively muted trading, with a daily average volume of 11.3 billion shares over the past 20 trading days.

The number of S&P 500 decliners and gainers was 12.2:1.

12 S&P 500 components hit new 52-week highs, two components hit new lows, 93 Nasdaq components hit new highs and 174 hit new lows.

Technical Analysis:

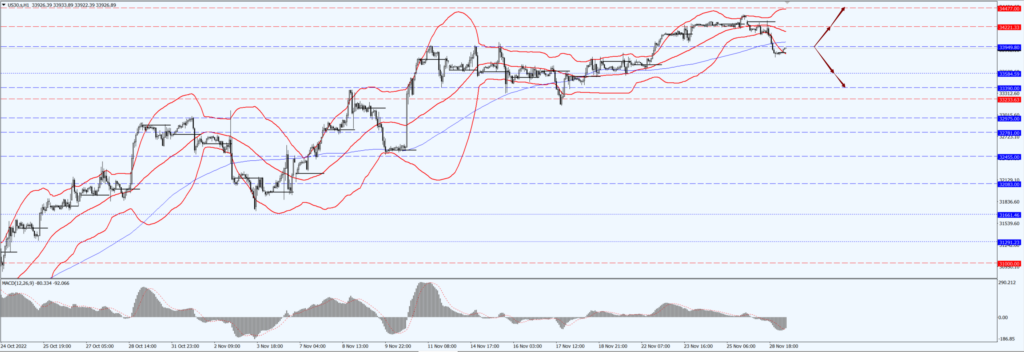

(Dow 30, 1-hour chart)

Execution Insight:

The Dow today pays attention to the 33949-line. If the Dow runs stably above the 33949-line, then pay attention to the suppression strength of the 34221 and 34477 positions.

Hong Kong Stocks

Fundamental Analysis:

Hong Kong stocks opened high in the morning session, and the Hang Seng TECH Index (HSTECH) closed sharply up 5.45% at noon, back to 3,600 points.

The Hang Seng Index (HSI), the Hang Seng China Enterprises Index (HSCEI) rose 3.85% and 4.72%, respectively, the HSI rose 666 points is expected to recover 18,000 points.

The half-day net southbound capital inflow was 3.104 billion Hong Kong dollars, the market turnover was 82.6 billion Hong Kong dollars.

On the market, the weighted technology stocks all pull up. Kuaishou Technology (1024.HK) rose 8.11%, JD.com, Inc. (9618.HK) rose 8%, Baidu, Inc. (9888.HK), NetEase, Inc. (9999.HK), Alibaba Group Holding Limited (9988.HK) rose more than 6%, Xiaomi Corporation (1810.HK), Tencent Holdings Limited (0700.HK), Kuaishou Technology (1024.HK) are strong.

Restaurant stocks and gambling stocks continue yesterday’s rise. Large financial stocks, Internet medical stocks, sporting goods stocks, automotive stocks rose.

On the other hand, power stocks fell against the trend, China Power fell more than 3%, by North Water for three consecutive days to reduce. Agricultural stocks and port shipping stocks were partly lower.

On the news, the capital market housing-related policies have once again ushered in major changes, the Securities and Futures Commission 28 in equity financing to adjust and optimize five measures, and effective immediately, including the resumption of listed real estate enterprises and listed companies involved in housing refinancing.

The policy clearly supports real estate equity financing, essentially moving the third bailout policy.

The advantage over the first two recent bailout policies is that they do not directly increase the scale of debt of real estate enterprises, while still providing sufficient channels for real estate enterprises to raise capital.

At this point, the first policy, namely credit placement, the second policy, namely bond financing, and the third policy, namely equity financing, are already in place.

The three policies are issued together, fully explaining that ‘save the market first save the enterprise’, creating a very good space and opportunity for the subsequent financing of real estate enterprises, etc.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 pays attention to the 17535-line today. If HK50 can run stably above the 17535-line, then pay attention to the suppression strength of the two positions of 18606 and 19517.

FTSE China A50 Index

Technical Analysis:

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 pays attention to the 12273-line today. If A50 runs stably below the 12273-line, then pay attention to the support strength of the two positions of 11955 and 11665. If A50 runs above the 12273-line, it will open up further upside space.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.