U.S. Stocks

Fundamental Analysis:

Major U.S. stock indexes rose Thursday, 23rd June 2022, with strong performance in defensive and technology stocks overshadowing lingering recession fears that led to declines in economically sensitive sectors.

The index S&P 500 moved above and below flat during the session, but regained momentum before the close. The U.S. Treasury benchmark yields fell to a two-week low, supporting technology stocks and other rate-sensitive growth stocks.

Trading remained shaky after last week’s biggest one-week percentage drop in the S&P 500 since March 2020. The index fell more than 20% from its all-time high in January earlier this month, confirming a bear market, and investors have since been weighing when stocks will hit bottom.

Technical Analysis:

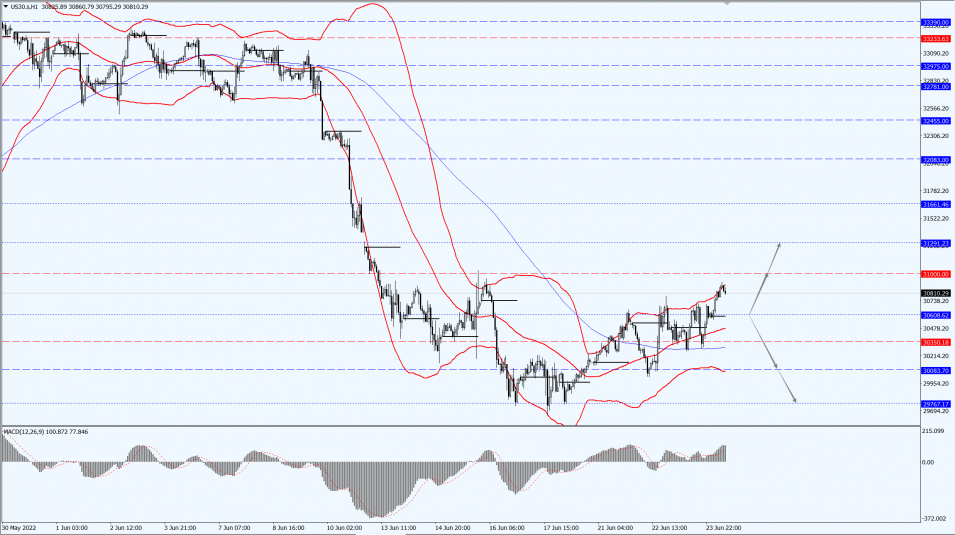

(Dow 30, 1-hour chart)

Execution Insight:

The Dow focuses on the 30608-line today. If the Dow runs steadily below the 30608-line, it will pay attention to the support strength of the two positions of 30083 and 29767. If the Dow runs steadily above the 30608-line, it will pay attention to the suppression strength of the two positions of 31000 and 31291.

Hong Kong Stocks

Fundamental Analysis:

Yesterday, the main indices of Hong Kong stocks performed strongly throughout the day, with popular sectors rising in general and overall sentiment better.

By the close of trading, the Hang Seng Index (HSI) rose 1.26%, the Hang Seng China Enterprises Index (HSCEI) rose 1.75% and the Hang Seng TECH Index (HSTECH) rose 2.28%.

The net inflow of southbound funds was HK$3.441 billion. Auto stocks, auto supporting stocks continued to rise, XPENG-W, Li Auto-W rose over 9%. Geely Auto rose over 7%, GAC Group, Great Wall Motor rose over 6%, NIO-SW, BYD shares rose over 4%。

Xinchen China Power Holdings Limited (1148.HK) rose over 27%, Zhejiang Shibao Company Limited (1057.HK) rose over 20%, Xin Point Holdings Limited (1571.HK) rose over 12%, Nexteer Automotive Group Limited (1316.HK) rose over 11%, and Minth Group Limited (0425.HK) rose over 9%.

On the news, Li Keqiang hosted an executive meeting of the State Council to determine the policy of increasing support for auto consumption. The meeting stressed the need to further unleash the potential of auto consumption: First, activate the used car market, then promote auto renewal consumption.

For small non-operating used cars, the move-in restrictions will be completely lifted from 1st August 2022, and the transfer registration will be separately endorsed and issued with temporary license plates from 1st October 2022.

The second is to support the consumption of new energy vehicles. Car purchase tax should be used mainly for road construction, taking into account the current actual study on the extension of the policy of exemption from the purchase tax of new energy vehicles.

Third, improve the parallel import policy to support the construction of parking lots. Policy implementation is predicted to increase auto and related consumption this year by about 200 billion yuan.

The online healthcare sector rebounded, JD Health International Inc. (6618.HK) rose nearly 6%, Alibaba Health Information Technology Limited (0241.HK) rose nearly 4%, Ping An Healthcare and Technology Company Limited (1833.HK) rose slightly.

Meanwhile, Chinese brokerage stocks performed well, CSC Financial Co., Ltd. (6066.HK) rose more than 7%, China Everbright Limited (0165.HK) rose more than 4%, China International Capital Corporation Limited (3908.HK) rose more than 3%, with CITIC Limited (0267.HK), Haitong Securities Co., Ltd. (6837.HK), China Merchants Securities Co., Ltd. (6099.HK), etc. following the rise.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 20467-line today. If HK50 can run stably above the 20467-line, then pay attention to the suppression strength of 21450 and 22127. If HK50 runs below the 20467-line, then pay attention to the support strength of 19517 and 18606.

FTSE China A50 Index

Technical Analysis:

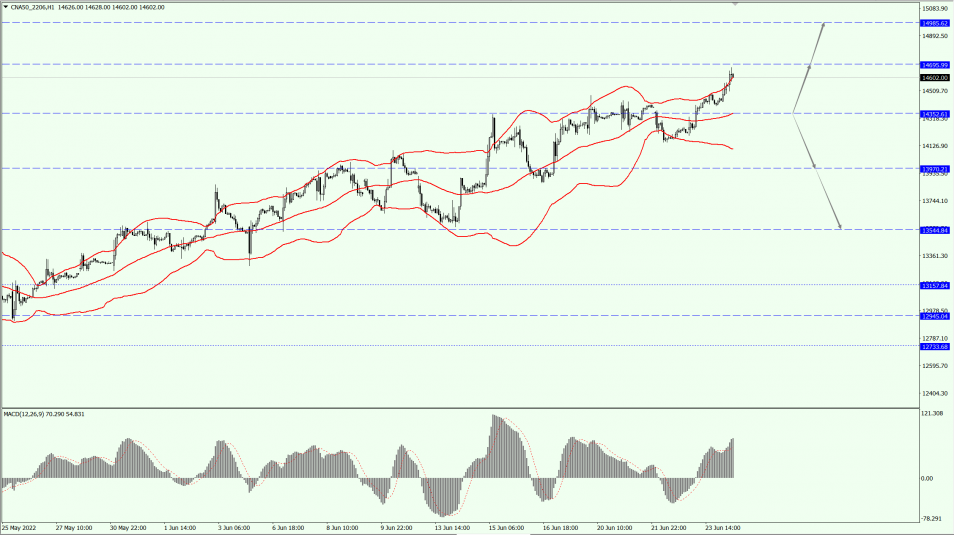

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 focuses on the 14352-line today. If the A50 runs steadily below the 14352-line, it will pay attention to the support strength of the two positions of 13970 and 13544. If the A50 runs above the 14352-line, it will open up further upward space. At that time, pay attention to the two positions of 14695 and 14985.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand the any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.