US Stocks

Fundamental Analysis:

The S&P 500 closed higher on Monday, 13 September 2021, ending a five-day losing streak as investors focused on potential corporate tax hikes and upcoming economic data.

There are probably not a lot of positive surprises coming this month, As the 10-year bond rate slowly grinds higher through the end of 2021, there will be another period of volatility where rotation could go back to cyclicals and the reopened trade.

Market participants are focused on the likely passage of U.S. President Joe Biden’s USD3.5 trillion budget package, which is expected to include a proposed corporate tax rate hike from 21% to 26.5%.

Besides that, the corporate tax rate will be increased to 25% and the passage of about half of a proposed increase to tax rates will be on foreign income, which would reduce S&P 500 earnings by 5% in 2022. The Department of Labor is due to release its consumer price index data on Tuesday, 14 September 2021, which could shed further light on the current inflation wave and whether it is as transitory as the Fed insists.

The Dow Jones Industrial Average rose by 0.76%, the S&P 500 gained 0.23%, and the Nasdaq Composite dropped by 0.07%.

Technical Analysis:

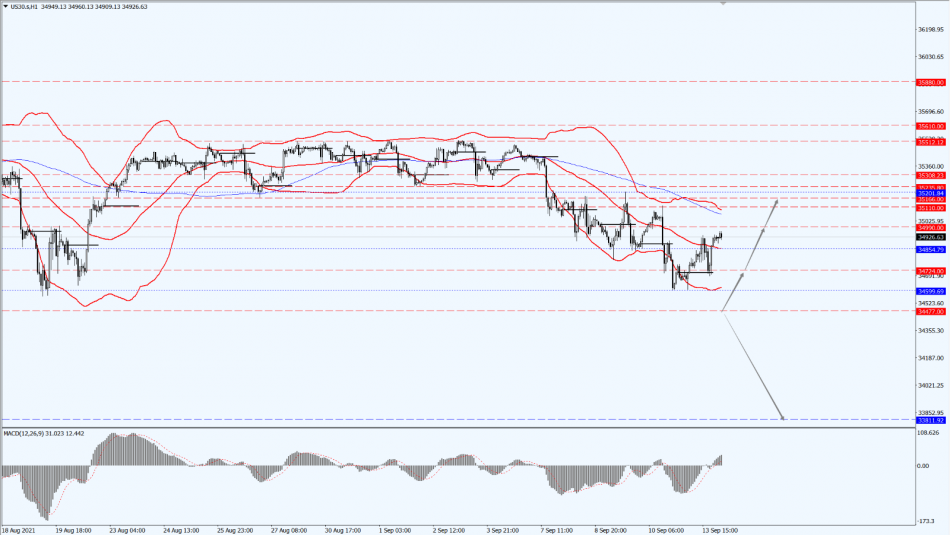

(Dow30,1-hour chart)

Execution Insight:

Today, we continue to pay attention to the direction of the Dow on the 34477 line. Once the Dow falls below the 34477 line, it will open up further downward revision. At that time, pay attention to the support of the 33811 line. If the Dow gets the support from the 34477 level, then divert your attention to the suppression strength of the two positions 34724 and 34990 above. Overall, the Dow is mainly sideways in the range of 34477–35166.

Hong Kong Stocks

Fundamental Analysis:

The main indices in the Hong Kong stock market were lower in early trading. As of writing, the Hang Seng Index (HSI) fell by 0.4%, Hang Seng China Enterprises Index fell by 0.7%, and the Hang Seng Technology Index dropped by 0.6%.

On the intraday market, the HSI blue-chip stocks rose less and fell more, BYD shares rose by more than 2%, PetroChina rose by more than 2%, AliHealth fell by nearly 5%. Meanwhile, most of the constituent stocks of the Hang Seng Technology Index fell, Trip.com Group fell by more than 5%, Bilibili fell by nearly 2%, Meituan fell by more than 1%, Lenovo rose by nearly 3%, and ZhongAn Online rose by nearly 2%.

In terms of industry sectors, oil stocks and pharmaceutical stocks rose top, while iron and steel, copper, and other hot resource stocks adjusted significantly yesterday.

Finally, on individual stocks, the Evergrande Group opened low and went low in early trading, Evergrande New Energy Auto dipped by more than 16%, the Evergrande Group fell by more than 7%, and Evergrande Property fell by nearly 6%.

Technical Analysis:

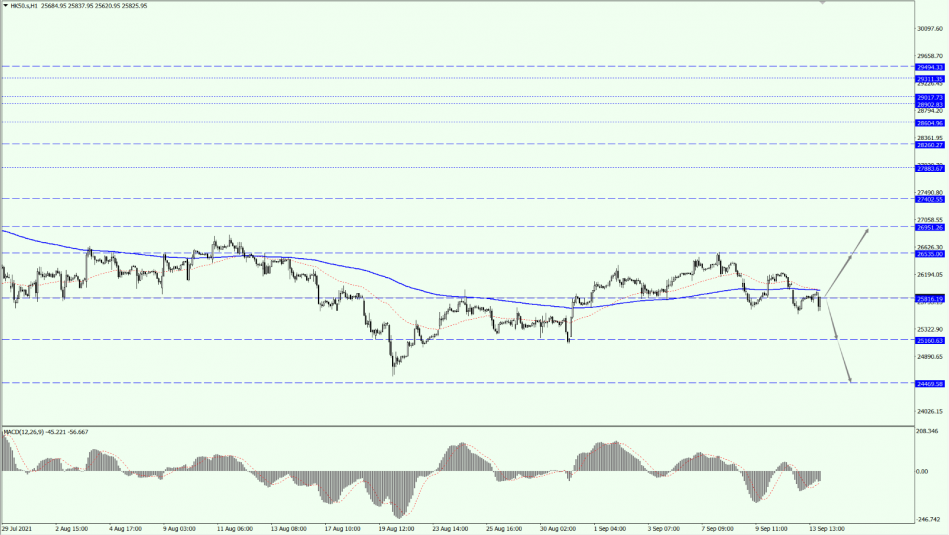

(HK50,1-hour chart)

Execution Insight:

On HK50 today, continue to pay attention to the support of the 25816 line. There is an uptrend line above 25816, and focus on the suppression strength of the two positions of 26535 and 26951 above. If HK50 falls below the 25816 line, then it will test the support of the 25160 line again.

FTSE China A50 Index

Technical Analysis:

(A50,1-hour chart)

Execution Insight:

Today, on A50, pay attention to the support of the 15298 line. As long as A50 runs stably above the 15298 line, focus on the suppression strength of the 15612 line. At that time, pay attention to the support of the 15074 and 14899 lines below.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home