U.S Stocks

Fundamental Analysis:

U.S. stocks were mixed but evaded from daily lows. Concurrently, Fed Chairman Jerome Powell said that the Fed still has some time to consider raising interest rates.

The S&P 500 Index of the U.S. stock market closed little on Wednesday,28th July, 2021 – but it was away from its daily low. Prior to this, the Fed stated that the U.S. economic recovery is still on track. Thus, Fed Chairman Powell said that the Fed still has some time to consider raising interest rates.

At the press conference, after the Fed policy statement was released, Powell also stated that the U.S. job market still needs to make some progress before the Fed decides to withdraw the support measures implemented in the spring of 2020 to combat the impact of the pandemic on the economy.

Alan Lancz, director of an investment consulting firm, Alan B. Lancz & Associates Inc., said: “For the market, the most positive thing could be – we are still far from Fed interest rate raise, in terms of time.”

Soon after the Federal Reserve issued the statement, the S&P 500 Index reversed its slight decline, but still closed slightly lower.

On another note, investors have been worried that the rising inflation and the surge of the Covid-19 cases may affect the Fed’s plan to withdraw stimulus measures.

In addition, the Fed stated that the rise in inflation is still caused by “temporary factors.” With that said, the Fed kept the overnight target interest rate close to zero and maintained its bond purchase plan.

F.L. Putnam Investment Management’s portfolio manager Ellen Hazen said: “They had the opportunity to show that they would become more hawkish, but they chose to stand still. The most important thing is that they are predictable and will continue to be.”

Technical Analysis:

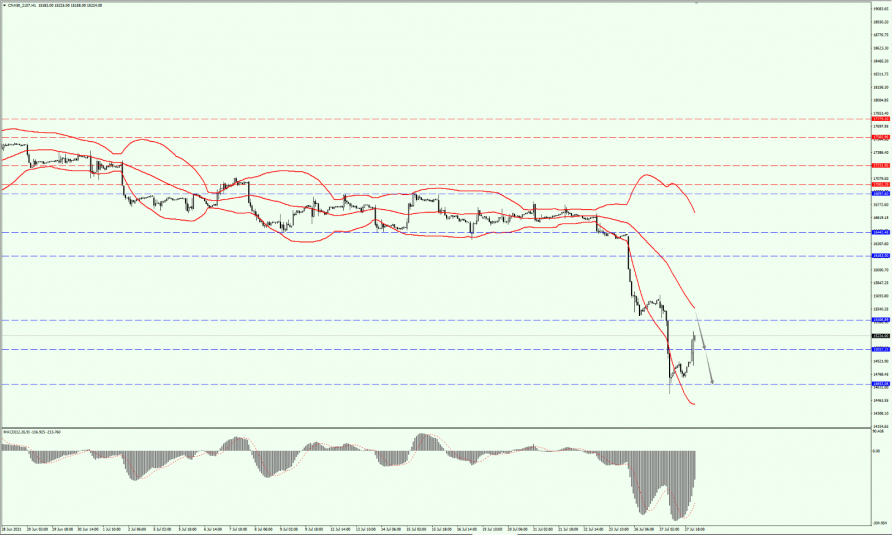

(Dow30, 1-hour chart)

Execution Insight:

Today, continue to pay attention to the direction of Dow’s breakthrough in the range of 34870 to 35080. Secondly, pay particular attention to the possibility of it falling below the 34870-line.

If Dow breaks above the 35080-line, it will create a new record high. With that, anticipate on the possibility of it forming a rise and fall.

Once the bullish trap signal is formed, it could be an opportunity to open a small position and possibly keeps its all-time high.

If the strength drops below the 34870-line, it will create a downside potential.

Hong Kong Stocks

Fundamental Analysis:

The Hang Seng Index opened up with 747.48-points, or at 2.93%, to 26221.36-points. The Hang Seng China Enterprises Index (HSCEI) rose by 3.36% to 9375.46-points. Hang Seng China-Affiliated Corporations Index (HSCCI) – “Red-chips” rose by 0.97% to 3,642.51-points.

The pre-market turnover stood at HK$10.326 billion. Meanwhile, the China stock market trended downwards. The Shanghai Composite Index (SSEC) closed down at 0.5%, while the turnover of the Shanghai and Shenzhen stock markets shrank slightly.

Hong Kong stocks rebounded after falling sharply for several days, though transactions remained active. According to market reports, the China Securities Regulatory Commission issued remarks to appease the market, which led to a significant rebound in China’s stocks. Coupled with oversold after the sharp drop, the index is expected to rebound.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 is focusing on the 25160-line today. As long as the HK50 runs above the 25160-line, it will maintain the rebounding trend. With that in mind, pay attention to the suppression of the 26951-line.

FTSE China A50 Index

Technical Analysis:

(A50, 1-hour chart)

Execution Insight:

Today, A50 is concerned about the possibility of the 15662-line breaking. Once A50 breaks through the 15662-line, it will create an upside potential. At that point, pay attention to the suppression of the positions between16388 and 16880.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.