US Stocks

Fundamental Analysis:

The Nasdaq Composite set a new high yesterday, while the S&P 500 pared earlier gains to close up just 0.03%, failing to reach a record high. Investors bought technology stocks again on the first day of September, and private employment data provided a rationale for dovish monetary policy.

Technology stocks rose, and the sector often benefited from a low interest rate environment. Owing to the impact of new COVID-19 variants, there will be some fluctuations in the economic recovery, and people will look for sectors with the best growth potential in the future.

The three major U.S. stock indices recently hit record highs, the S&P 500 Index has risen for seven consecutive months because investors ignored the rising risk of new virus infections and hoped that the Federal Reserve would maintain a dovish policy stance.

Technical Analysis:

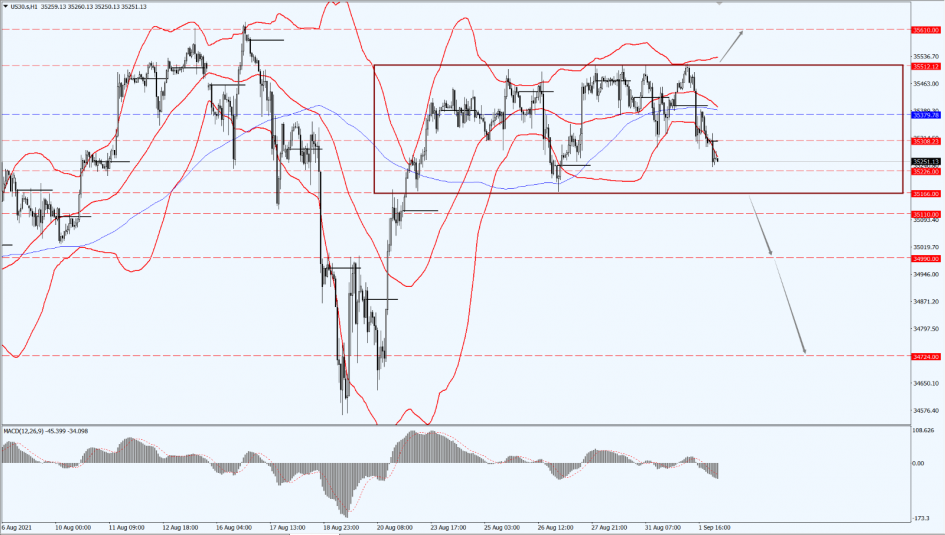

(Dow30,1-hour chart)

Execution Insight:

The Dow Jones Industrial Average was suppressed again by the 35512 line yesterday and fell sharply, causing the shock range to expand to 35166–35512.

Today, pay attention to the breakthrough direction of the expanded shock range and if it falls below the 35166 line, it will open up further downward revision. Subsequently, focus on the support strength of the 34990 line. If it breaks through the 35512 line, it will open up further upward revision, then divert your attention to the suppression strength of the 35610 line.

Hong Kong Stocks

Fundamental Analysis:

The Hang Seng Index opened 0.67% higher, while the Hang Seng Technology Index rose by 1.96%. Kuaishou rose by more than 7%, the Shenzhen Stock Exchange transferred it to the list of Hong Kong Stock Connect stocks under Shenzhen-Hong Kong Stock Connect, Meituan rose by nearly 4%, Alibaba increased by nearly 3%. In the Asia-Pacific market in early trading, FTSE China A50 Index futures rose by 0.35%.

Technical Analysis:

(HK50,1-hour chart)

Execution Insight:

HK50 continued to rise yesterday, paying attention to the support of the 25816 line today. Above this line, there is a bullish trend, and focus on the suppression of the two positions of 26535 and 26951. If HK50 falls below the 25816 line, there is a possibility of testing the supporting strength of the 25160 line.

FTSE China A50 Index

Technical Analysis:

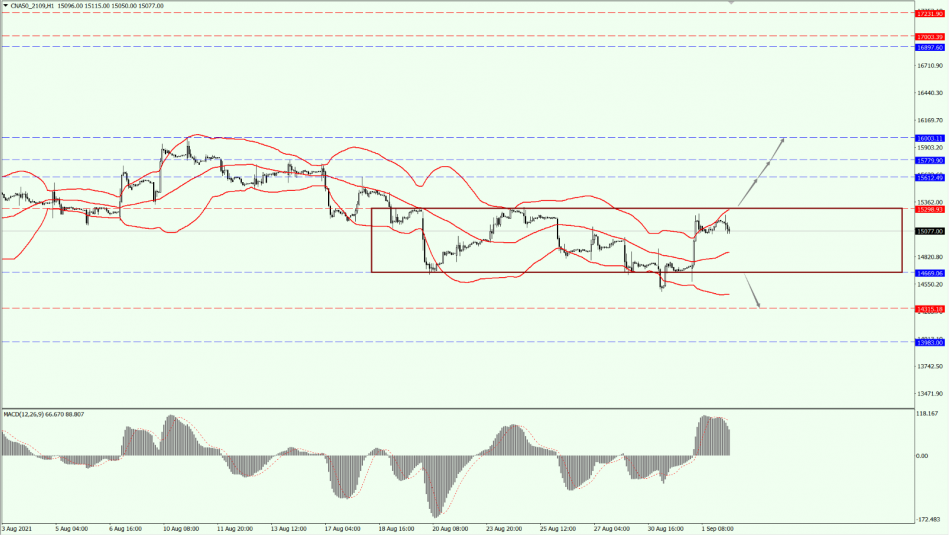

(A50,1-hour chart)

Execution Insight:

Today, A50 focuses on whether it can cross the 15298 line with the possibility of opening up further upward revision. If it manages to break the 15298 line, then pay attention to the suppression strength of the two positions 15612 and 15779.

If it is suppressed by the 15298 line and turns to the downside, it will enter the shock collation again. At that time, shift your attention to the breakthrough direction of the 14669–15298 range.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.