U.S. Stocks

Fundamental Analysis:

Stocks, bonds, cash and gold have all seen outflows recently, with technology stocks seeing the largest outflow so far this year at $1.1 billion, second only to financial stocks at $2.6 billion.

Apple was one of the major stocks leading the major Wall Street indices to new highs after the pandemic-induced crash of 2020, but the stock has now fallen into a bear market, down nearly 10% this week alone. It’s an abrupt shift from six weeks ago when the company’s shares were near record highs.

The tech-dominated Nasdaq 100 is poised to fall for a sixth straight week, its longest losing streak since November 2012, as markets worry that a hawkish central bank overlaid with high inflation could trigger a recession.

Technical Analysis:

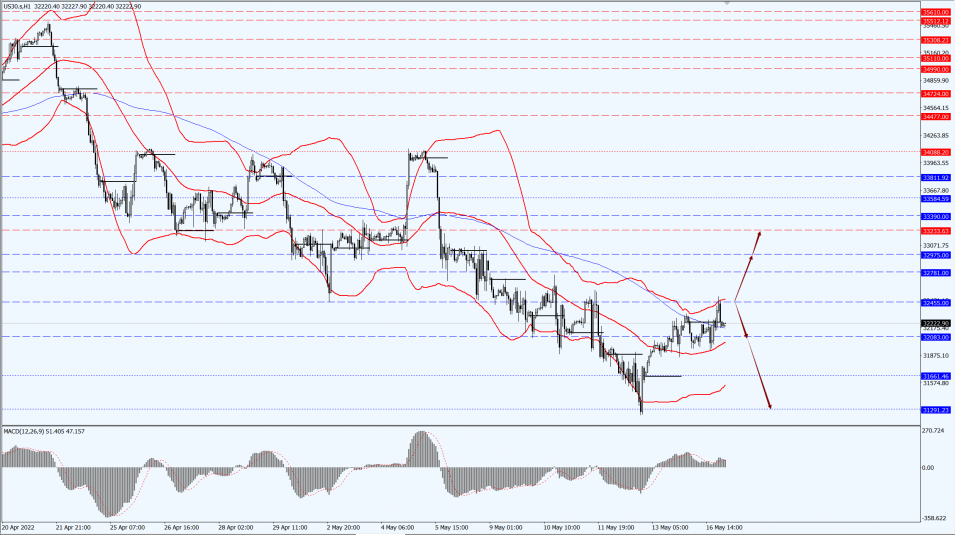

(Dow 30, 1-hour chart)

Execution Insight:

The Dow is concerned about the 32455-line today. If the Dow runs stably below the 32455-line, it will pay attention to the support strength of the 32083 and 31291 positions. If the Dow rebounds above the 32455-line, it will pay attention to the suppression strength of the 32975 and 33233 positions.

Hong Kong Stocks

Fundamental Analysis:

Yesterday, by the close of trading, the Hang Seng Index (HSI) rose 0.26% to 19,950.21 points, Country Garden Holdings Company Limited (2007.HK) rose 10.4%, leading the blue chips, while Haidilao International Holding Ltd. (6862.HK) rose over 6%.

Hang Seng TECH Index (HSTECH) rose 0.01%, GDS Holdings Limited (9698.HK) rose 5.6%, Ping An Healthcare and Technology Company Limited (1833.HK), XPeng Inc. (9868.HK), Trip.com Group Limited (9961.HK) rose more than 4%, Bilibili Inc. (9626.HK) rose 2%, while Alibaba Group Holding Limited (9988.HK) rose 3%.

Bridgewater Associates continues to be bullish on Chinese assets. Alibaba, Pinduoduo, Baidu, and other Chinese stocks have all increased their holdings, while Tesla, which has fell by nearly 30% during the year, has been reduced by liquidation.

In addition to Bridgewater Associates, Fidelity International, JPMorgan and others also began to increase their holdings of Internet stocks such as JD.com and Meituan.

Three private real estate companies, Country Garden, Longfor Properties and Midea Real Estate, has been selected by regulators as model real estate companies that will issue RMB bonds one after another this week.

This afternoon, the three stocks broke out, and by the end of the day, Country Garden Holdings Company Limited (2007.HK) surged more than 10%, Longfor Group Holdings Limited (0960.HK) rose nearly 5%, and Midea Real Estate Holding Limited (3990.HK) rose 8%.

From 16th May 2022 onwards, Shanghai will promote the restoration of business back to the market in phases, and consumer stocks have collectively risen. Cathay Media and Education Group Inc. (1981.HK), and Huazhu Group Limited (1179.HK) jumped nearly 8%, New Oriental Education & Technology Group Inc. (9901.HK), and Haidilao International Holding Ltd. (6862.HK) rose more than 6%. Cloud Village Inc. (9899.HK) rose 5.5%, SJM Holdings Limited (0880.HK), Shenzhou International Group Holdings Limited (2313.HK), and XPeng Inc. (9868.HK) rose more than 4%.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 19517-line today. If HK50 can run stably above the 19517-line, then pay attention to the suppression strength of the 20467 and 21450 positions. If the HK50 runs below the 19517-line, then pay attention to the support of the 18606-line.

FTSE China A50 Index

Technical Analysis:

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 focuses on the 13157-line today. If the A50 runs steadily below the 13157-line, it will pay attention to the support strength of the two positions of 12733 and 12328. If the A50 runs above the 13157-line, it will open up further upward space. At that time, pay attention to the two positions of 13496 and 13983.

Risk Disclosure

Trading in financial instruments involves a high degree of risk due to fluctuations in the value and price of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with us. You should seek independent professional advice if you do not understand the risks disclosed by us herein.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.