U.S. Stocks

Fundamental Analysis:

U.S. stocks closed higher on Monday, 24th October 2022 extending last week’s rally, as signs of economic weakness suggest that the Federal Reserve’s aggressive policies aimed at cooling the economy and thus curbing inflation, which is at multi-decade highs, are starting to take effect.

All three major U.S. stock indexes gained momentum in the first trading day of the week, with several giants set to report earnings this week and a number of key economic data coming out.

U.S. business activity shrank for the fourth straight month in October, with both manufacturers and service sector firms reporting weaker customer demand in the monthly survey of purchasing managers.

This hints that the Fed’s string of sharp rate hikes is having the desired effect, raising hopes that the Fed may begin to slow the pace of rate hikes.

Of the 11 major sectors in the S&P 500, nine closed higher, with health care stocks gaining the most. Materials and real estate stocks closed lower.

Tesla Inc. fell 1.5% after the company cut prices for its Model 3 and Model Y cars by as much as 9% in China, signaling weak demand in the world’s largest auto market.

The third-quarter earnings season is set to reach its climax this week.

So far, nearly one-fifth of the S&P 500 component companies have reported earnings. According to Luft’s data, 74.7% of them exceeded expectations. Lufthansa data also shows that the overall earnings of S&P 500 component companies are expected to grow 3.0%, down from the 4.5% forecast at the beginning of the month.

The results from a series of technology and technology-related giants are likely to be the highlight of this week’s earnings reports.

Technical Analysis:

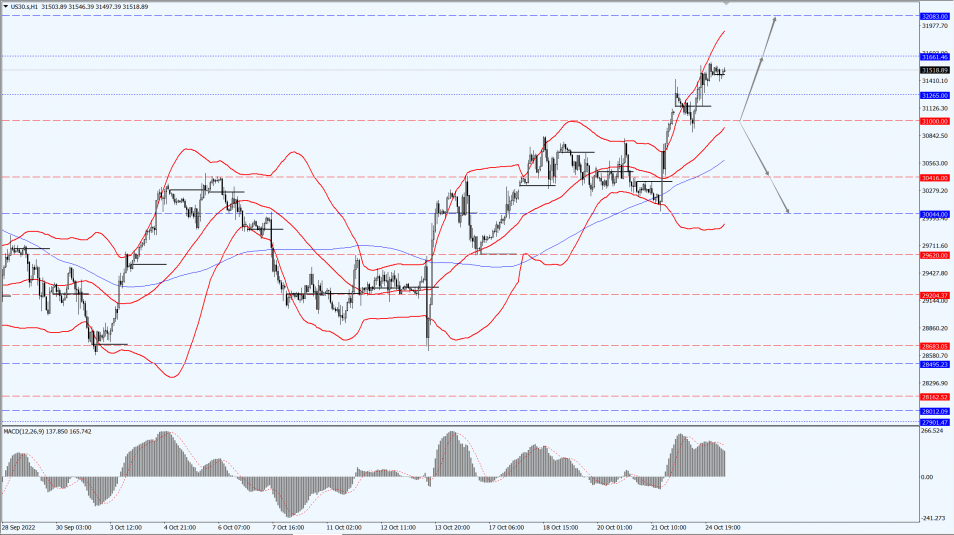

(Dow 30, 1-hour chart)

Execution Insight:

The Dow focuses on the 31000-line today. If the Dow runs steadily above the 31000-line, it will pay attention to the suppression of the 31661 and 32083 positions. If the Dow runs steadily below the 31000-line, it will pay attention to the support strength of the 30416 and 30044 positions.

Hong Kong Stocks

Fundamental Analysis:

Hong Kong stocks continued to bottom out and saw heavy volume declines.

The Hang Seng Index (HSI) fell by more than 1,000 points and quickly dropped to the 15,000-point mark.

The market turnover also surged to more than 160 billion yuan, the largest daily turnover in 4 months. Every wave of bottom-seeking market ends with selling. After the market has released the potential selling pressure through heavy volume decline, there is a chance to find a stage bottom.

Therefore, since September, the trading volume of Hong Kong stocks has been the most reliable signal for judging whether funds have been bought back at low prices.

At present, the Hong Kong stock market has finally dropped in heavy volume, and it is expected that the Hong Kong stock market is very close to the stage bottom position.

Overnight, the three major U.S. stock indexes closed up collectively, and the China Concept Index once fell by more than 20%.

Hong Kong stocks, which fell sharply yesterday, rebounded and opened higher, with the Hang Seng Index (HSI) up 0.4%, the Hang Seng China Enterprises Index (HSCEI) up 0.7%, and the Hang Seng TECH Index (HSTECH) up 1.18%.

On the market, some of the Chinese concept stocks returning back to Hong Kong fell, led by ZTO Express (Cayman) Inc. (2057.HK) and Li Auto Inc. (2015.HK). JD.com, Inc. (9618.HK), Meituan (3690.HK), and NetEase, Inc. (9999.HK), rose slightly, while Tencent Holdings Limited (0700.HK) opened 2% lower;

Internet medical stocks were strong, logistics stocks, mobile phone concept stocks, Drug stocks rose.

On the other hand, domestic insurance stocks continued to decline, sporting goods stocks and catering stocks generally fell, and auto stocks showed divergent trends. Nongfu Spring Co., Ltd. (9633.HK) rose by more than 6%, and JD Health International Inc. (6618.HK) rose by nearly 15%.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 15995-line today. If HK50 can run stably above the 15995-line, then focus on the suppression strength of the 16964 and 17535 positions. If the HK50 runs below the 15995-line, then pay attention to the support strength of the 15136 and 14309 positions.

FTSE China A50 Index

Technical Analysis:

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 focuses on the 12135-line today. If the A50 runs stably below the 12135-line, then pay attention to the support strength of the two positions of 11690 and 11423. If the A50 runs above the 12135-line, it will open up further upward space. At that time, pay attention to the two positions of 12336 and 12659.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.