U.S. Stocks

Fundamental Analysis:

U.S. stocks surged on Friday, 21st October 2022, after reports that the Federal Reserve will likely debate a smaller rate hike in December raised hopes that the Fed may be prepared to adopt a less aggressive policy stance.

Last week, the S&P 500 climbed 4.74%, the Dow gained 4.89% and the Nasdaq jumped 5.22%.

All three major indexes posted their biggest one-week percentage gains in four months. The report helped stocks recover from an early session decline.

Snap plunged 28.08% after reporting its slowest quarterly revenue growth in five years, which dragged stocks lower at the start of the session as advertisers cut spending due to inflation and geopolitical woes.

That also pressured other stocks that rely heavily on advertising revenue, with American Express and Verizon Communications down 1.67% and 4.46%, respectively, after reporting quarterly results.

This week, companies such as Twitter, Microsoft, Alphabet and Apple will report results.

Despite a recent batch of disappointing results, the third-quarter earnings season so far has been better than previously feared, with profit growth for S&P 500 constituents expected to be 3.1%, up from 2.8% earlier this week but still well below the 11.1% forecast in early July, according to Lufthansa data.

Technical Analysis:

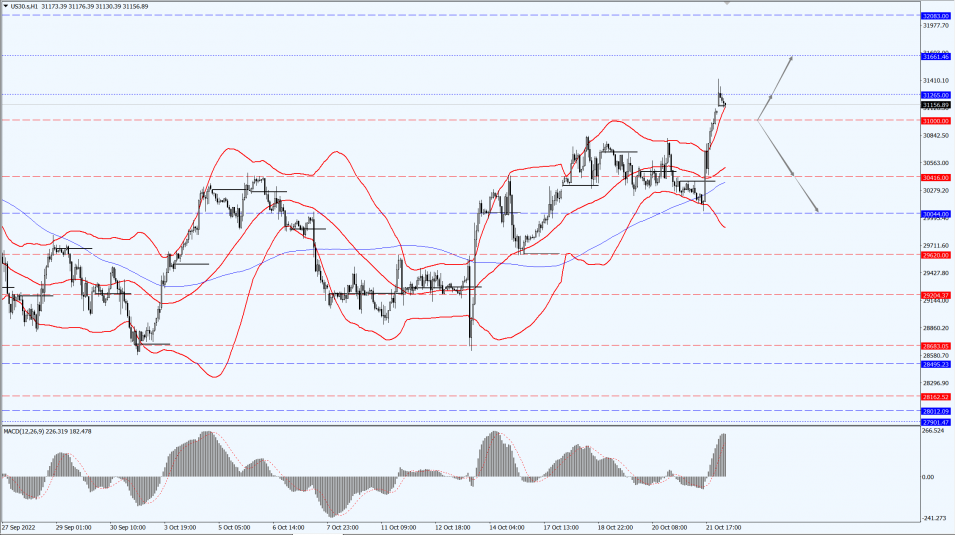

(Dow 30, 1-hour chart)

Execution Insight:

The Dow is focusing on the 31000-line today. If the Dow runs steadily above the 31000-line, it will pay attention to the suppression strength of the two positions of 31265 and 31661. If the Dow runs steadily below the 31000-line, it will pay attention to the support strength of the two positions of 30416 and 30044.

Hong Kong Stocks

Fundamental Analysis:

The Hong Kong stock market continued to move lower in early trading, with the Hang Seng Index (HSI) temporarily down 4.67%, or 757 points, at 15,454.38 points. As for the Hang Seng TECH Index (HSTECH) it fell 5.61% to 2928 points.

Among the blue chips, Alibaba Group Holding Limited (9988.HK) plunged 10.49% to HK$62.35, while hitting a record low and dragging the HSI by more than 120 points.

Other components of the stock, Country Garden Services Holdings Company Limited (6098.HK) fell nearly 10%, Longfor Group Holdings Limited (0960.HK) fell 9.11%, JD.com, Inc. (9618.HK) fell 9%, Baidu, Inc. (9888.HK) fell 8.47%, Meituan (3690.HK) fell 7.34%, Tencent Holdings Limited (0700.HK) fell 6.79%.

Although this round of foreign capital outflows in the Hong Kong stock market is not as large as in 2018-2019, the impact on stock prices appears to be greater, reflecting that capital flows and stock prices do not have a linear relationship.

If the internal and external environment improves, the Hong Kong stock market is expected to rebound more strongly in the future.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 15995-line today. If HK50 can run stably above the 15995-line, then focus on the suppression strength of the 16964 and 17535 positions. If the HK50 runs below the 15995-line, then pay attention to the support strength of the 15136 and 14309 positions.

FTSE China A50 Index

Technical Analysis:

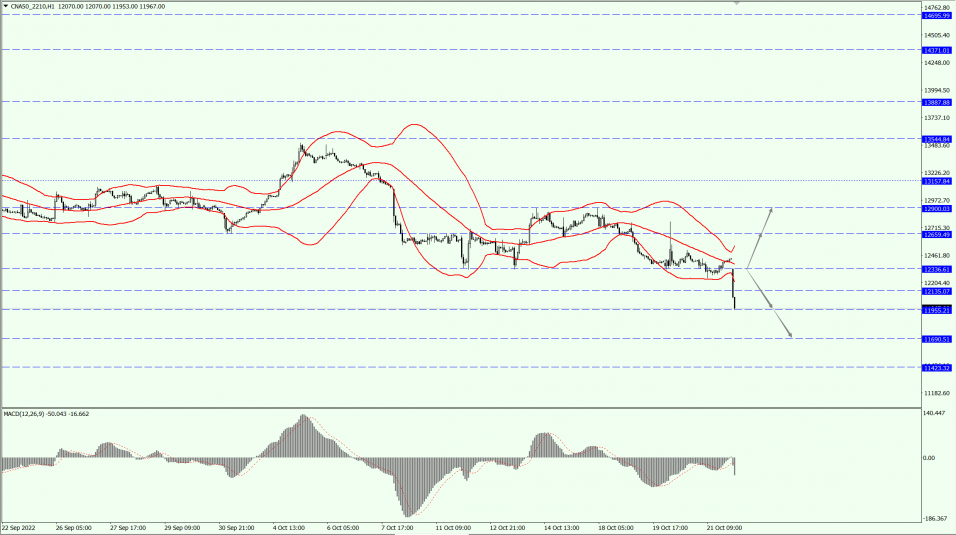

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 pays attention to the 12336-line today. If the A50 runs steadily below the 12336-line, pay attention to the support strength of the two positions of 11955 and 11690. If the A50 runs above the 12336-line, it will open up further upward space. At that time, pay attention to the two positions of 12659 and 12900.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.