U.S. Stocks

Fundamental Analysis:

U.S. stocks rose late on Tuesday, 7th June 2022, to close higher for a second straight day, with technology and energy stocks gaining and the S&P 500 approaching a near one-month high.

Apple rose 1.8% despite earlier news that the company must replace iPhone ports sold in Europe by 2024 after EU countries and lawmakers agreed to use a single charging port for phones, tablets and cameras.

The S&P 500 index of technology stocks rose by 1%, giving the benchmark the biggest boost.

Microsoft climbed 1.4%. The S&P 500 energy stock index jumped 3.1 percent to close at its highest level since 2014, as oil prices surged.

By Tuesday’s close, the Dow Jones Industrial Average rose 264.36 points, or 0.8%, to 33,180.14, the S&P 500 rose 39.25 points, or 0.95%, to 4,160.68, and the Nasdaq rose 113.86 points, or 0.94%, to 12,175.23.

Technical Analysis:

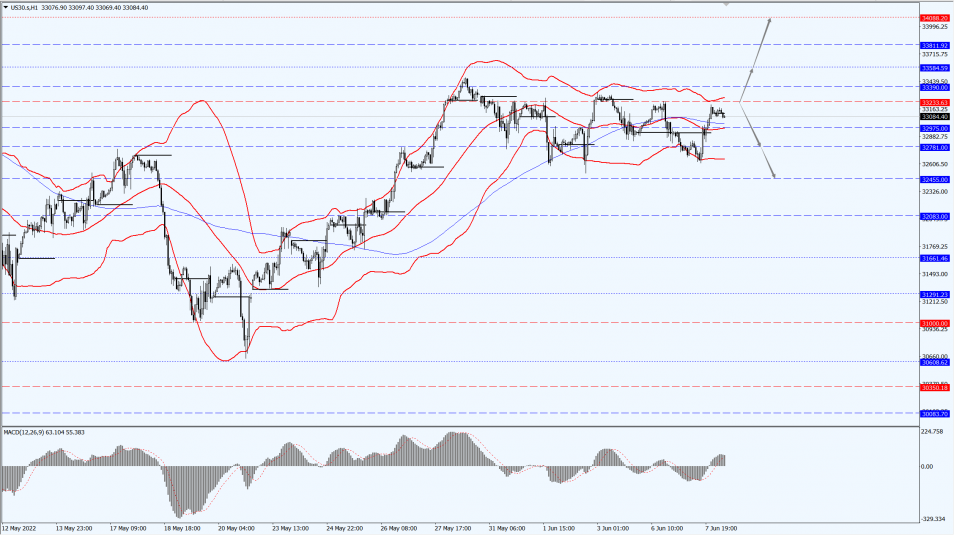

(Dow 30, 1-hour chart)

Execution Insight:

The Dow focuses on the 33233-line today. If the Dow runs stably above the 33233-line, it will pay attention to the suppression strength of the 33584 and 34088 positions. If the Dow falls below the 33233-line, it will pay attention to the support strength of the 32781 and 32455 positions.

Hong Kong Stocks

Fundamental Analysis:

Hang Seng Index (HSI) opened 1.19% higher, posting a new 2-month high while Hang Seng TECH Index (HSTECH) rose 2.13%.

Alibaba rose 4.66%, leading the blue chips as pharmaceutical stocks, oil stocks are active. Bilibili Inc. (9626.HK) rose more than 11%, XD Inc. (2400.HK) rose nearly 6%.

Yesterday, the State Press and Publication Administration again issued the second batch of game version number in the year.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 21450-line today. If HK50 can run stably above the 21450-line, then pay attention to the suppression strength of 22127 and 22785. If HK50 runs below the 21450-line, then pay attention to the support strength of 20467 and 19517.

FTSE China A50 Index

Technical Analysis:

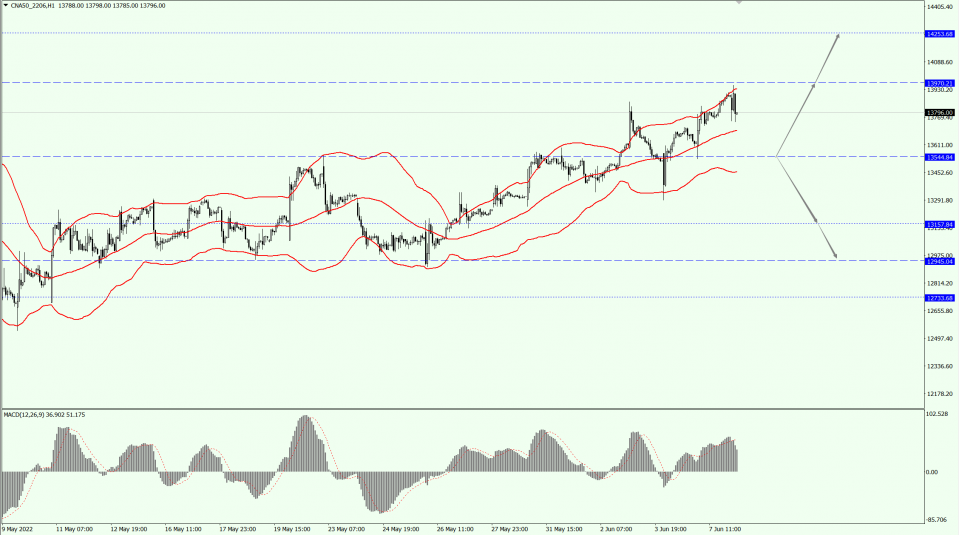

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 focuses on the 13544-line today. If the A50 runs steadily below the 13544-line, it will pay attention to the support strength of the two positions of 13157 and 12945. If the A50 runs above the 13544-line, it will open up further upward space. At that time, pay attention to the pressure of the two positions at 13970 and 14253.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand the any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.