U.S. Stocks

Fundamental Analysis:

U.S. stocks closed sharply higher on Tuesday, 17th May 2022, boosted by Apple, Tesla and other growth stock giants, as strong April retail sales data eased concerns about slowing economic growth.

Ten of the S&P’s 11 major sector indexes rose, with financials, materials, non-essential consumer goods and technology stocks all up more than 2%.

Investors were cheered as data showed U.S. retail sales rose 0.9% in April, with consumers buying cars as supply improved and frequenting restaurants.

Recent sell-offs in Microsoft, Apple, Tesla and Amazon rose between 2% and 5.1%, pushing the S&P 500 and Nasdaq higher.

Stocks rebounded across the board Tuesday after a weeks-long sell-off in U.S. stocks, with the S&P 500 falling last week to its lowest level since March 2021.

The S&P 500 climbed 2.02% to close at 4,088.85. The Nasdaq rose 2.76% to 11,984.52, while the Dow Jones Industrial Average gained 1.34% to 32,654.59.

Technical Analysis:

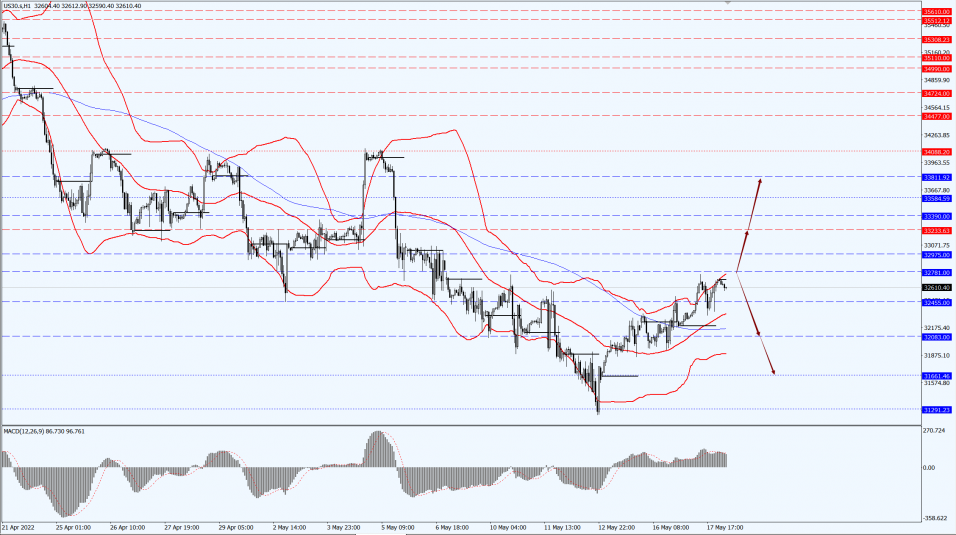

(Dow 30, 1-hour chart)

Execution Insight:

The Dow is concerned about the 32781-line today. If the Dow runs stably below the 32781-line, then it will pay attention to the support strength of the 32083 and 31661 positions. If the Dow rebounds above the 32781-line, then pay attention to the suppression strength of the 33233 and 33811 positions.

Hong Kong Stocks

Fundamental Analysis:

Yesterday, the Hang Seng Index (HSI) and the Hang Seng TECH Index (HSTECH) rose 3.3% and 5.8% respectively, extending the upward trend since 13th May 2022.

Two factors that dragged down the performance of Hong Kong stocks from early April to early May, namely exchange rate depreciation and the domestic epidemic, have shown signs of reversal: overseas “inflation” to “stagnation”.

The exchange rate depreciation is expected to reverse: from April 18 to May 16, the slowdown in growth due to the domestic epidemic and the Federal Reserve’s hawkish stance has led to a 6.2% depreciation of the RMB against the USD.

However, the strong dollar logic since April is expected to come to an end considering that the daily Covid-19 cases in the U.S. exceeded 100,000 again.

The consumer confidence in May has fallen to its lowest point since the European debt crisis in 2011; and the continued deterioration of SME expectations for increased employment, future sales and economic outlook since the beginning of the year.

In the future, the market will likely shift from “inflation” to “stagnation”, and the RMB/USD exchange rate is expected to gradually stabilize and rebound.

Domestic local epidemic control is improving, and measures to stabilize growth the repair of fundamentals: 17th May 2022, Shanghai announced that the city’s 16 administrative regions have achieved zero social surface.

The future resumption of work and production is expected to continue to promote, while the nationwide daily new confirmed cases also fell from 5659 cases on 28th April to 175 cases on 16th May.

Under the expectation that economic momentum will be restored and the policy of stabilizing growth will continue to be introduced, the trend of downward revisions in the performance forecasts of major Hong Kong stock indexes since the beginning of the year has also reversed.

Last week, the 2022 net profit growth forecasts of the Hang Seng Index and the Hang Seng Composite Index were both revised upwards, and the revenue growth forecasts for both have rebounded since April.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 19517-line today. If HK50 can run stably above the 19517-line, then pay attention to the suppression strength of the 20467 and 21450 positions. If the HK50 runs below the 19517-line, then pay attention to the support of the 18606-line.

FTSE China A50 Index

Technical Analysis:

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 focuses on the 13157-line today. If the A50 runs steadily below the 13157-line, it will pay attention to the support strength of the two positions of 12733 and 12328. If the A50 runs above the 13157-line, it will open up further upward space. At that time, pay attention to the two positions of 13496 and 13983.

Risk Disclosure

Trading in financial instruments involves a high degree of risk due to fluctuations in the value and price of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with us. You should seek independent professional advice if you do not understand the risks disclosed by us herein.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.