U.S. Stocks

Fundamental Analysis:

U.S. stocks closed slightly lower on Wednesday, 12th October 2022, trading in choppy territory as minutes from the Federal Reserve’s September meeting showed that policymakers agree they need to maintain a more restrictive policy stance.

The minutes from the September meeting also showed that many Fed officials highlighted the cost of not doing enough to reduce inflation.

The recent market weakness is partly related to investors’ growing concern that aggressive Fed rate hikes could plunge the world’s largest economy into recession.

Interest rate-sensitive utilities stocks fell 3.4% and real estate stocks fell 1.4%, leading to declines among the S&P 500 sectors.

The market rebounded after the opening bell as data released earlier in the day showed a surprise rise in producer prices in September.

The Labor Department’s producer price index (PPI) rose 8.5% in the 12 months ending in September, slightly above the estimated 8.4%.

It was still lower than the 8.7% increase in August, however.

Thursday’s U.S. consumer price report is considered more critical by the market, while the U.S. third-quarter earnings season will also kick off, with a number of large U.S. banks due to report earnings on Friday.

The S&P 500 financial stock index closed down 0.3%. Among the gainers, PepsiCo jumped 4.2% after the soft drink maker raised its annual revenue and profit forecasts as demand for its sodas and snacks remained firm despite several price increases.

Meanwhile, the Biden administration is weighing restrictions on Russian aluminum imports, and the U.S. government is now considering possible reactions to Moscow’s military escalation in Ukraine.

The ratio of stocks down to stocks up on the NYSE was 1.64:1.

The Nasdaq market was 1.15:1.

No S&P 500 components hit new 52-week highs and 78 components hit new lows and 20 Nasdaq components hit new 52-week highs and 433 hit new lows.

The U.S. exchanges traded a cumulative total of 10.01 billion shares, compared to a daily average of 11.68 billion shares over the past 20 trading days.

Technical Analysis:

(Dow 30, 1-hour chart)

Execution Insight:

The Dow focuses on the 29204-line today. If the Dow runs steadily above the 29204-line, it will pay attention to the suppression strength of the two positions of 29538 and 29767. If the Dow runs steadily below the 29204-line, it will pay attention to the support strength of the two positions of 28809 and 28495.

Hong Kong Stocks

Fundamental Analysis:

This morning, the Hang Seng Index (HSI) opened flat at 16700.65 points. The Hang Seng TECH Index (HSTECH) fell 0.28% to 3260.37 points and the Hang Seng China Enterprises Index (HSCEI) fell 0.15% to 5683.9 points.

On the market, new energy auto stocks are lower, Li Auto Inc. (2015.HK) fell more than 1%.

Gas stocks continue to move lower, domestic banking stocks, dairy stocks, sporting goods stocks, cell phone concept stocks most of the decline, China Merchants Bank Co., Ltd. (3968.HK) fell more than 3% again.

On the other hand, biotechnology stocks rose sharply, BeiGene, Ltd. (6160.HK) and CARsgen Therapeutics Holdings Limited (2171.HK) both jumped nearly 15%.

E-cigarette concept stocks Smarter International continued yesterday’s rise, restaurant stocks, photovoltaic stocks, aluminum stocks have rebounded, Aluminum Corporation of China rose more than 4%.

In September, the U.S. non-farm payrolls exceeded expectations again, the unemployment rate fell back, but the U.S. economic leadership index indicates that recession is approaching.

The U.S. dollar and U.S. debt rates will continue to be strong before the November interest rate hike, and the trend of the RMB during this period will dampen foreign investors’ desire to allocate to Hong Kong stocks.

Although Hong Kong stocks have entered the end of the bear market, valuation, market width, turnover and adjustment time have begun to meet the characteristics of a bear market bottoming, but for the time being, we have not seen the ultimate fall triggered by deleveraging, and earnings forecasts continue to be revised downward, the capital flow back to the U.S. dollar trend will not change.

In addition, Hong Kong stocks need to build a big bottom with the U.S. stock bottoming, U.S. stocks down Hong Kong stocks is difficult not to fall. However, Hong Kong stocks have more short positions and are ready to force a short market.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 17535-line today. If HK50 can run stably above the 17535-line, then pay attention to the suppression strength of the 18606 and 19517 positions. If the HK50 runs below the 17535-line, then pay attention to the support strength of the 16664 and 15995 positions.

FTSE China A50 Index

Technical Analysis:

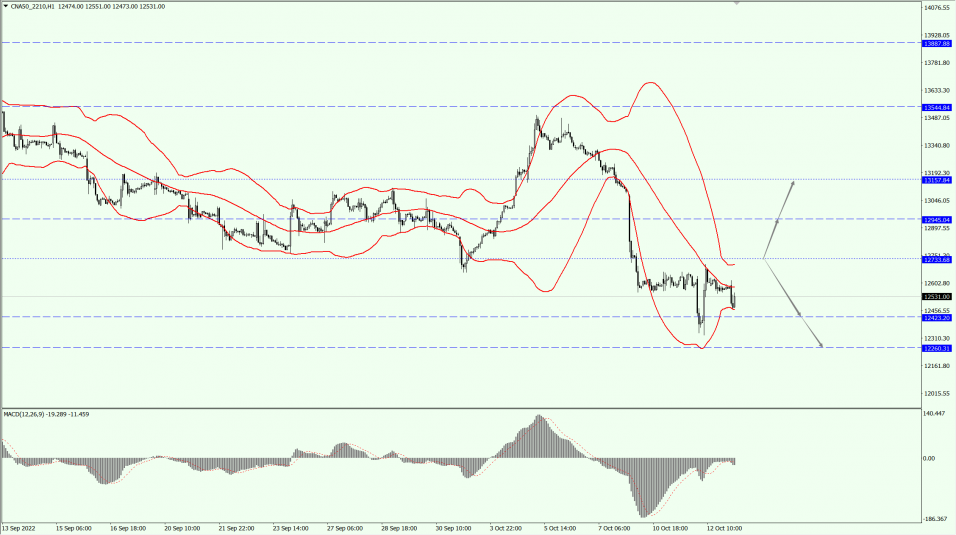

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 pays attention to the 12733-line today. If the A50 runs steadily below the 12733-line, it will pay attention to the support strength of the two positions of 12423 and 12260. If the A50 runs above the 12733-line, it will open up further upward space. At that time, pay attention to the two positions of 12945 and 13157.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.