US Stocks

Fundamental Analysis:

U.S. stocks ended bullish on Tuesday, 5 October 2021, as Microsoft and Apple led a strong rebound in growth stocks and investors waited for monthly payroll data later this week to reflect a decision from the US Federal Reserve, which may affect when to reduce monetary stimulus.

Apple, Microsoft, Amazon, and Alphabet – Wall Street’s most valuable companies – each rose by more than 1% earlier the day after selling in growth stocks. Meanwhile, technology stocks and other high-growth stocks took a beating on Monday, 4 October 2021, as US Treasury yields ticked higher amid concerns about a potential U.S. government debt default.

Apart from that, the Senate will vote on a Democratic-backed measure to suspend the U.S. debt limit on Wednesday, 6 October 2021, a prominent lawmaker said yesterday, as partisan fracas in Congress risks a financially crippling federal loan default.

Technical Analysis:

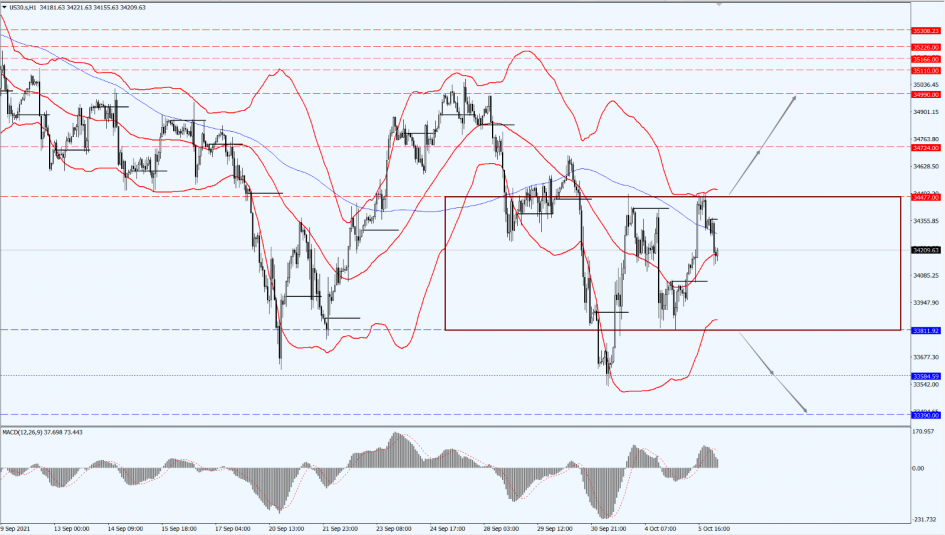

(Dow30,1-hour chart)

Execution Insight:

Today, we pay attention to the breakthrough direction of its shock range from 33811 to 34477. If it breaks through the 34477 line, it will open up further upward revision, and then focus on the suppression strength of the 34724 and 34990 positions. If it falls below the 33811 line, it will open up further downward revision. At that time, shift your attention to the support of the 33584 and 33390 positions.

Hong Kong Stocks

Fundamental Analysis:

Hong Kong stocks opened higher and went lower, with the Hang Seng Technology Index widened its decline to 1%, and the Hang Seng Index fell by 0.8%. On the other hand, photovoltaic, pharmaceutical, and real estate stocks fell the most, while Country Garden Services led the blue-chip declines.

Energy stocks strengthened against the market, with Sinopec Oilfield Service rose by more than 9%. Energy stocks led the gains in Hong Kong stocks. Among them, the “three barrels of oil” performed brilliantly. After PetroChina’s high opening, the increase once expanded to 5%, continuing to hit a new high since May 2019. However, the current rise has fallen back to 4%. Subsequently, Yanzhou Coal Mining Company rose by nearly 5%, while China National Offshore Oil Corporation rose by 2.13%.

Besides that, Shares of China Evergrande New Energy Vehicle have widened their decline to 10%. CST Group announced that the company has sold 32.18 million shares of Evergrande New Energy Vehicle through the open market on 5 October, with an average price of HK$3.89 per share and an aggregate consideration of HK$125 million.

Technical Analysis:

(HK50,1-hour chart)

Execution Insight:

On HK50 today, we pay attention to the breakthrough direction of the bottom shock range from 23832 to 24670. If it breaks through the 24670 line, it will open up further upward revision. At that time, focus on the suppression strength of the 25160 line. If it falls below the 23832 line, it will open up further downward revision. Then, divert your attention to the support of the 23294 line.

FTSE China A50 Index

Technical Analysis:

(A50,1-hour chart)

Execution Insight:

On A50, pay attention to the 15184 line today. If A50 is above the 15184 line, it will remain as a bullish trend. Then, pay attention to the support of the 14669 line below.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.