U.S Stocks

Fundamental Analysis:

The U.S. stocks have been ending with rapid fluctuation for five consecutive days. In the meantime, the market stays cautious upon the posting of the technology giants’ earnings and the Federal Reverse’s decision.

In spite of the U.S. stock market closed lower on Tuesday,27th July 2021, the three major stock indexes ended high, on a five-day streak. With this, investors remain cautious until the top technology and Internet companies post their earnings, along with the Federal Reserve’s announcement towards its policy decision on Wednesday.

The Nasdaq index leads the fall, setting the biggest single-day percentage drop since 12th May. However, the three major stock indexes regained some of their losses at the end of the session, precisely, far from their daily low.

The technology and Internet giants have been on the rise recently, regaining their leading positions in the market last week. Thus, raising investors’ concerns about their performance.

Kingsview Wealth Management’s portfolio manager, Paul Nolte said, “The market has very high hopes. They will announce decent results… But we are hoping for more, or they might downplay their expectations for the second half of the year’s earnings.”

Another factor that causes rising uncertainty is that the Fed began its two-day meeting today, and investors will look for clues as to when the Fed intends to start scaling back its large-scale stimulus plan.

Technical Analysis:

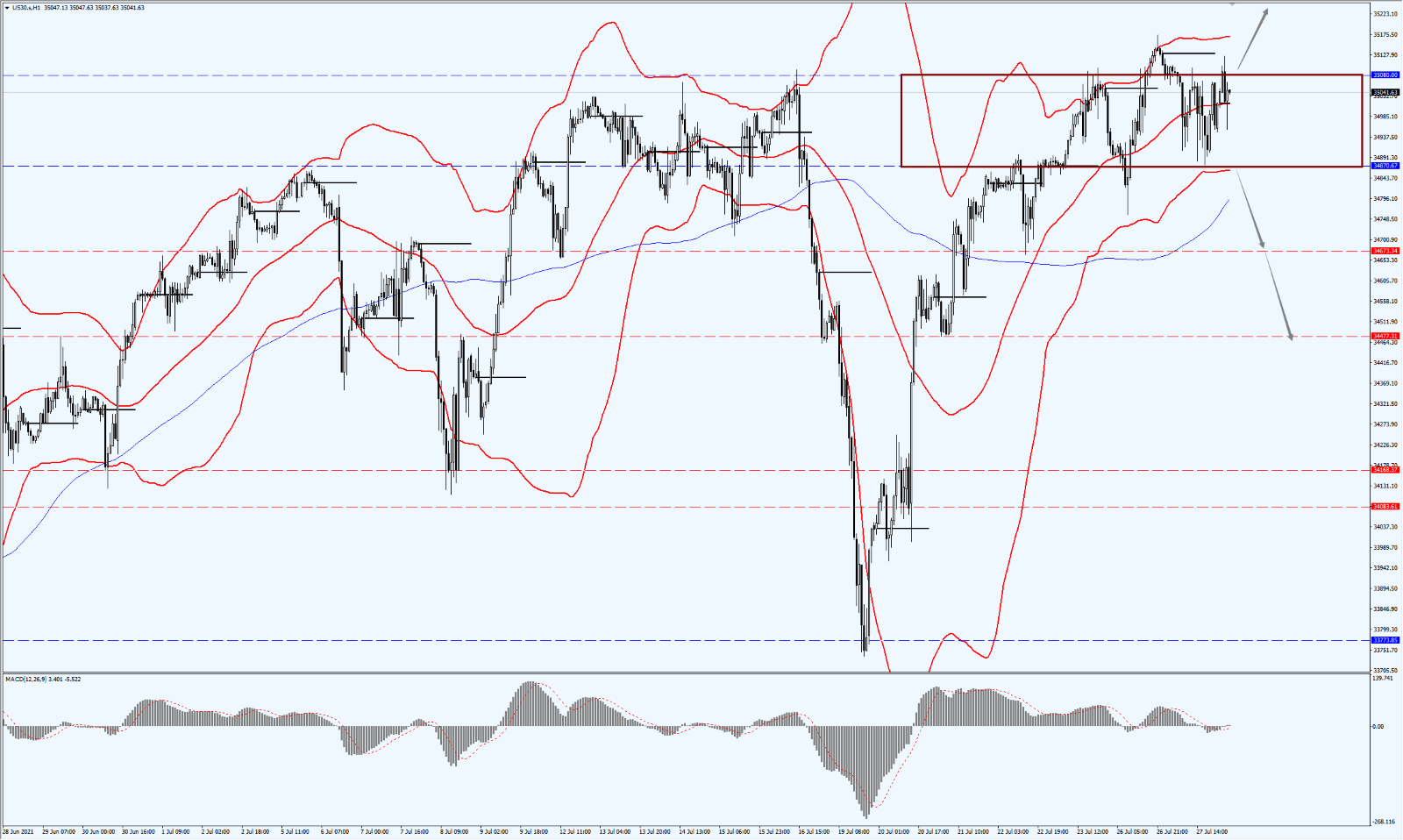

(US30, 1-hour chart)

Execution Insight:

Today, pay attention to the direction of the Dow’s breakthrough, between the range of 34870 to 35080. Specifically, in the event of it falling below the 34870-line.

If the Dow breaks through the 35080-line, it will create a record high. With this, pay closer attention to the possibility of it forming a “bullish trap” signal of rapid rising and falling.

Once it has been formed, this could be an opportunity to open a small position and possibly keeps its all-time high.

If the strength drops below the 34870-line, it will open up a further down going position.

Hong Kong Stocks

Fundamental Analysis:

Hong Kong stocks gained more than 400-points this morning after its sharp drop over the past two days. Hong Kong’s Hang Seng Index rose by 1.08% at the opening, and then rapidly surged to 1.6%, achieving 25520-points.

Education stocks rebounded across the board, opening with a strong climb. New Oriental Edu opened with more than 12%, SCHOLAR EDU rose by more than 10%, while the Koolearn Tech and China Education Group Holdings both rose.

New Oriental Edu’s growth rate continues to climb, extending to 15%. The Hang Seng Technology Index rose nearly 3% at the beginning of the market, while technology stocks rose collectively.

In addition, Meituan rose by 9%, NetEase rose nearly by 6%, Jingdong rose nearly 4%, whilst Baidu and Xiaomi Group both rose about 4%.

Technical Analysis:

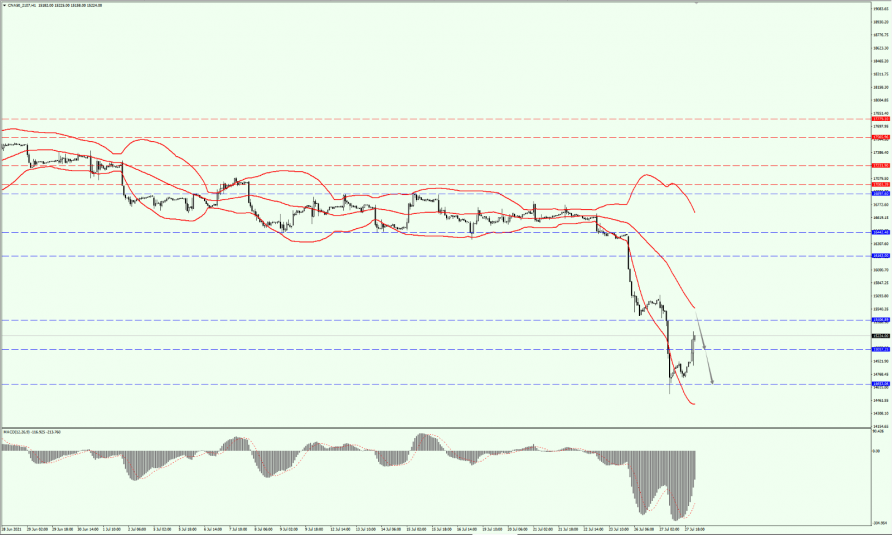

(HK50, 1-hour chart)

Execution Insight:

HK50 still remains bearish towards the trend today. With this, pay attention to the support of the two positions between 24469 and 24029 below.

At the same time, focus on the suppression of the two positions 25880 and 26535 as well.

FTSE China A50 Index

Technical Analysis:

(A50, 1-hour chart)

Execution Insight:

A50 rebounded after falling yesterday. Today, start paying attention to the strength of the rebound pressure. Focus on the suppression of the A50 by the Bollinger Band Middle Rail.

Once the rebound is under pressure, you can consider taking the trend to bearish, and then pay attention to the support of the two positions between 15057 and 14653 below.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.