U.S. Stocks

Fundamental Analysis:

The three major U.S. stock indexes closed up more than 2% on Monday, 3rd October 2022, as weaker-than-expected manufacturing data led to a big drop in U.S. bond yields, boosting the appeal of stocks on the first trading day of the fourth quarter.

U.S. stocks have fallen for three straight quarters in this year’s shaky trading, a period characterized by interest rate hikes by multiple central banks to curb inflation, which is at an all-time high, and concerns about a slowing economy.

Indicators of falling U.S. 10-year Treasury yields after British Prime Minister Donald Truss was forced to scrap plans to abandon the top income tax rate further supported rate-sensitive growth stocks.

All 11 major sectors of the S&P 500 closed higher, with energy stocks gaining the most.

Oil giants Exxon Mobil and Chevron rose more than 5%, following oil price gains as sources said the Organization of Petroleum Exporting Countries (OPEC) and its allies are considering the sharpest production cuts since the start of the Covid-19 epidemic.

Large growth and technology stocks such as Apple and Microsoft rose more than 3%, while bank stocks climbed 3%.

U.S. manufacturing activity grew at its slowest pace in nearly two-and-a-half years in September as new orders contracted, the data showed, likely due to cooling demand for goods caused by rising interest rates.

The Institute for Supply Management (ISM) said the U.S. manufacturing purchasing managers’ index (PMI) fell to 50.9 in September, lower than expected but still above 50, indicating that the manufacturing sector is still expanding.

The three major stock indexes closed lower in a turbulent third quarter on growing concerns that the Fed’s aggressive monetary policy will plunge the economy into recession.

Tesla plunged 8.6% after the company reported weaker-than-expected third-quarter car sales, hampered by logistical problems that saw deliveries lag far behind production.

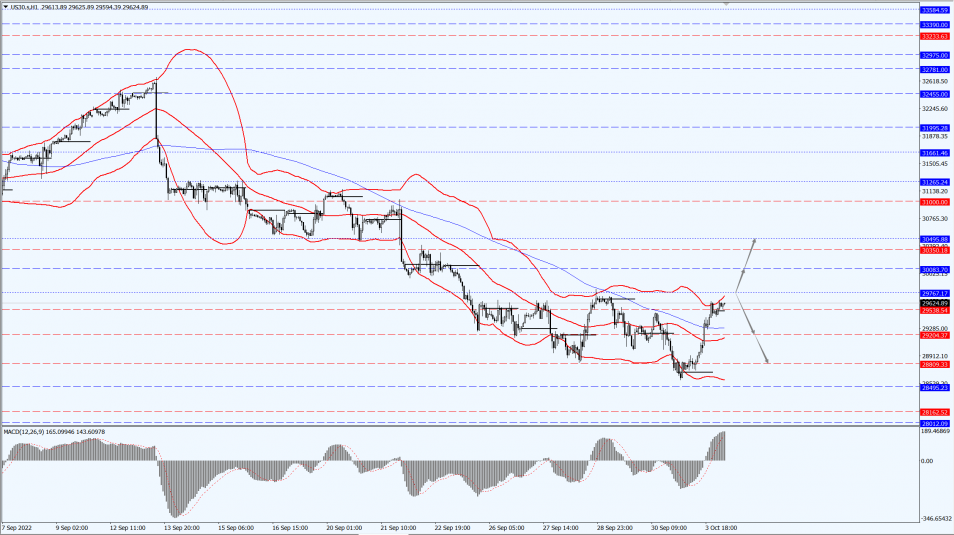

Technical Analysis:

(Dow 30, 1-hour chart)

Execution Insight:

The Dow focuses on the 29767-line today. If the Dow runs steadily above the 29767-line, it will pay attention to the suppression strength of the 30083 and 30495 positions. If the Dow runs steadily below the 29767-line, it will pay attention to the support strength of the 29204 and 28809 positions.

Hong Kong Stocks

Fundamental Analysis:

The three major indices continued to their downward momentum.

The Hang Seng Index (HSI) fell below 17000 points intraday to hit a new low since October 2011, closing at 17079 points, down 0.83%. The Hang Seng China Enterprises Index (HSCEI) fell 0.97% at 5856.82 points, the Hang Seng TECH Index (HSTECH) fell 0.67% at 3427.13 points.

From the perspective of the market, real estate stocks performed the most under the stimulus of the policy, especially the mainland property index, which rose by more than 4%. Powerlong Real Estate Holdings Limited (1238.HK), a single stock in the industry, rose by 13.7%, and Country Garden Holdings Company Limited (2007.HK), which rose by 9% on the previous trading day, rose by 8.8%.

Property management, building materials stocks followed the strong, Country Garden Services Holdings Company Limited (6098.HK) rose 8%, China Resources Cement Holdings Limited (1313.HK) rose 5.8%.

Tourism, education, gold and other concepts were active. Koolearn Technology Holding Limited (1797.HK) rose 11%, China Tourism Group Duty Free Corporation Limited (1880.HK) rose 5.8% to hit a new high on the market.

Financial stocks led the decline, Postal Savings Bank of China Co., Ltd. (1658.HK) fell 11%, Haitong International Securities Group Limited (0665.HK) fell 7%, and New China Life Insurance Company Ltd. (1336.HK) fell nearly 6%.

Most of the technology stocks fell, AAC Technologies Holdings Inc. (2018.HK) fell 3%, Jinshan International, JD.com, Inc. (9618.HK), and Meituan (3690.HK) fell more than 2%.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 18606-line today. If HK50 can run stably above the 18606-line, then pay attention to the suppression strength of the 19517 and 20467 positions. If the HK50 runs below the 18606-line, then pay attention to the support strength of the 17535 and 16664 positions.

FTSE China A50 Index

Technical Analysis:

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 focuses on the 12945-line today. If the A50 runs stably below the 12945-line, pay attention to the support strength of the two positions of 12733 and 12533. If the A50 runs above the 12945-line, it will open up further upward space. At that time, pay attention to the two positions of 13157 and 13344.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.