U.S. Stocks

Fundamental Analysis:

The U.S. stock market S&P 500 and Nasdaq closed sharply higher on Friday, 11th November 2022, extending the rally that began the day before, after softening inflation readings raised hopes that the Federal Reserve will be less aggressive in raising interest rates.

Amazon jumped 4.3%, while Apple and Microsoft both rose more than 1%, giving the Nasdaq a boost.

Declines in health care stocks limited gains in the Dow Jones Industrial Average, with UnitedHealth Group plunging 4.1%.

The markets are pricing an 81% chance of a 50-basis point Fed rate hike in December and a 19% chance of a 75-basis point rate hike.

Volume on the U.S. exchanges was relatively large, totaling 13.5 billion shares traded, compared to an average of 12 billion shares traded in the previous 20 full trading days.

Six of the 11 sectors in the S&P 500 rose, led by the energy sector with a 3.07% gain, followed by communication services stocks, up 2.48%.

The S&P 500 Growth Stock Index, which includes interest-rate-sensitive technology stocks, rose 1.6%, outpacing the Value Stock Index, which gained 0.3%.

Last week, the S&P 500 rose 5.9%, the Dow gained 4.15% and the Nasdaq jumped 8.1%.

It was the biggest single-week gain for the S&P 500 since June and the biggest weekly gain for the Nasdaq since March.

Technical Analysis:

(Dow 30, 1-hour chart)

Execution Insight:

The Dow pays attention to the 33811-line today. If the Dow runs stably above the 33811-line, then pay attention to the suppression strength of the 34221 and 34477 positions.

Hong Kong Stocks

Fundamental Analysis:

The Hong Kong’s Hang Seng Index (HSI) opened up 3.89%. The Hang Seng TECH Index (HSTECH) rose 5.56%.

Property, finance and technology sectors opened sharply higher, with Country Garden Services Holdings Company Limited (6098.HK), and Longfor Group Holdings Limited (0960.HK) up nearly 15% while Ping An Insurance (Group) Company of China, Ltd. (2318.HK) up nearly 9%.

Large-scale science and technology network stocks generally opened higher, NetEase, Inc. (9999.HK) rose more than 10%, JD.com, Inc. (9618.HK), Bilibili Inc. (9626.HK) rose nearly 10%, Meituan (3690.HK), Tencent Holdings Limited (0700.HK) rose more than 4%.

Hong Kong stocks on 11th November, a rare super thousand-point surge, mainly by the joint stimulation of internal and external good. First of all, the U.S. announced CPI U.S.

CPI in October was 7.7%, lower than the expected 8%, the data released after the U.S. dollar index dived more than 2%, U.S. bond yields fell 30 bp, the expectation of future Fed rate hikes weakened, the tough statement after the November rate hike seems to become a false alarm.

U.S. stocks technology stocks surged, the Hong Kong stocks of science and technology network companies also produced a great stimulus, and the Hang Seng TECH Index (HSTECH) rose more than 10%.

Overall, the Hong Kong stock volume surge, further strengthening the market’s medium-term bottom, the market should be more sentiment and release momentum, the current position of the market is still at a relatively low of nearly 20 years.

As the positive effect of this internal and external policy is very strong, the subsequent rebound target can also be more optimistic.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 16964-line today. If HK50 can run stably above the 16964-line, then pay attention to the suppression strength of the 18606 and 19517 positions. If the HK50 runs below the 16964-line, then pay attention to the support strength of the 15995 and 15136 positions.

FTSE China A50 Index

Technical Analysis:

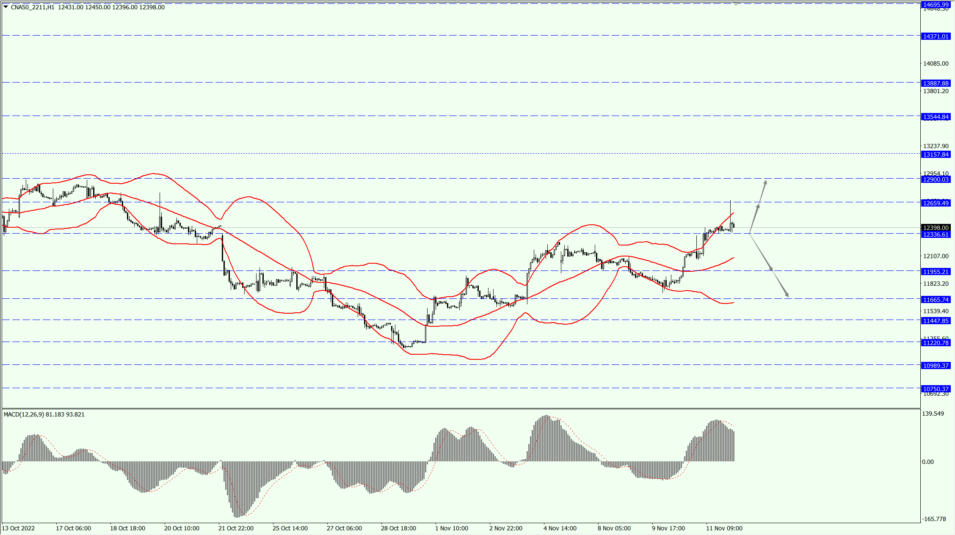

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 pays attention to the 12336-line today. If A50 runs stably below the 12336-line, pay attention to the support strength of the two positions of 11955 and 11665. If A50 runs above the 12336-line, it will open up further upside space.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.