U.S Stocks

Fundamental Analysis:

There is a delay in the U.S. Senate’s debate, with votes on the $550 billion infrastructure bill delayed until this week.

The Senate continued to debate on the U.S. $550 billion infrastructure package last Sunday, 8th August, 2021. This could last for days, due to its slow progress, leading to lawmakers’ unattainability to agree on the final amendments to be considered.

The amendments that are still under discussion include proposals for new regulations on cryptocurrencies, plus how some state and local governments could be given flexibility in the bill if they choose to spend some unused funds for disaster prevention and relief funds on road and bridge construction.

U.S. Senator Bill Cassidy of Louisiana said that he expects the funding package related to roads, water systems and, broadband expansion to eventually pass. However, it could take up to two days, unless all 100 senators agree to speed things up.

U.S. Senate Majority Leader, Chuck Schumer, said at the beginning of the agenda on 8th August, 2021, that the Democrats are ready to evaluate amendments to the legislation, which is a cornerstone of President Biden’s policy agenda.

“This will require the cooperation of our colleagues from the Republican Party, and we will continue to move forward until we complete this bill.” Once the bill is passed, it will play a supporting role in the stock market.

Technical Analysis:

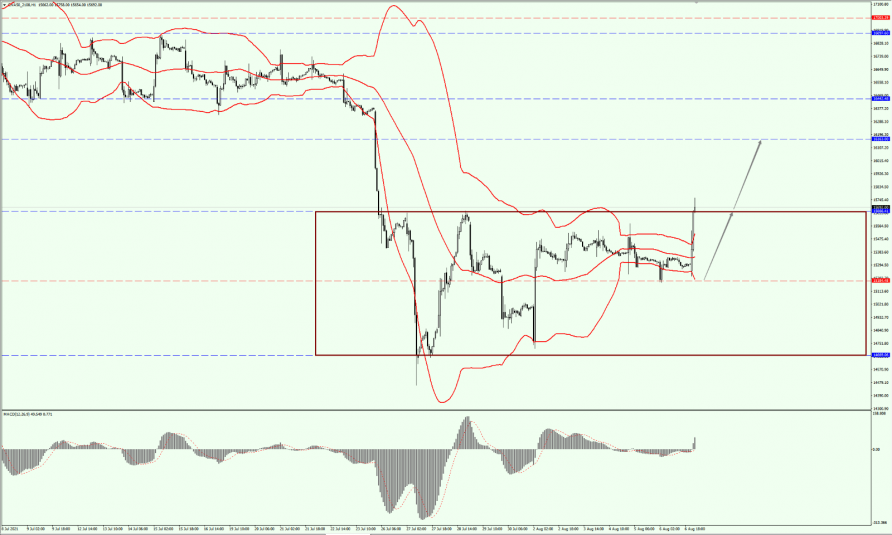

(Dow30,1-hour chart)

Execution Insight:

On Dow today, mainly focus on the 35110-line. Once the strength of the Dow falls below the 35110-line, it will open up further downside potential. At that time, pay attention to the support of the middle rail on the Bollinger band. Once the strength of the Dow falls below the middle rail on the Bollinger band, then pay attention to the supporting strength on the 34870-line.

Hong Kong Stocks

Fundamental Analysis:

After a sharp adjustment in the previous week, the overseas Chinese stock market stabilized at a low-level last week.

Most sectors – including materials, automobiles, and telecommunications – rose last week, which is largely consistent with our week before’s judgment that the market may gradually bottom out and enter the layout zone.

However, under the uncertainty of policy, there is still a big divergence within the growth sector.

Hardware sectors such as semiconductors attracted significant southbound inflows last week, while gaming, healthcare and related targets such as live streaming continued to be under pressure, mainly due to regulatory policy concerns.

The Hang Seng Index’s gains expanded to 1% after falling to 0.8% at one point, while the short-video concept and real estate industry were among the top gainers.

Technical Analysis:

(HK50,1-hour chart)

Execution Insight:

On HK50 today, pay attention to the direction of the breakthrough in the 25816 to 26535 range. If it breaks above the 26535-line, it will open up further upside potential. At that time, pay attention to the suppression on the 26951-line. If it drops below the 25816-line, it will open up further downside potential. At that time, pay attention to the strength of 25160-line on support.

FTSE China A50 Index

Technical Analysis:

(A50,1-hour chart)

Execution Insight:

On A50 today, pay attention to the 15184-line of support strength. As long as the A50 runs above the 15184-line, it should maintain on an advantageous trend. With that, pay attention to the suppression on the 16163-line.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.

Home

Home