U.S. Stocks

Fundamental Analysis:

U.S. stocks posted their biggest gain in seven weeks on Thursday, 28th April 2022, driven by strong corporate earnings, extending the violent and volatile trend that has plagued the market.

The S&P 500 surged more than 2% in regular trading, its biggest gain since 9th March, and the Nasdaq 100 rose more than 3%.

Technology stocks fell in after-hours trading, with Amazon shares down by 10% after reporting results and Intel down by 5% on a weaker sales outlook. Apple, which also reported earnings after the bell on Thursday, beat revenue estimates and authorized a massive stock buyback.

Despite an unexpected shrank in the U.S. economy in the first quarter for the first time since 2020, investors saw signs of solid consumer demand.

The S&P 500 Index turned higher this week after a big rally on Thursday, though it still fell more than 5% in April, or the biggest one-month drop since the market fell into a bear market during the epidemic.

Technical Analysis:

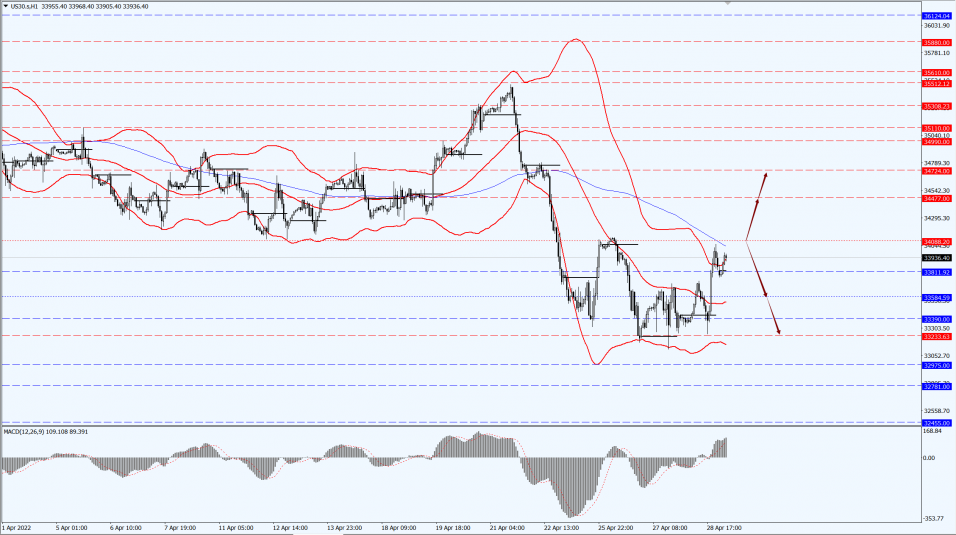

(Dow 30, 1-hour chart)

Execution Insight:

The Dow focuses on the 34088-line today. If the Dow runs stably below the 34088-line, then pay attention to the support strength of the two positions of 33584 and 33390. If the Dow index breaks above the 34088-line, then pay attention to the suppression strength of the two positions of 34477 and 34724.

Hong Kong Stocks

Fundamental Analysis:

Hong Kong stocks opened lower, the Hang Seng Index (HSI) fell 0.02%, the Hang Seng China Enterprises Index (HSCEI) fell 0.3%, and the Hang Seng TECH Index (HSTECH) fell 0.32%.

On the market, large technology stocks were divided. Baidu, Inc. (9888.HK) rose nearly 2%, NetEase, Inc. (9999.HK), Meituan (3690.HK) rose slightly, Kuaishou Technology (1024.HK), Xiaomi Corporation (1810.HK), and JD.com, Inc. (9618.HK) are down. Meanwhile, auto stocks led the decline, with building materials cement stocks, and gas stocks partly lower, as Anhui Conch Cement Company Limited (0914.HK) fell 2.67%.

On the other hand, the oil stocks were strong, CNOOC Limited (0883.HK) opened 6.64% higher after the results, while insurance stocks, biotechnology stocks, power stocks, and most of the gambling stocks rose.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 19517-line today. If HK50 can run stably above the 19517-line, then pay attention to the suppression of the 20467 and 21450 positions. If the HK50 runs below the 19517-line, then pay attention to the support of the 18606-line.

FTSE China A50 Index

Technical Analysis:

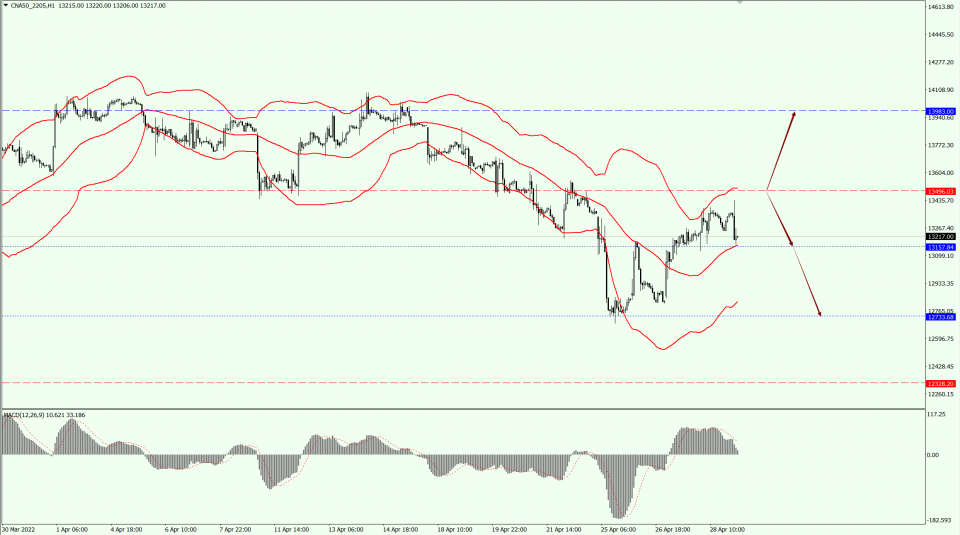

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 pays attention to the 13496-line today. If the A50 runs steadily below the 13496-line, then pay attention to the support strength of the 13157 and 12733 positions. If the A50 runs above the 13496-line, it will open up further upward space. At that time, pay attention to the suppression of the 13983-line.

Risk Disclosure

Trading in financial instruments involves a high degree of risk due to fluctuations in the value and price of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with us. You should seek independent professional advice if you do not understand the risks disclosed by us herein.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.