US Stocks

Fundamental Analysis:

U.S. stocks climbed on Thursday, 7 October 2021, in a broad-based rally led by heavyweight technology stocks, after a temporary truce in the debt-ceiling standoff in Congress relieved concerns of a possible government debt default later this month.

The U.S. Senate has agreed to raise the Treasury Department’s borrowing authority until early December, with a possible vote for a debt limit increase of USD480 billion.

Uncertainty over the debt-ceiling negotiations was one concern investors cited in September as the S&P 500 logged its biggest monthly percentage drop since the onset of the COVID-19 pandemic in March 2020.

Meanwhile, data showed the number of Americans filing new claims for jobless benefits dropped last week by the most in three months, suggesting the labor market recovery was regaining momentum as the latest wave of COVID-19 infections began to subside.

Technical Analysis:

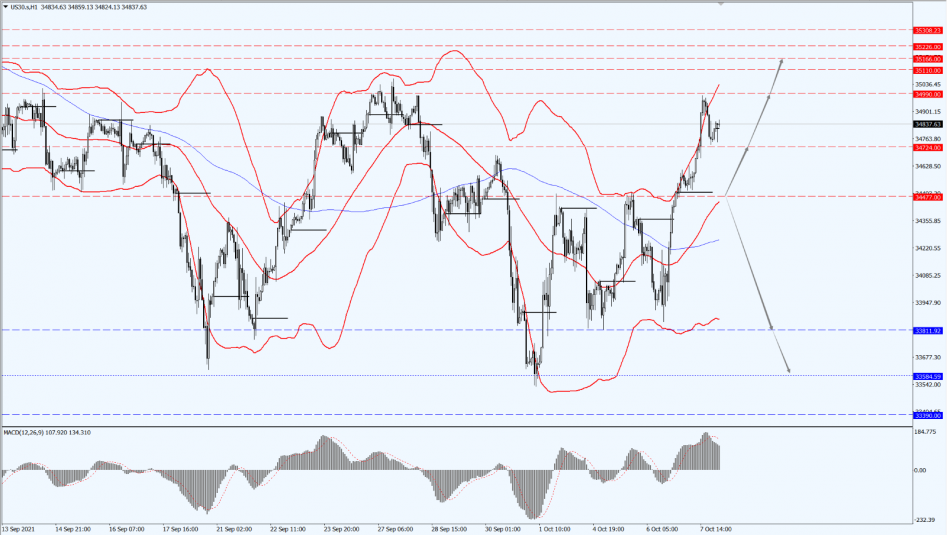

(Dow30,1-hour chart)

Execution Insight:

The Dow is focusing on the 34477 line today, and above this line, pay attention to the suppression strength of the 34724 and 34990 positions. Once the Dow falls below the 34477 line, it will test the support of the 33811 line again.

Hong Kong Stocks

Fundamental Analysis:

The two parties in the U.S. Congress reached an agreement to raise the debt ceiling in the short term, which caused the CBOE Volatility Index (VIX) fell. Overnight, the three major U.S. stock indices opened higher.

Hong Kong stocks gained a boost in early trading, with the Hang Seng Index opening 1.47% higher at 25,064 points, Hang Seng China Enterprises Index rising 1.44% to 8,838 points, and the Hang Seng Technology Index jumping 2.1% to 6,301 points. Among blue-chip stocks, Alibaba rose by 4.82%, Tencent rose by 3.95%, and Meituan rose by 2.95%. Subsequently, AAC Technologies fell by 9.71%, Longfor Properties fell by 2.1%, and Shenzhou International fell by 0.45%.

Technical Analysis:

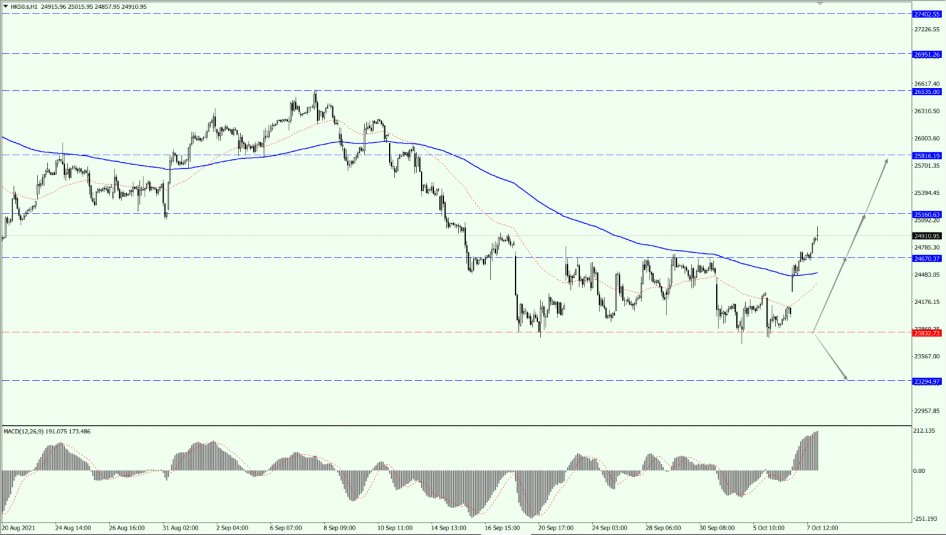

(HK50,1-hour chart)

Execution Insight:

On HK50 today, we focus on the 23832 line. Above this line, it will maintain as a bullish trend. Then, watch closely at the suppression strength of the 25160 and 25816 positions above. Once HK50 falls below the 23832 line, it will open up further downward revision. At that time, pay attention to the support of the 23294 line.

FTSE China A50 Index

Technical Analysis:

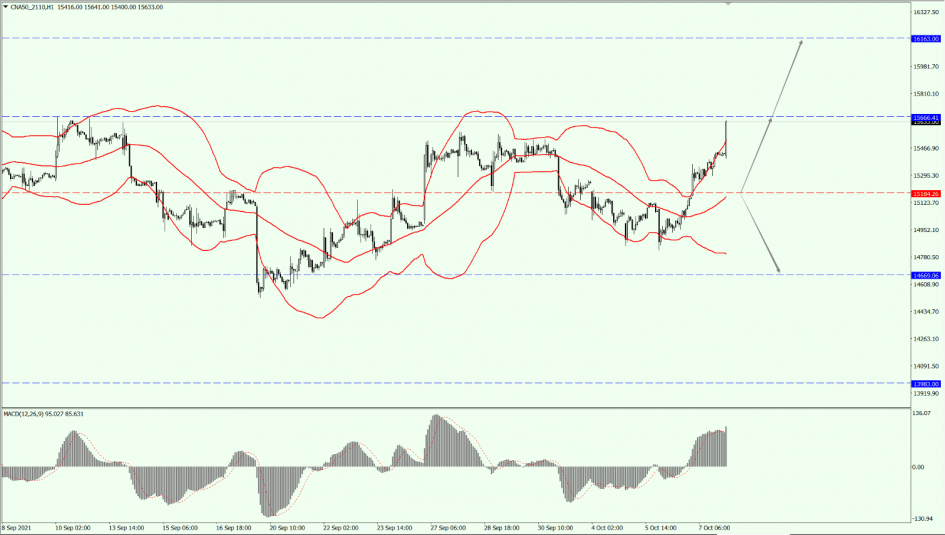

(A50,1-hour chart)

Execution Insight:

On A50, pay attention to the 15184 line today. If A50 is above the 15184 line, it will remain as a bullish trend. Once it moves pass the 15666 line, it will open up further upward revision. At that time, pay attention to the suppression strength of the 16163 line. If A50 falls below the 15184 line, divert your attention to the support of the 14669 line.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.