U.S. Stocks

Fundamental Analysis:

U.S. stocks closed lower on Friday, 16th September 2022, touching their lowest in two months, as FedEx warned of an impending global slowdown, further pushing investors into safe-haven assets at the end of a shaky week.

All three major U.S. stock indexes touched their lowest levels since mid-July, with the S&P 500 closing below 3,900, a closely watched support level.

The S&P 500 and Nasdaq posted their biggest weekly percentage declines since June.

This week, markets were plagued by inflation concerns, looming interest rate hikes and ominous economic warning signs.

Financial markets already expect an 18% chance of the Federal Reserve offering an ultra-substantial, 100 basis point rate hike on Wednesday.

Nine of the S&P 500’s 11 major sectors closed lower, with energy and industrial stocks posting the biggest percentage losses.

The Dow Jones Transportation Index, considered a barometer of economic health, fell sharply by 5.1%.

Technical Analysis:

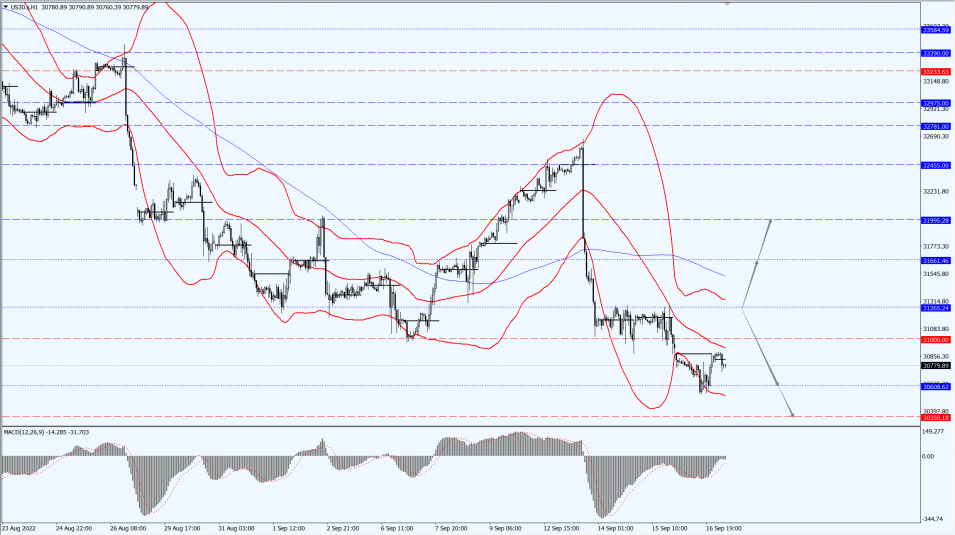

(Dow 30, 1-hour chart)

Execution Insight:

The Dow focuses on the 31265-line today. If the Dow runs steadily above the 31265-line, it will pay attention to the suppression strength of the 31661 and 31995 positions. If the Dow runs steadily below the 31265-line, it will pay attention to the support strength of the 30608 and 30350 positions.

Hong Kong Stocks

Fundamental Analysis:

In the morning session, the three major indexes of Hong Kong stocks continued the last week’s decline.

The Hang Seng Index (HSI) fell 0.96%, the Hang Seng China Enterprises Index (HSCEI) fell 1.24%, the Hang Seng TECH Index (HSTECH) fell 2.04%.

All three are refreshed, adjusted to the lower price.

The half-day southbound capital flow bucked the trend with a net inflow of HK$ 986 million, and the market turnover was HK$ 51.2 billion.

On the market, the heavyweight technology stocks continue to fall, dragging the market lower. NetEase Inc. (9999.HK), Alibaba Group Holding Limited (9988.HK) fell more than 3%, Xiaomi Corporation (1810.HK), Baidu Inc. (9888.HK), JD.com, Inc. (9618.HK), Tencent Holdings Limited (0700.HK), etc. all fell.

Vocational education stocks fell significantly, biomedical stocks, semiconductor stocks, military stocks, blockchain concept stocks, film and entertainment stocks, domestic housing stocks and property management stocks fell.

New energy automotive stocks fell more than the trend.

On the other hand, Hong Kong considered the abolition of mandatory segregation of hotels.

Hong Kong local stocks bucked the trend, led by retail stocks Chow Tai Fook, Hong Kong considers abolishing mandatory hotel segregation rules.

JP Morgan latest upgraded Chow Tai Fook Jewellery Group to Overweight.

According to Hong Kong media, Hong Kong Medical and Health Bureau Secretary Lo Tseng Mau recently said he will actively consider improving the current hotel quarantine program for inbound people.

It is reported that Hong Kong will shortly cancel the “3 + 4” entry quarantine arrangements, to become “0 + 7”.

In addition, the existing social distance measures have been extended several times is expected to partially “untie”.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 19517-line today. If HK50 can run stably above the 19517-line, then focus on the suppression strength of the 20467 and 21450 positions. If the HK50 runs below the 19517-line, then pay attention to the support strength of the 18606 and 17535 positions.

FTSE China A50 Index

Technical Analysis:

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 focuses on the 13157-line today. If the A50 runs steadily below the 13157-line, it will pay attention to the support strength of the two positions of 12945 and 12733. If the A50 runs above the 13157-line, it will open up further upward space. At that time, pay attention to the two positions of 13544 and 13887.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.