U.S. Stocks

Fundamental Analysis:

U.S. stocks were mixed on Thursday, 4th August 2022, with gains in high-growth stocks offsetting losses in energy stocks, as investors looked to the monthly U.S. jobs report for clues on the pace of the Federal Reserve’s rate hikes.

The tech-heavy Nasdaq hit a new three-month high, led by Amazon and AMD, while losses in energy stocks including Exxon Mobil and Chevron weighed on the S&P 500.

Worries about a global economic slowdown pushed oil prices to their lowest levels since conflicts in Russia and Ukraine in February, and U.S. bond yields fell after the Bank of England warned of a prolonged recession.

A strong earnings report and an unexpected pickup in activity in the U.S. services sector propelled the major indexes sharply higher in the previous session.

Friday’s focus will be on the closely watched U.S. jobs report, which is expected to show nonfarm payrolls rose by 250,000 jobs in July, compared with a gain of 372,000 in June.

Any signs of strength in the labor market could fuel fears of aggressive measures by the Federal Reserve to curb inflation.

Cleveland Fed President Mester on Thursday reiterated comments from earlier in the week that she would need to see before she believes the Fed can slow the pace of rate hikes and provide a more precise trajectory of when inflation will return to its target. Inflation fell for several months in a row.

She has voting rights on the Federal Open Market Committee (FOMC) this year. The S&P 500, which has risen about 14% from a low hit in mid-June, is still down about 13% this year amid concerns about the impact of the war in Ukraine, soaring inflation, a resurgence of the virus and aggressive interest rate hikes.

Technical Analysis:

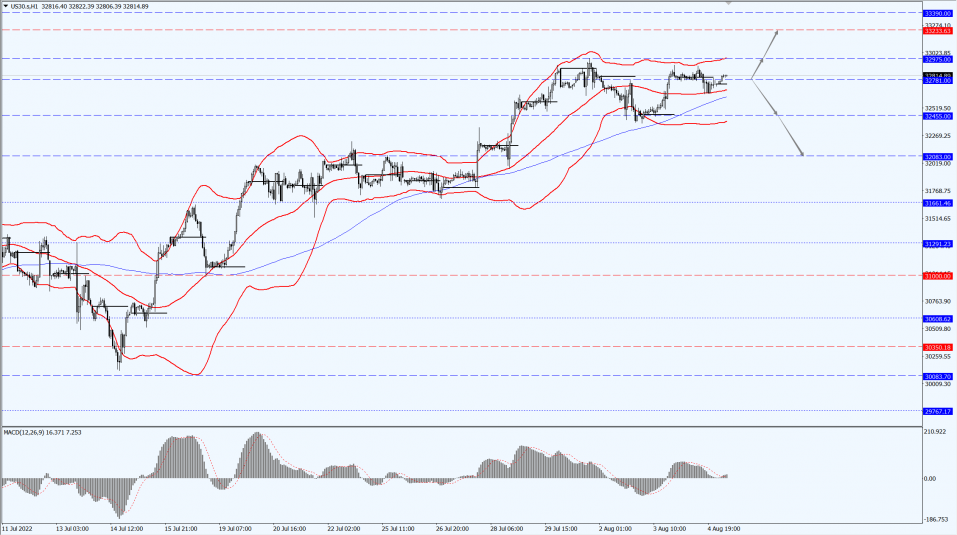

(Dow 30, 1-hour chart)

Execution Insight:

The Dow is focused on the 32781-line today. If the Dow runs steadily above the 32781-line, it will pay attention to the suppression strength of the two positions of 32975 and 33233. If the Dow runs steadily below the 32781-line, it will pay attention to the support strength of the two positions of 32455 and 32083.

Hong Kong Stocks

Fundamental Analysis:

The three major indices of Hong Kong stocks closed up collectively in midday trading.

The Hang Seng Index (HSI) rose 0.09% to 20192 points, the Hang Seng TECH Index (HSTECH) rose 0.72% to 4413 points, the Hang Seng China Enterprises Index (HSCEI) rose 0.16% to 6891 points.

The southbound capital inflow bucked the trend with a net inflow of HK$1.446 billion in half a day, and the market turnover was HK$46.7 billion

On the market, large technology stocks were mixed, with Bilibili Inc. (9626.HK) and Baidu, Inc. (9888.HK) up 1%, Alibaba Group Holding Limited (9988.HK) down 2%, and Tencent Holdings Limited (0700.HK) down 1%.

Biotechnology stocks and drug stocks rose sharply, BeiGene, Ltd. (6160.HK) rose 9% after the performance, Innovent Biologics, Inc. (1801.HK) attracted investment, Sanofi rose 6%, CanSino Biologics mRNA vaccine base planned to produce 100 million doses in the first phase, up 6%.

The geopolitical situation continues to be tense, gold prices on the 1800 U.S. dollars, and gold stocks strengthened.

Semiconductor stocks rose again in late trading driven by A shares, and Hua Hong Semiconductor Limited (1347.HK) rose 9%

Port and shipping stocks, photovoltaic stocks, education stocks, etc. Stocks rose generally.

On the other hand, the market worries about economic recession, overnight U.S. oil Russia-Ukraine conflict to fall below $ 90 for the first time, oil stocks fell.

Tobacco stocks, coal stocks, handheld stocks, beer stocks, cloud computing stocks and other stocks weakened.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 20467-line today. If HK50 can run stably above the 20467-line, then pay attention to the suppression strength of 21450 and 22127. If HK50 runs below the 20467-line, then pay attention to the support strength of 19517 and 18606.

FTSE China A50 Index

Technical Analysis:

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 focuses on the 13887-line today. If the A50 runs stably below the 13887-line, pay attention to the support strength of the two positions of 13544 and 13157. If the A50 runs above the 13887-line, it will open up further upward space. At that time, pay attention to the two positions of 14371 and 14695.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand the any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.