US Stocks

Fundamental Analysis:

The US stock market gave up some ground yesterday, although there were signs that inflation had eased. Meanwhile, economic uncertainty and the growing possibility of a rise in the corporate tax rate hit investor sentiment and triggered a widespread sell-off.

Optimism faded throughout the session, reversing an initial rally following the Department of Labor’s Consumer Price Index (CPI) report.

All three major US stock indices closed lower, reminding people that September is usually a difficult month for the stock market. The emergence of the highly contagious Delta variant has exacerbated pessimism about the recovery of the economy from the global health crisis, and many now expect the stock market to pull back sharply before the end of 2021.

The lower-than-expected CPI reading in August supported Fed chairman Jerome Powell’s assertion that the sharp rise in inflation was temporary and calmed market fears that the Fed would start tightening monetary policy earlier than expected.

The Dow closed 0.84% lower, the S&P 500 was down 0.57%, and the Nasdaq had fallen 0.45%.

Technical Analysis:

(Dow30,1-hour chart)

Execution Insight:

Today, we continue to pay attention to the direction of the Dow on the 34477 line. Once the Dow falls below the 34477 line, it will open up further downward revision. At that time, pay attention to the support of the 33811 line. If the Dow gets the support from the 34477 level, then divert your attention to the suppression strength of the two positions 34724 and 34990 above. Overall, the Dow is mainly sideways in the range of 34477–35166.

Hong Kong Stocks

Fundamental Analysis:

The three major indices of Hong Kong stocks collectively opened low. The Hang Seng Index fell by 0.75% to 25,310 points, Hang Seng China Enterprises Index fell by 0.75% to 9,013 points, and the Hang Seng Technology Index fell by 1.19% to 6,425 points.

On the intraday market, Macau conducted a public consultation on amending the gaming law. As a result, gambling stocks fell sharply across the board. Meanwhile, Sands China opened sharply lower by nearly 15%, Galaxy Entertainment and Wynn Macau all fell by more than 10%.

At the same time, large technology stocks continued their decline, Meituan, Tencent, and Jingdong all opened lower by more than 3%. The stocks for iron and steel, aluminum, and other non-ferrous metals industries fell, with Masteel and Ansteel fell by more than 2%. Other sectors, such as dairy stocks, pharmaceutical stocks, and bank stocks strengthened.

Technical Analysis:

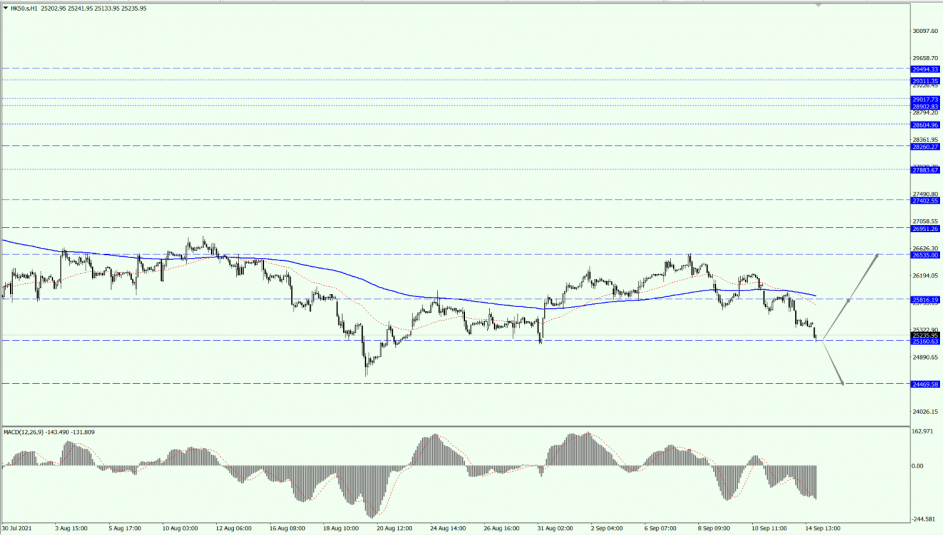

(HK50,1-hour chart)

Execution Insight:

HK50 fell below the 25816 line yesterday and dropped back to the 25160 line. Today, pay attention to the 25160 line. If HK50 gets the support on the 25160 line, then focus on the suppression strength of the two positions of 25816 and 26535 above. However, if HK50 falls below the 25160 line, it will open up further downward revision. At that time, shift your attention to the support of the 24469 line.

FTSE China A50 Index

Technical Analysis:

(A50,1-hour chart)

Execution Insight:

Today, on A50, pay attention to the support of the 15074 line. As long as A50 runs stably above the 15074 line, focus on the suppression strength of the two positions of 15298 and 15612. Once A50 falls below the 15074 line, pay attention to the support of the 14899 line below.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.