US Stocks

Fundamental Analysis:

US stocks rose to record highs as strong corporate earnings and a rally in commodity prices outweighed lingering concerns about the threat of COVID-19 to the global economy. The S&P 500 and Nasdaq 100 gained. This is alongside energy, consumer discretionary, and materials stocks – all of which are among the best performers as investors await insights from Federal Reserve chairman Jerome Powell’s address during the upcoming Jackson Hole Symposium.

As long as the economic and corporate earnings environments continue to improve, the market is likely to withstand ongoing concerns about the virus and policy. That said, risks for the market are becoming more balanced as we move throughout the market cycle.

While markets started strong this week, equities in the US and Europe remain volatile on concern over the spread of the Delta variant and tighter monetary policy. Economic data so far this week has painted a mixed picture, with the manufacturing Purchasing Managers’ Indices (PMI) in Europe and the US showing continued growth, though slowing from last month’s levels.

Technical Analysis:

Execution Insight:

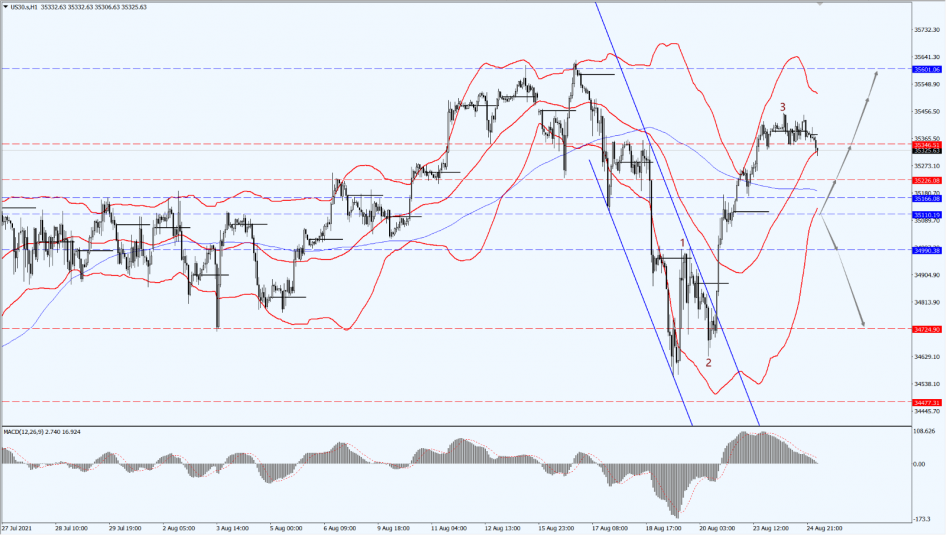

As can be seen from the chart above, the Dow has completed the third-wave process yesterday, and has now entered the fourth wave, which is the adjustment process.

The future market should focus mainly on the 35110 line. As long as the Dow does not fall below the 35110 range, it will still maintain the bullish trend and look for the opportunity to intervene again after the stabilization of the fourth callback. Therefore, it is necessary to pay attention on the support of the 35346, 35226, and 35110 lines.

On the top, focus on the strength of the historical high of the 35601 position to suppress again. Once the Dow falls below 35110, there is a possibility of opening up further downward revision. At that time, pay attention to the support of the 34990 and 34724 lines.

Hong Kong Stocks

Fundamental Analysis:

Overnight, Chinese stocks continued to rebound sharply, and TechNet (Hong Kong) stocks opened higher. The Hang Seng Technology Index rose by 2.54% to 6,609 points, the Hang Seng Index (HSI) rose by 0.79% to 25,930 points, and the National Index rose by 1.01% to 9,190 points.

On the intraday market, large-scale network stocks Tencent and JingDong rose by more than 5%; Baidu, Tencent, and Meituan rose by more than 4%; Kuaishou rose by 3.3%; Meituan rose by 2.58%; and JD Health surged by more than 7% on sharp improvement.

Education stocks rose sharply across the board, with New Oriental and Koolearn opening nearly 15% higher, and China East Edu and Scholar Education rose by more than 8%; photovoltaic stocks, gambling stocks, sporting goods stocks, pharmaceutical stocks, and property management stocks generally rose as well. Meanwhile, power stocks and gas stocks continued to be weak, and dairy stocks and blue-chip real estate stocks fell.

Technical Analysis:

Execution Insight:

On HK50, we continue to focus on the 25816 line. If HK50 manages to rise to the 25816 range again, it will open up further upward revision. At that time, pay attention to the suppression strength of the two positions of 26535 and 26951. If HK50 runs below the 25816 line, it might be advantageous to pay attention to the support of the 25160 position.

FTSE China A50 Index

Technical Analysis:

Execution Insight:

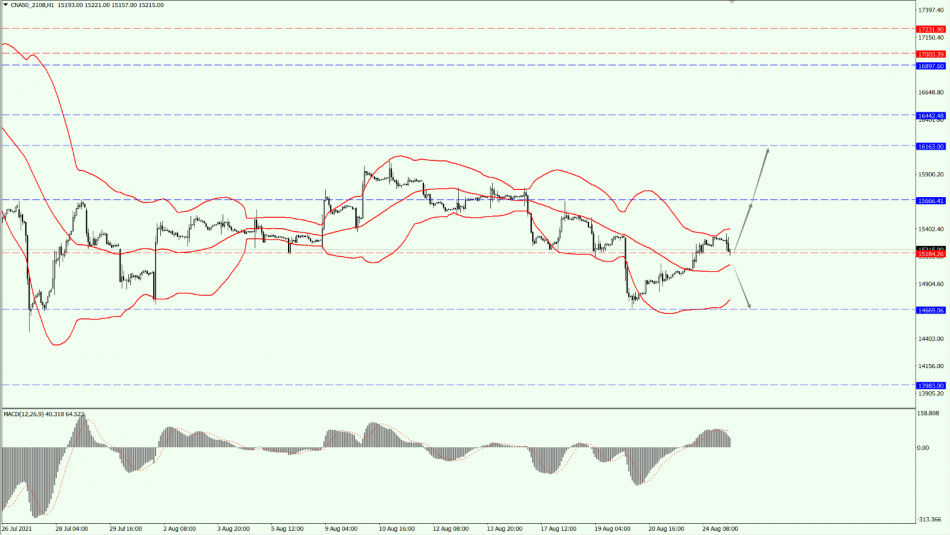

On A50, we shall focus on the middle Bollinger Band today. As long as A50 runs above the middle Bollinger Band, the buying order is strong. Then, pay attention to the suppression strength of the 15666 and 16163 lines on the top. If A50 falls below the middle Bollinger Band, the buying order turns to weak. At that time, shift your focus to the support of the 14669 line below.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.