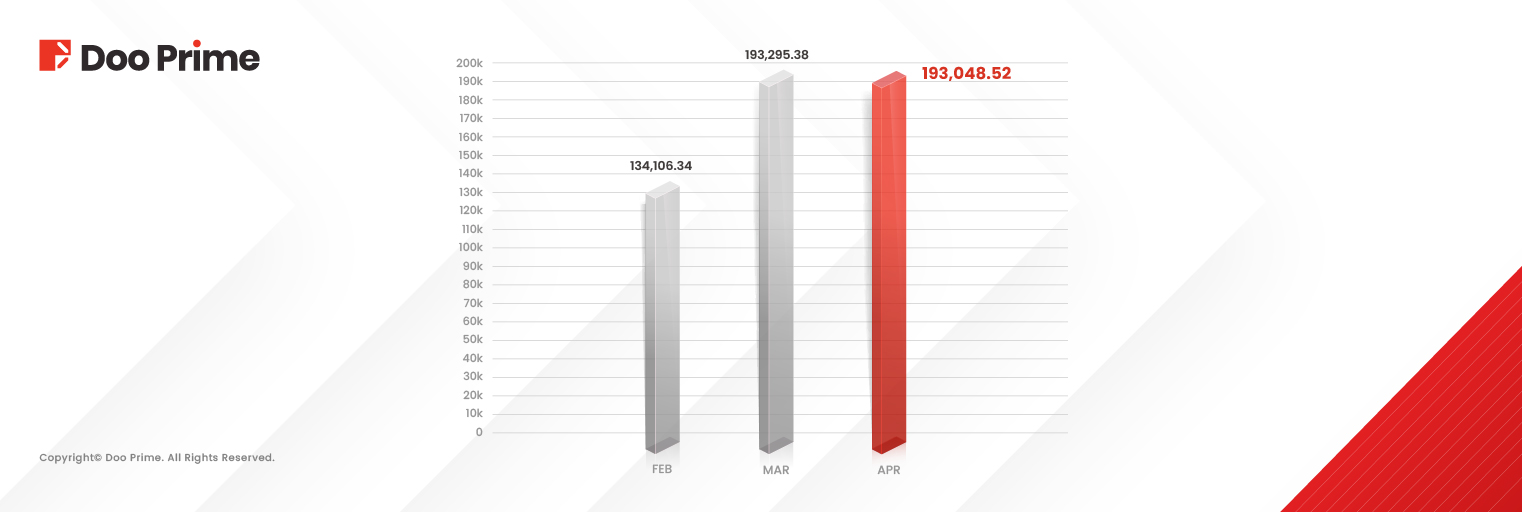

April was another standout month for Doo Prime, as we continue to ride the wave of strong market momentum and growing investor interest. Our latest trading volume report shows that activity remained near record levels, with total trading volume reaching an impressive USD 193.05 billion.

Behind these numbers is a dynamic market landscape shaped by global events, rising volatility, and shifting investor sentiment. Through it all, our clients remained highly engaged, especially in gold and major currency pairs, helping us achieve this outstanding performance.

April 2025 Trading Highlights

- Total Trading Volume: USD 193.05 billion

- Average Daily Volume (ADV): USD 6.44 billion

- Month-on-Month Growth: +3.23%

- Most Traded Products: XAU/USD, EUR/USD, US30 (Dow Jones), NAS100 (Nasdaq), GBP/USD

- Biggest Gainer: Gold Futures (GC_2506), up 104.28%

Momentum Continues

April’s trading volume of USD 193.05 billion closely mirrors our record high in March, reinforcing Doo Prime’s strong and consistent market presence. The 3.23% month-over-month increase in average daily volume highlights growing client activity amid a climate of global uncertainty.

Market Context: Volatility Spurs Activity

The global financial landscape in April was shaped by heightened uncertainty. On April 2, US President Donald Trump announced a new wave of “reciprocal tariffs,” which exceeded market expectations and sparked fears of a global trade war. This led to a sharp rise in the CBOE Volatility Index (VIX), as markets reacted to growing instability.

In response, major US indices including the Dow Jones, Nasdaq, and S&P 500 fell sharply to levels not seen since early 2024. Amid the turbulence, investors sought safety in gold. XAU/USD surged to an intraday peak of USD 3,500 per ounce, eventually stabilizing above the key USD 3,000 level. With a transaction value of USD 174.65 billion, XAU/USD was the most traded product in April.

Beyond gold, non-USD currencies like the euro and British pound gained ground. Concerns over the USD’s credit rating, driven by ongoing tariff tensions, fueled strong performances across EUR/USD and GBP/USD trading pairs.

Exceptional Product Performance

As for the investors’ top picks, XAU/USD, EUR/USD, US30 (Dow Jones), NAS100 (Nasdaq), and GBP/USD were among the top 5 most popular products.

Among all products, Gold Futures (GC_2506) stood out with a remarkable 104.28% increase in trading volume compared to March, marking it as the fastest-growing instrument for the month.

Sustained Growth and Commitment to Excellence

Doo Prime’s April volume represents a 75.99% increase year-over-year, underscoring our rapid growth and increasing relevance in today’s fast-moving financial markets.

As a trusted and ever-expanding online broker, we remain committed to providing a seamless and high-performance trading experience. Supported by a powerful platform, robust global partnerships, and an experienced technical team, Doo Prime continues to empower traders worldwide with the tools and support they need to succeed.

Risk Disclosure

Trading in securities, futures, contracts for difference (CFDs) and other financial products carries high risks due to the rapid and unpredictable fluctuation in the value and prices of these financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases and other unforeseen circumstances. You may sustain substantial losses, including losses exceeding your initial investment within a short period of time.

You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before you begin to trade or engage in any transactions with us. When you engage in transactions with us, you acknowledge that you are aware of and accept these risks. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.

Disclaimer

The information contained in this blog is for general informational purposes only and should not be considered as financial, investment, legal, tax or any other form of professional advice, recommendation, an offer, or an invitation to buy or sell any financial instruments. The content herein, including but not limited to data, analyses and market commentary, is presented based on internal records and/or publicly available information and may be subject to change or revision at any time without notice and does not consider any specific recipient’s investment objectives or financial situation. Past performance is not an indicator of future performance and D Prime and its affiliates give no assurance that any views, projections or forecasts will materialize. D Prime and its affiliated entities make no representations or warranties about the accuracy or completeness of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained in this blog. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.