In 2022, the global economy has faced unprecedented changes in a century, and the succession of major events has caused dramatic fluctuations in the market this year. Through this, the previous investment logic is constantly being modified.

As the saying goes, there is nothing new under the sun.

Through reviewing, analyzing, and understanding the dynamics of major economic events, investors can learn from the past and grasp the future situation.

That said, let’s take a look back at the major economic events that shaped the market in 2022 (in no particular order).

1. Ratification Of RCEP

In 2012, the ten ASEAN countries launched the negotiations of the Regional Comprehensive Economic Partnership (RCEP) agreement. As of 15th November 2020, the RCEP was formally signed by the ten ASEAN countries and 15 Asia-Pacific countries, including China, Japan, South Korea, Australia and New Zealand and entered into force on 1st January 2022.

The entry into force of RCEP creates a new opportunity for strengthening regional cooperation and is of great significance to promote regional economic integration in East Asia. The main contents and impacts of RCEP are mainly reflected in the following three aspects.

- Significant Tariff Reduction:

The RCEP will eliminate tariffs and barriers on a wide range of goods traded, ultimately achieving more than 90% of the overall number of products with zero tariffs. With significant tariff reductions, intra-regional trade will gain momentum, and it will also help countries achieve economic recovery after the pandemic.

With the elimination of tariff barriers, market choices will be more abundant, and consumers’ diversified consumption needs will undoubtedly be met. As ASEAN’s number one trading partner, China’s trade ties with countries in the region will also be further strengthened.

- Promotes Regional Trade and Industrialization:

A portion of the ten ASEAN member countries currently have relatively weak industrial bases, high population densities and high population numbers, with the need to address their employment and livelihood issues of their large populations.

By integrating their countries into the broader regional economic development, ASEAN countries can better develop their industrial bases, promote industrialization and create more employment opportunities for their populations.

- China-Japan-South Korea Free Trade Agreement (FTA):

Under the framework of RCEP, China, Japan and South Korea have achieved cooperation on free trade. Based on the current RCEP, China, Japan and South Korea may reach a higher level of China-Japan-South Korea FTA in the future to further realize economic integration and help countries get rid of their respective domestic involution and internal friction.

2. Russia Invasion Of Ukraine

On 24th February 2022, the Russia-Ukraine war broke out. The current impact on the economy is mainly reflected in the following three major aspects:

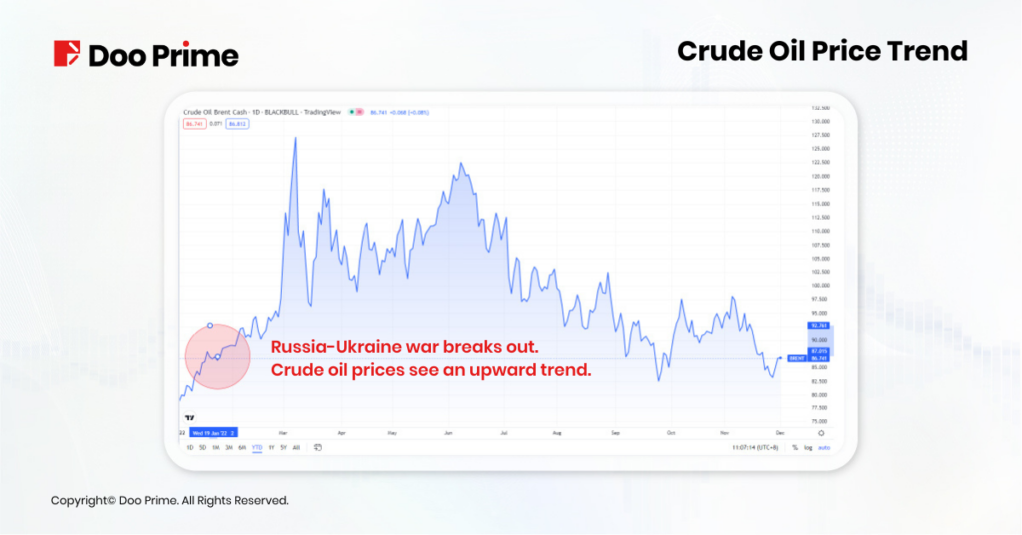

- Energy Crisis:

With the concern that Russia would cut off energy supplies to Europe, energy prices such as gas and oil rose sharply in response to the outbreak of the war. The impact of high energy prices has since spread to other sectors of the economy, pushing up transportation costs, food prices, etc., and ultimately causing high inflation in many countries around the world.

- Higher Inflation:

Ukraine, the breadbasket of Europe, accounts for more than 10% of global exports of both corn and wheat. With this, the ongoing conflict has caused a decrease in Ukraine’s agricultural exports to the outside world, with prices soaring. At the same time, the price of value energy has also risen, ultimately causing record high levels of inflation in many European countries.

- Euro Weakens:

The outbreak of war has caused instability in the European region, with large amounts of capital fleeing Europe for safety in order to hedge against risk. Against this, the euro has fallen more than 10% against the U.S. dollar so far this year.

Yet, the current war between Russia and Ukraine shows no sign of ending in the near term and it may continue to slow the pace of global economic recovery next year in 2023.

3. Covid-19 Pandemic Yet To Be Over

The Covid-19 pandemic is now in its third year since its outbreak. Earlier this year, a new strain of Coronavirus – Omicron – began rampaging through countries around the world. All signs seem to indicate that the world is still in the throes of the Covid-19 pandemic.

But in September, with weekly new cases and deaths having fallen to their lowest levels since March 2020, World Health Organization (WHO) Director-General Tedros Adhanom Ghebreyesus said the world is at the most opportune time to end the Covid-19 pandemic.

The negative impact of the pandemic on the world economy is likely to be mitigated next year as more and more countries around the world gradually lift their pandemic restrictions.

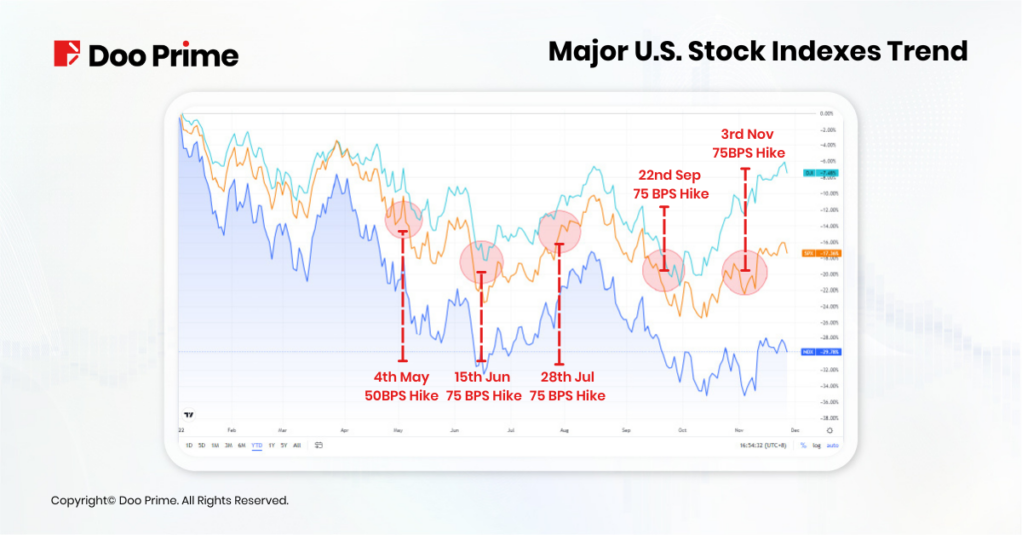

4. The Federal Reserve’s Aggressive Rate Hikes

To curb the high inflation levels in the U.S., the Federal Reserve decided to raise the interest rates by 25 basis points in March 2022, followed by a 50 basis point hike in May. Since June, the Federal Reserve has been raising rates by a substantial 75 basis points, and then maintaining an aggressive 75 basis points all the way through.

Ever since the Federal Reserve started the aggressive interest rate hikes, U.S. stocks entered a bear market downtrend at the same time. So far this year, all three major U.S. stock indexes have plunged. At this point in time, the Dow Jones, S&P 500 and Nasdaq have fallen 9.36%, 20.19% and 33.01%, respectively, this year.

Although the U.S. stocks continue to plummet, the Federal Reserve has been holding a hawkish stance so far, in order to suppress inflation, and has yet shown any intention to slow down the pace of interest rate hikes.

Meanwhile, the market expects that the Fed may gradually slow down the rate of interest rate hikes next year.

That said, if the U.S. stock market wants to fully recover from the current bear market, it will need to anticipate the Fed’s policy reversal.

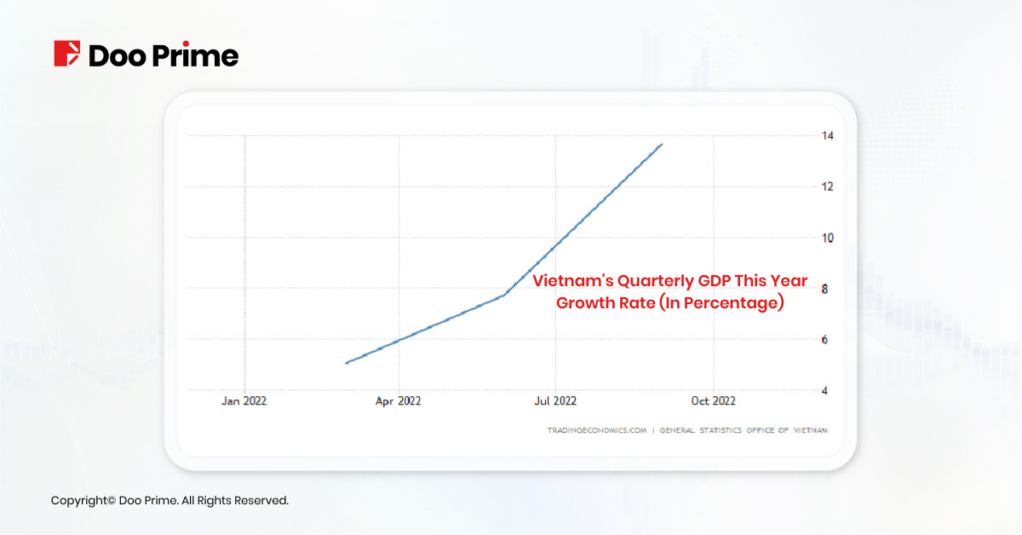

5. Vietnam’s Rapid GDP Growth

While the European and American economies are facing a looming recession in 2022, and China’s GDP growth slowing down, Vietnam’s economic growth, on the other hand, has been soaring.

Vietnam’s GDP growth rate reached 13.7% in the third quarter of this year and is expected to reach 8% for the whole year, making it the fastest growing economy in Southeast Asia this year. Thus, attracting a great deal of attention on its current market.

There are two main factors behind Vietnam’s rapidly rising GDP in recent years.

- Ideal Infrastructure:

In order to stimulate trade, exports and investments by foreign enterprises to build factories, the Vietnamese government has continuously introduced favorable tax reduction policies, making the Vietnam financial market attractive in the eyes of foreign investors.

In addition, the Vietnamese government has been investing in infrastructure construction in recent years. At present, the Vietnamese government’s investment in infrastructure has accounted for 6% of GDP. In contrast, other neighboring Southeast Asian countries have an average of only about 2.3%, which is far lower than Vietnam. Therefore, the country’s infrastructure strength has led to Vietnam being in a more favorable market for foreign companies to invest in its construction industry.

- Demographic:

At the beginning of the Covid-19 outbreak in 2020, Vietnam had relatively good control of the pandemic, providing a safe and stable environment for foreign investment.

In addition, with the trade friction between China and the U.S. (Sino-U.S.), as well as China’s own rising labor costs, more and more low-end manufacturing industries have relocated their factories from China to Vietnam, where costs are cheaper.

With more than half of the country’s population under the age of 35, Vietnam’s demographic dividend is well positioned to take on the low-end manufacturing capacity moving out of China.

Although Vietnam’s economy has developed rapidly in recent years, it has undertaken a lot of low-end production capacity from China, which has aroused speculation in the market that Vietnam will challenge the status of China’s manufacturing power.

However, considering that Vietnam itself is relatively small, it cannot fully undertake China’s manufacturing capacity.

At the same time, China itself intends to upgrade its manufacturing industry and get rid of its dependence on intensive production capacity.

Ultimately, the economic development between the two countries is at a completely different stage, so it is more likely that China and Vietnam will form a mutually reinforcing cooperative relationship, rather than being in an open market conflict.

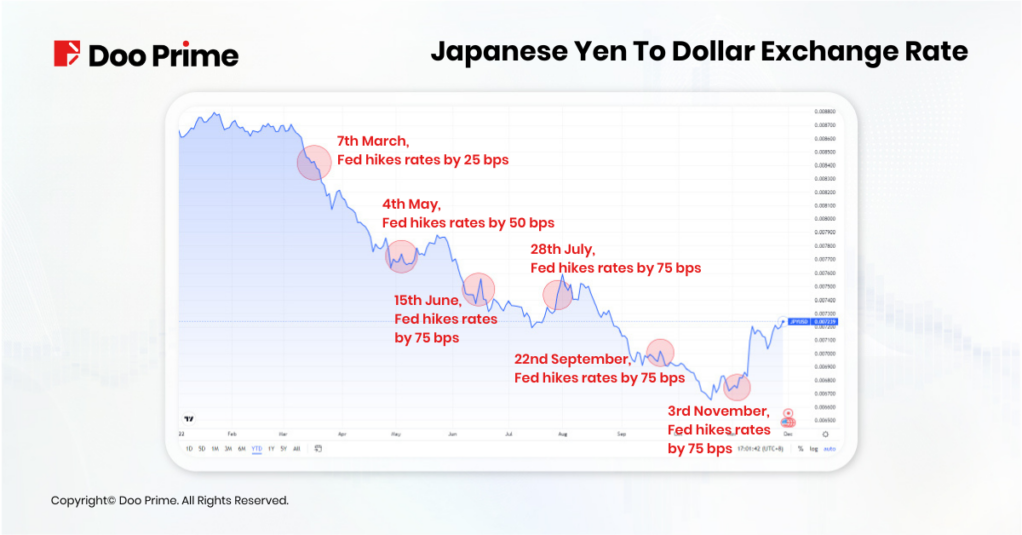

6. Shinzo Abe’s Assassination, Yen Collapses

Former Japanese Prime Minister Shinzo Abe was assassinated on 8th July 2022, after being attacked by a gunman during a speech on the street. The assailant claimed that his mother’s involvement in the Unification Church had led to the loss of her family’s fortune, and that he was unhappy with Abe’s close ties to the religion.

The assassination of the former prime minister is not the only misfortune in Japan this year. This year, as the Federal Reserve continues to raise interest rates aggressively in order to curb inflation, the exchange rate of the Japanese yen against the U.S. dollar has plummeted all the way. That said, a number of global hedge funds regard shorting the Japanese yen as the best trading strategy for the year.

The plunge of the yen has caused Japan to face multiple challenges:

- Imported energy prices are rising rapidly:

As a resource-poor island nation, Japan relies on external imports for many energy sources, especially crude oil as an important strategic resource. However, this year itself, the price of crude oil has risen due to the war between Russia and Ukraine, and crude oil is usually denominated in U.S. dollars.

With this, the plunge in Japan’s exchange rate against the U.S. dollar has ultimately caused a significant increase in Japan’s spending on oil purchases and higher oil prices, which in turn has led to domestic inflation.

- Decline In Domestic Consumer Demand:

In recent years, Japan has already been in a “low desire” social state, and with inflation pushing up the prices of commodities in the country, the nation’s willingness to consume has fallen further, lowering consumer demand.

- Capital flight, lowering the international status of the yen:

First of all, as a major trading country, Japan has close and frequent economic relations with other countries in the world. Therefore, the violent fluctuation of the Japanese yen exchange rate is naturally not conducive to the normal trade between Japan and other countries.

Thus, this reduces the trading volume of the yen, which in turn makes countries reduce their reserve positions against the currency and lowers the international status of the yen.

Japan’s current problem is whether the Bank of Japan should follow the pace of Europe and the U.S. in raising interest rates continuously, so as to increase the exchange rate of the yen and control the depreciation of the exchange rate.

But if the interest rate hikes start, it will undoubtedly inhibit economic development. In addition, the Japanese government is heavily indebted, and the ratio of debt to GDP is maintained at more than 200% all year round.

Thus, once the interest rate hike is raised, it will undoubtedly trigger the government’s fiscal crisis.

Therefore, most market views continue to believe that the Bank of Japan may not increase the interest rate in the near future.

In this day and age, the world situation is overwhelming. Major economic events are like a torrent of the times, driving market sentiment forward and backward in a new cycle.

Our review is not over yet -stay tuned for the upcoming “2022 Market Review: Global Economic Events (II)”!

| About Doo Prime

Our Trading Instruments

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime is an international pre-eminent online broker under Doo Group, which strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 90,000 clients, with an average trading volume of more than USD51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 10 different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe : +44 11 3733 5199

Asia : +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China : +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.