China, the world’s second-largest economy, started the year strongly after lifting COVID-19 restrictions. However, concerns have arisen as its economic growth barely registered in the second quarter, sparking fears of a potential era of sluggish expansion similar to Japan’s “lost decades” of stagnation.

The economic recovery lost momentum in Q2, posing risks to Beijing’s growth target and raising broader concerns about a slowdown in the global economy. As demand weakened both domestically and abroad, pressure mounted on policymakers to implement more stimulus measures to bolster economic activity.

Despite the need for intervention, Beijing hinted that this year’s stimulus measures would likely remain limited in scale, reflecting its relatively modest growth target of approximately 5% for the year.

However, even this cautious target is now at risk, as leading economists at Citigroup Inc. have lowered their growth forecast for China in 2023 to 5% from 5.5%. Similarly, Morgan Stanley revised its projection to 5% from 5.7%, while UOB Ltd. and JPMorgan Chase & Co. foresee similar expansion, down from their earlier estimates of 5.6% and 5.5%, respectively.

The Chinese authorities now face a formidable challenge in steering the economic recovery while addressing unemployment concerns and avoiding excessive stimulus that could lead to debt risks and structural imbalances.

This article delves into the assessment of China’s Q2 economic performance, the prospects for additional stimulus and the market’s response.

Assessing China’s Q2 Economic Performance

During the first half of 2023, China’s economy demonstrated signs of a steady post-COVID recovery, surpassing its half-year GDP growth target. Notably, the second quarter witnessed substantial improvements in sectors like services and consumption, while industrial and manufacturing output accelerated in June compared to the previous month.

However, monthly growth rates have tapered off over the past two months, indicating the need for additional stimulus measures to sustain economic momentum throughout the year.

Let’s take a closer look at China’s economic performance in H1 2023:

- H1 2023 GDP: RMB 59.3 trillion (approx. USD 8.3 trillion), +5.5% y/y

- Q2 2023 GDP: RMB 30.8 trillion (approx. USD 4.29 trillion), +6.8% y/y

- Retail sales: RMB 22.76 trillion (approx. USD 3.17 trillion), +8.2% y/y

- Industry output: +3.8% y/y

- Fixed assets investment: RMB 24.3 trillion (approx. USD 3.38 trillion), +3.8% y/y

- Foreign trade: RMB 20.1 trillion (approx. USD 2.8 trillion), +2.1% y/y

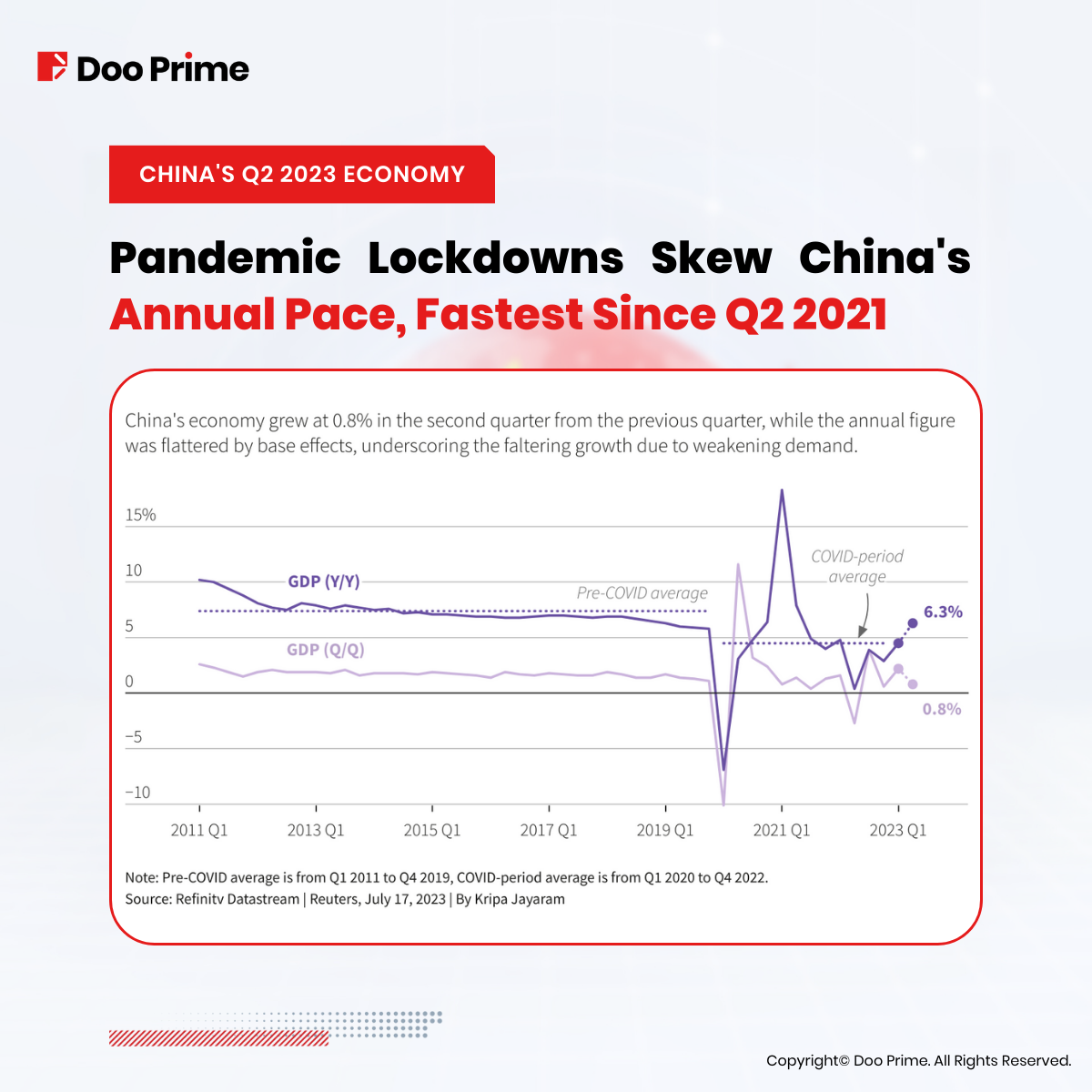

Despite the positive indicators, China’s GDP grew by only 0.8% in April-June from the previous quarter on a seasonally adjusted basis. This figure fell short of analysts’ expectations and was considerably lower than the 2.2% expansion observed in the first quarter.

On a year-on-year basis, the GDP expanded by 6.3% in Q2, a notable acceleration from the 4.5% growth recorded in the first three months of the year. However, this growth rate still fell well below the forecasted 7.3% growth.

The pandemic-induced lockdowns in major cities during the previous year heavily skewed the annual pace, making it the quickest since Q2 2021.

Economists, like Carol Kong from the Commonwealth Bank of Australia, have expressed concerns about the apparent slowdown in China’s post-COVID boom. Despite certain higher-frequency indicators showing improvement since May, the overall recovery appears bleak and faltering. The country also faces record-high youth unemployment rates, adding further complexity to the economic challenges.

These developments have raised the risk of China missing its modest 5% growth target for 2023, according to some economists. The latest data indicates a slowing retail sales growth rate of 3.1% in June, a sharp decline from the 12.7% jump observed in May. Similarly, although industrial output quickened to 4.4% in June from 3.5% in May, the demand remained lukewarm.

Private fixed-asset investment saw a 0.2% shrinkage in the first half of the year, in stark contrast to the 8.1% growth observed in investment by state entities, revealing signs of weak private business confidence. Furthermore, exports faced a decline, and China’s property sector continued to experience a downtrend, impacting the overall momentum.

Amid growing concerns over global recession risks and China’s growth target for 2023, authorities are set to introduce more stimulus measures, including fiscal spending on infrastructure, consumer and private firm support, and potential property policy easing. However, analysts caution against expecting an immediate turnaround.

Policymaker Response And Stimulus Measures To Revive China’s Economy

In response to the prevailing economic challenges, Chinese policymakers have pledged to escalate stimulus measures, acknowledging the “new” difficulties faced by the economy during the meeting of the ruling Communist Party’s influential politburo on July 25th, 2023.

Following a recent gathering of the ruling Communist Party’s powerful politburo, the country unveiled its economic policy direction for the second half of 2023, aiming to tackle the prevailing issues.

While the official readout left some aspects unaddressed, it shed light on several key policy areas:

Macro Policies:

The politburo emphasized a “proactive” fiscal stance, “prudent” monetary policy, a stable yuan, livelier capital markets, and measures to address mounting financial risks. It hinted at unspecified reductions in taxes and fees and the issuance of special local government bonds for infrastructure investment. However, it reinforced expectations that central bank liquidity injections and interest rate cuts would be limited in size.

Property:

The politburo removed a key phrase from its April meeting readout, signaling a potentially more relaxed stance on property market regulations. While markets expect further easing to address the downturn in the housing market, the politburo flagged a “city-based” approach rather than nationwide changes. Calls for “more affordable” housing suggest state-led investments into new projects.

Local Government Debt:

The politburo announced plans to resolve risks stemming from local government debt, which economists estimate to be more than USD 9 trillion. The focus on addressing local government financing issues is crucial in the aftermath of the property market bubble burst in 2021.

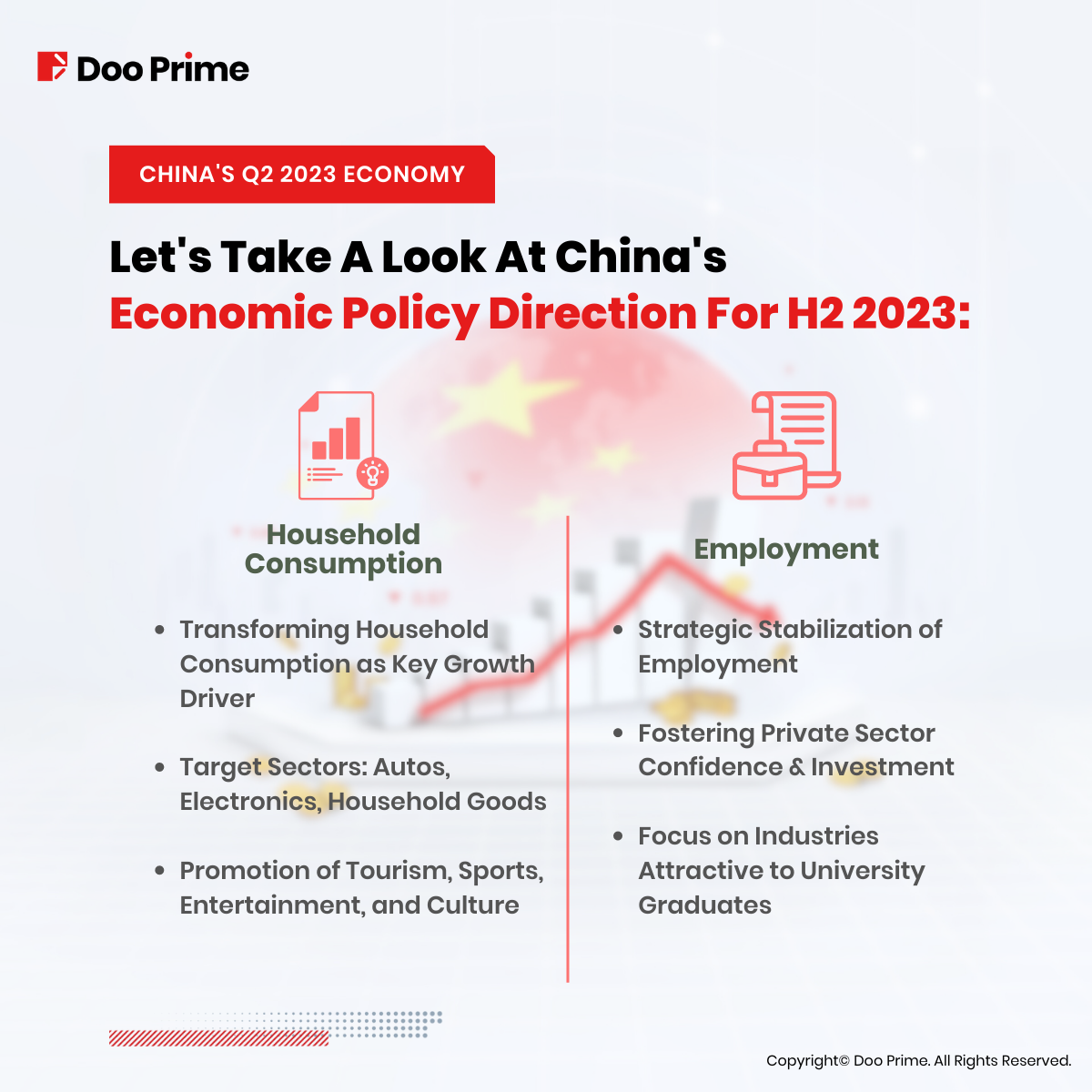

Household Consumption:

The politburo emphasized transforming household consumption into a key driver of growth. It intends to boost consumption in sectors like autos, electronic products, household goods, and promote tourism, sports, entertainment, and culture. However, there were no immediate measures to boost household income directly, leaving some economists disappointed.

Employment:

The politburo stressed the importance of stabilizing employment from a strategic perspective, recognizing the risks of social instability posed by a sluggish job market. Policymakers aim to foster private sector confidence and investment, particularly in industries attractive to university graduates.

Despite these stimulus efforts and the goal of reaching approximately 5% growth in 2023, many economists remain underwhelmed. The ease in achieving this growth target is attributed to favorable base effects from a challenging year in China’s economic history. Additionally, the level appears less impressive considering China invests about 40% of its GDP annually, twice the rate of the United States.

While China’s commitment to stimulating the economy is evident, the effectiveness and impact of these measures will be closely monitored as the country navigates its path to sustained economic recovery and growth.

Impact On Global Markets: Reactions To China’s Stimulus Measures And Yuan Resilience

Yuan Resilience And Stimulus Measures

On July 21st, ahead of the China politburo meeting, the Chinese yuan displayed remarkable resilience, rebounding 0.1% against the dollar following a notably robust daily midpoint fixing by the People’s Bank. However, the currency had faced challenges throughout the week due to concerns over China’s slowing economic growth.

In response to the situation, China’s top currency regulator expressed intentions to implement additional measures to bolster the yuan. Furthermore, media reports indicated that major state-owned banks intervened in the currency markets by selling dollars to support the yuan, further contributing to its recovery.

Amid discussions surrounding stimulus measures, the National Development and Reform Commission, China’s top economic planner, unveiled new initiatives aimed at bolstering spending on automobiles and consumer electronics. While these measures intend to provide much-needed support to the country’s slowing economic recovery, they also increase liquidity, placing additional pressure on the yuan.

Market Reactions And Hedge Fund Interest

Despite the stimulus announcement, broader markets did not show significant enthusiasm, reflecting cautious sentiment. This year, the yuan has been one of the worst-performing Asian currencies, depreciating by 4% against the dollar, drawing attention from global investors.

In the context of Hong Kong’s financial landscape, the Hang Seng Index experienced a remarkable surge of 4.1%, closing at 19,434.40, its highest level since March 1st. This surge on July 25th was fueled by the most substantial rally in Chinese developers’ stocks since November, triggered by Beijing’s unexpected post-Politburo meeting statement, signaling stronger stimulus measures to combat the slump in the housing market.

The Hang Seng Tech Index also saw a notable 6% increase, while the Shanghai Composite Index advanced 2.1%. Furthermore, U.S.-listed Chinese stocks experienced a substantial overnight gain of 4.3%, the most significant increase in six months, indicating renewed investor interest.

Additionally, after the recent politburo meeting, global hedge funds demonstrated increased interest in Chinese equities, making substantial purchases on Tuesday, July 25th, at the fastest pace since October 2022, according to a report by Goldman Sachs.

The higher inflows were primarily focused on mainland A-shares and Hong Kong-listed shares, with U.S.-listed Chinese American Depositary Receipts (ADRs), primarily internet companies, experiencing relatively smaller inflows. The report noted that the inflows were mainly driven by long-buys, with a lesser contribution from short covers.

Among the sectors, consumer discretionary, staples, financials, materials, and industrials were the primary beneficiaries of hedge fund purchases, as indicated by Goldman Sachs’ tracking data. This renewed interest in Chinese equities reflects a more optimistic view of the country’s economic prospects.

Ongoing Challenges And Improving Sentiment

The recent expression of support for capital markets and the announcement of more significant easing measures to boost the economy during the latest Politburo meeting led to a rebound in Chinese stocks. However, the performance of both Hong Kong’s Hang Seng Index and China’s CSI 300 Index throughout the year has been relatively weaker compared to major global indexes, a reflection of the ongoing challenges.

Concerns surrounding China’s post-pandemic economic recovery and escalating tensions between China and the U.S. had prompted global investors to withdraw from Chinese markets in the previous months. As a result, hedge funds’ exposure to Chinese equities remained at historically low levels last seen in November 2022, significantly below five-year averages.

However, sentiment is improving in July, with net foreign buying in mainland Chinese equities through the China-Hong Kong Stock Connect program reaching 20 billion yuan, making it the strongest month since April, according to official data. This signals a potential shift in investors’ perceptions.

Despite recent positive momentum, the situation remains dynamic, prompting investors to closely monitor policy developments and economic indicators for informed decisions on their exposure to Chinese equities. Global markets will continue to respond to China’s economic trajectory and stimulus efforts, impacting investment strategies worldwide.

China’s Economy At A Critical Juncture

Fostering a resilient global economy hinges on cooperation and engagement within the international community, particularly as the world closely observes China’s economic trajectory. China’s economy stands at a critical juncture, with significant global implications. Balancing growth promotion and risk management will be pivotal for the future.

As the world’s second-largest economy, China’s policy decisions and economic performance are closely scrutinized, given its interconnectedness with nations worldwide. Prioritizing prudent fiscal and monetary policies, targeted stimulus measures, and fostering innovation and domestic consumption can bolster economic prospects and contribute to global economic recovery. Ultimately, understanding these intricacies is crucial for shaping effective strategies and responses to capitalize on opportunities and mitigate risks.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime, an international preeminent online broker under Doo Group, strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 130,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.