Copper, a metal long valued for its conductive properties, is currently experiencing a bullish trend, with its prices witnessing a significant surge. This increase is not a random occurrence but stems from a combination of factors that highlight the metal’s enduring value and crucial role across multiple industries. In this article, we will examine the various dynamics at play, including market trends, supply-demand imbalances, and the broader economic implications that contribute to the rising value of copper.

Copper’s Bullish Trend in the Commodities Market

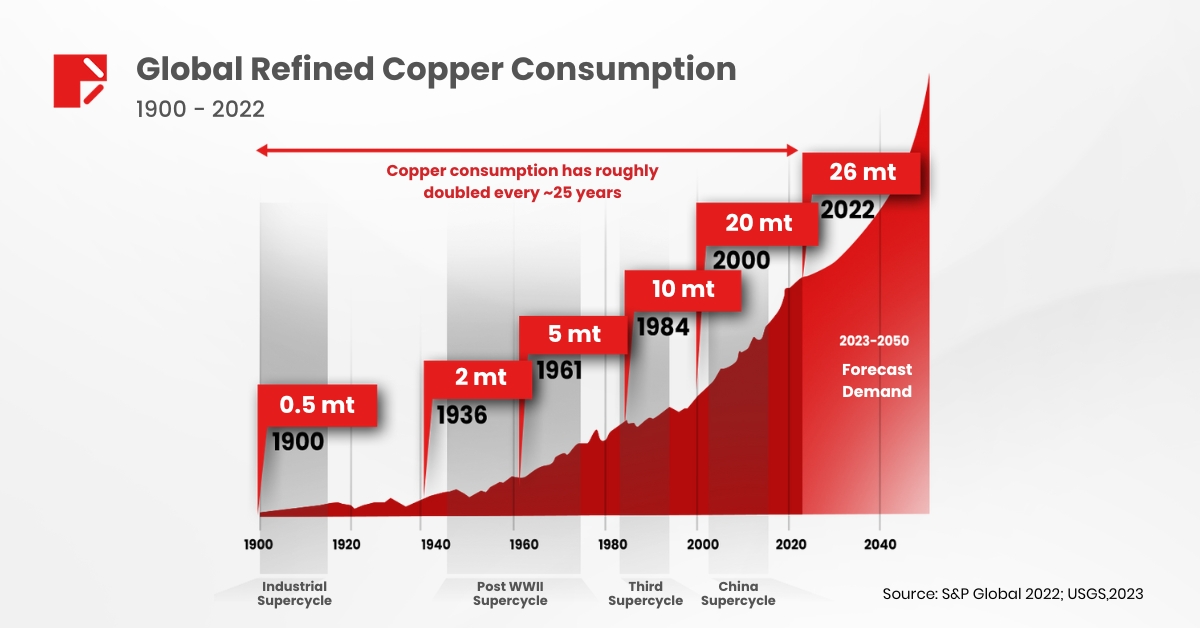

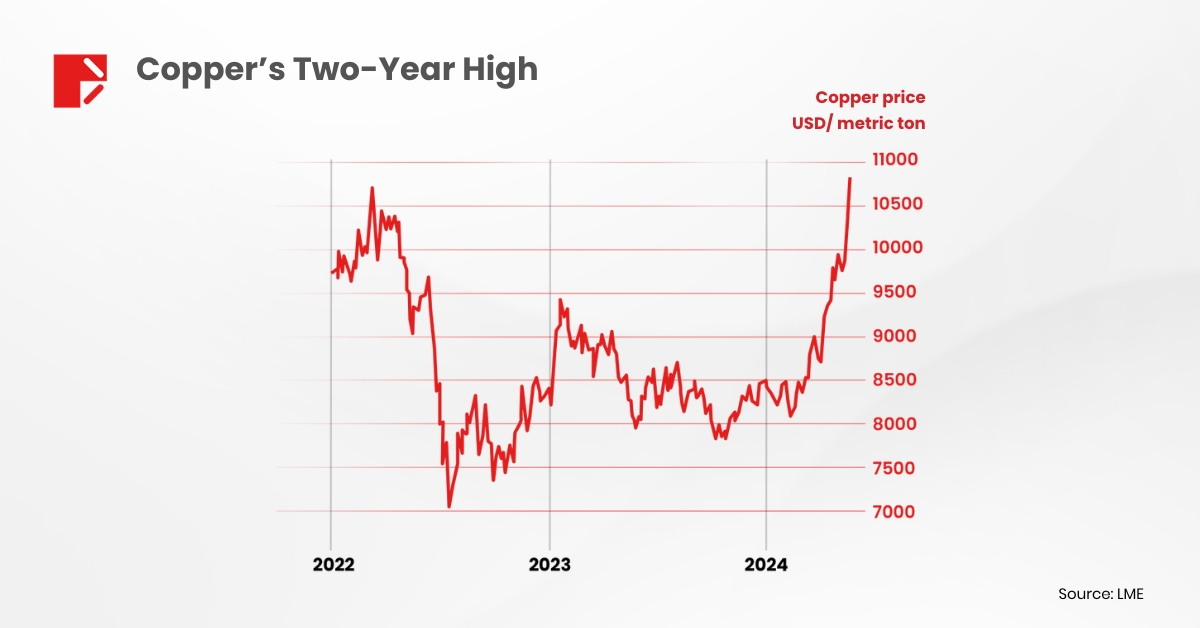

The escalation in copper prices is part of a broader bullish trend within the commodities market. Over the past four years, 47 commodities across different sectors have reached multi-year or all-time highs. According to analysts from GSC Commodity Intelligence, copper, alongside gold and silver, is poised for substantial growth in the coming months. Notably, copper has entered its second secular “bull market this century”, starting off 2024 with prices surging to a new all-time record high of USD 11,104 per metric ton. This substantial increase forms a critical part of the broader commodities boom.

Central to copper’s price surge is its critical role in various sectors, including construction, manufacturing, and defense, which are foundational to the global economy. In fact, copper is generally seen as a key barometer of global economic health because of its wide-ranging use in construction and manufacturing.

The demand for copper is surging due to its vital role in the construction and defense industries, as well as being a key component in electric cars, wind turbines, and the power grid.

Offshore wind, for example, requires about “three times as much copper as coal-fired power generation in terms of tons per gigawatt of capacity.”

However, mining companies are struggling to keep pace with demand. According to the International Energy Agency (IEA), existing mines and projects under construction are projected to fulfill only 80% of global copper demand by 2030. Given that the development of a new copper mine can take approximately 23 years, this lag in production is a critical concern as global demand for copper continues to rise.

In an interview with The Morning Brief, Wells Fargo Head of Real Asset Strategy John LaForge highlighted a key factor behind the copper price surge: a recent supply squeeze. He pointed out that global copper production simply isn’t keeping pace with the surge in demand, creating a situation where “there are buyers everywhere right now for copper.”

Copper’s Two-Year High

Reflecting these pressures, copper prices have been on an upward trend since the end of 2023. They have surged over 20% since mid-February 2024, reaching a two-year peak of nearly USD 10,000 per tonne due to copper ore shortages.

Long-Term Demand Drivers

Here are the key factors ensuring copper remains in high demand:

- Technological Advancement: Copper is a vital component in the semiconductor industry, the backbone of modern technology. The growth of sectors like electric vehicles and renewable energy, which rely heavily on copper, will further drive demand.

- Shift Towards Renewables: The global transition towards renewable energy sources like wind and solar power heavily relies on copper for its transmission and distribution infrastructure.

- Inflationary Pressures: As inflation rises, investors seek tangible assets like copper to hedge against currency devaluation, making the metal a more attractive investment option.

Potential Rate Cuts as a Catalyst

The possibility of central banks implementing rate cuts in the future could further fuel the copper boom. Lower interest rates decrease the opportunity cost of holding non-interest-bearing assets like metals, making them more appealing to investors. This could lead to increased investment in copper and contribute to its upward price momentum.

Is Copper the New Gold?

2024 has been aptly named the “Year of the Metals” by GSC Commodity Intelligence, reflecting a trend driven by the exceptional performance of precious metals and the similar dynamics at play for copper. As a cornerstone commodity, copper is not only a critical element of modern infrastructure but also a strategic investment in light of broader economic trends.

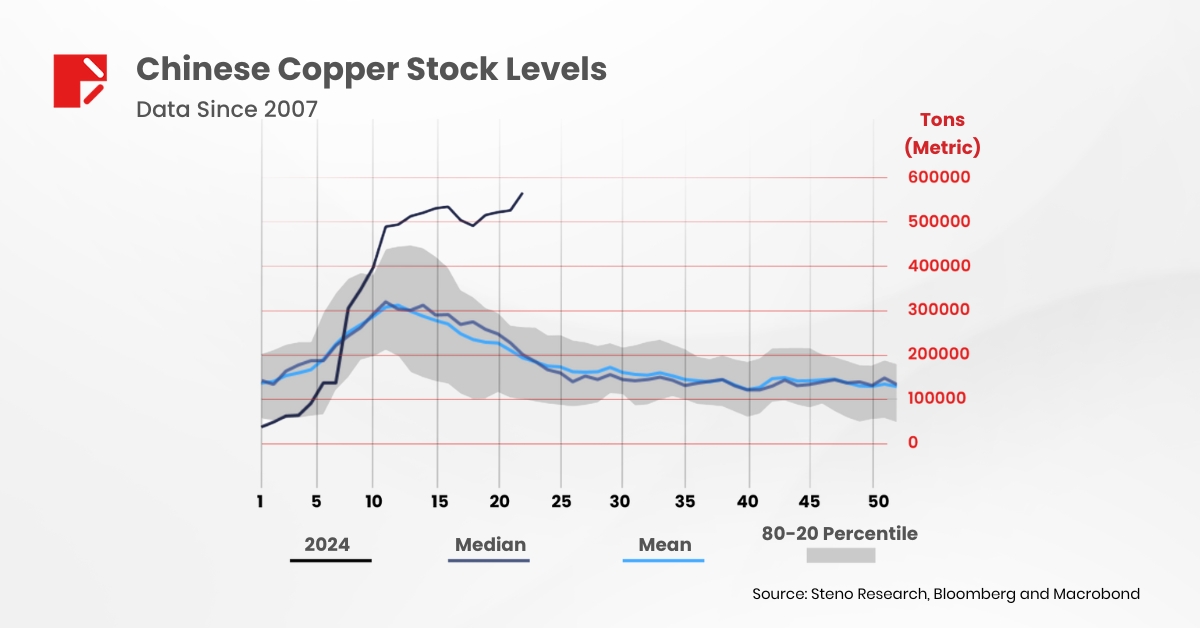

Given its current trajectory and the factors driving its demand, copper’s role and relevance are expected to grow significantly. Notably, this year has witnessed a dramatic increase in Chinese copper stock levels, as stakeholders accumulate reserves in anticipation of rising demand and potential price increases. This trend of hoarding copper, highlighted by recent charts, indicates a strong confidence in its sustained value.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.