The tech world is buzzing with one question: Where is Apple AI?

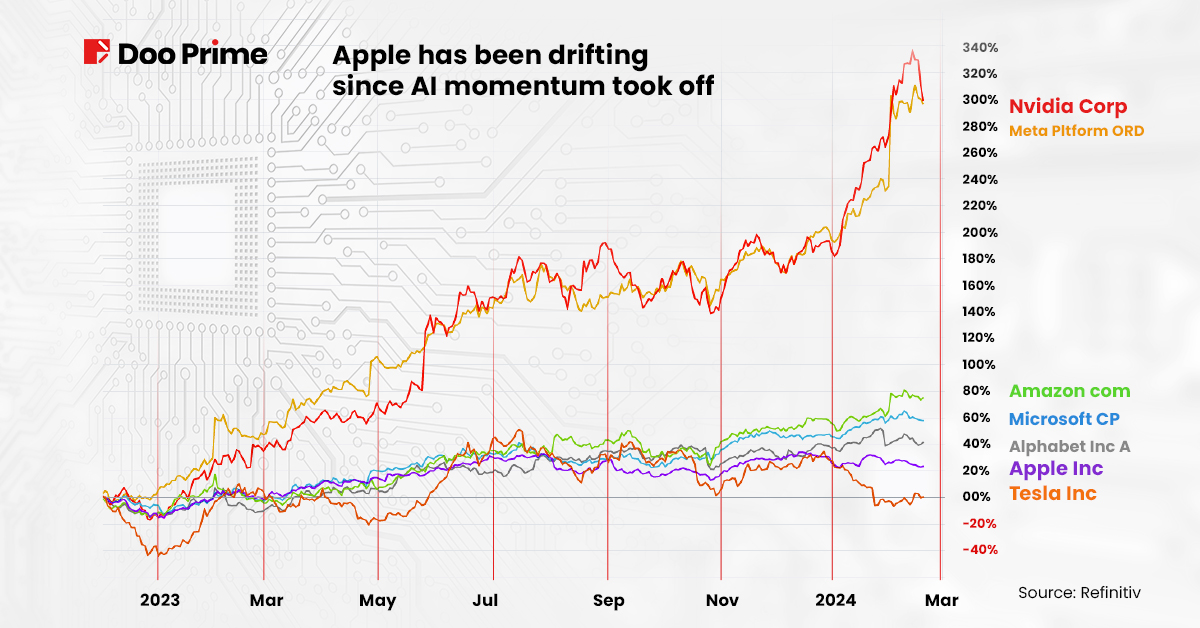

Apple’s stock price lags behind its peers in the AI race. Nvidia (NVDA), Meta (META), Microsoft (MSFT), and Amazon (AMZN) are all leading the race for now.

However, Apple is known for its secrecy. Remember the iconic “One More Thing” moment during Steve Jobs’ presentations? Apple might be waiting for the perfect moment to unveil a revolutionary AI integration that shakes things up in the world of AI stocks.

In the ever-evolving world of technology, Apple has consistently stood at the forefront of innovation. With its iconic product lineup and unwavering commitment to the user experience, the tech giant has captured the hearts and minds of millions worldwide.

Now, as we stand on the precipice of a new era in artificial intelligence, Apple is poised to revolutionize the industry once again. This article dives into what we know about Apple’s behind-the-scenes AI developments and why these lower stock prices might be a buying opportunity for investors.

AI Stocks since ChatGPT

ChatGPT was launched in late November 2022, and the AI fever took off. Among tech giants, Nvidia (NVDA) and Meta (META) have emerged as clear leaders.

Meanwhile, Tesla (TSLA) seems to have lost some momentum, and Apple (AAPL) remains curiously quiet.

This lack of fanfare surrounding Apple AI is sparking questions. Is the tech giant truly falling behind, or are they planning a strategic surprise? Their history of secrecy suggests the latter could be true.

Investors shouldn’t forget that Apple was one of the first companies to begin its artificial intelligence journey with the introduction of Siri, the first widely-used voice assistant on a smartphone.

Apple AI Journey: From Siri to “Apple GPT”

Since Siri’s groundbreaking launch, competitors like Google Assistant and Amazon’s Alexa have eclipsed the new AI voice assistant. However, Apple has been quietly working on its next-generation AI, Apple GPT.

Recent acquisitions like DarwinAI, a Canadian AI startup, hint at Apple’s ambitions but have yet to reveal any major uses of the technology.

Apple reportedly races to develop a next-generation AI system called Apple GPT, likely drawing inspiration from OpenAI’s groundbreaking GPT-3 large language model.

Here’s what we can expect from Apple GPT (based on industry speculation):

Focus on User Privacy:

A core principle of Apple’s products, user privacy, is likely to be a major focus in Apple GPT. The system might prioritize on-device processing and limit data collection compared to competitors.

Enhanced Siri Capabilities:

Apple GPT could significantly improve Siri’s natural language processing and context awareness. Imagine Siri anticipating your needs, proactively suggesting actions, and carrying on comprehensive conversations.

Integration with the Apple Ecosystem:

One of the key advantages Apple holds in the AI race is its closed ecosystem. Apple GPT could seamlessly connect with various Apple devices, including the iPhone, iPad, iWatch, and the recently announced Apple Vision Pro. This seamless integration would create a powerful and intelligent ecosystem.

Apple’s AI could also find its way into the company’s services, such as Apple Music, Apple TV+, and Apple Arcade. Imagine AI-generated playlists tailored to your mood or AI-enhanced gaming experiences that adapt to your skill level. The possibilities are endless.

Moreover, the Apple Vision Pro, unveiled at the 2024 Worldwide Developers Conference (WWDC), is a testament to Apple’s commitment to pushing the boundaries of technology. With its advanced augmented reality (AR) capabilities and powerful AI integration, the Apple Vision Pro is set to redefine the way we interact with the world around us.

Apple GPT is poised to transform the way we communicate with our devices and access information.

Imagine an iPhone 16 Powered by AI

Imagine an iPhone that anticipates your needs before you even think of them. Personalized health suggestions, proactive camera adjustments that capture stunning photos every time, or seamless integration with your smart home—the possibilities are endless. Apple’s focus on user experience makes them uniquely positioned to create an AI that feels intuitive and helpful, not intrusive.

Samsung’s Galaxy S24 series and Google’s Pixel 8/8 Pro have introduced phones like this, but the capabilities seem incremental and not revolutionary. Therefore, Apple can break new ground by introducing revolutionary upgrades to the iPhone and once again attract all the attention the company and the stock currently need.

Apple AI: $1 Billion Annual Investment

To stay ahead in the AI race, Apple has been investing heavily in its AI capabilities. The company reportedly spends $1 billion annually on AI research and development, ensuring that it remains at the forefront of innovation. This investment is already yielding impressive results, as evidenced by the capabilities of the Apple Vision Pro and Apple GPT.

Apple AI Stock Performance

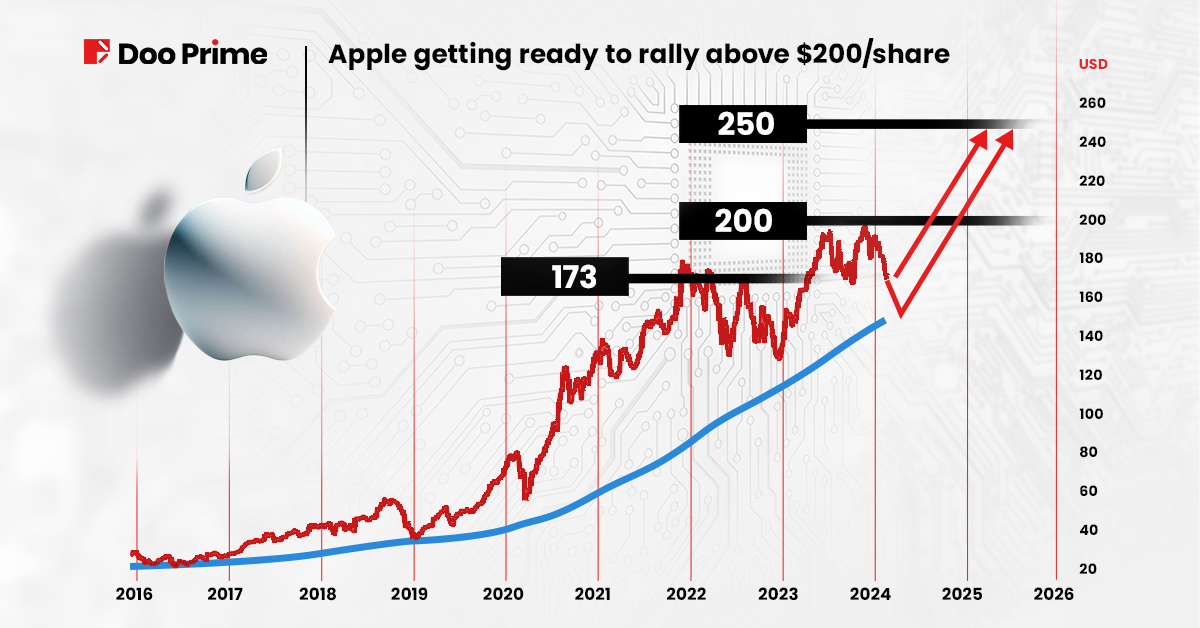

Apple stock (AAPL) might be down a bit this year, but a strong AI pivot could be the catalyst it needs to trigger a bullish rally.

Currently, the stock price is hovering around the crucial $170 support level. If investors continue to accumulate shares at this level, we might see a surge back towards the all-time highs.

On the other hand, if the price breaks below $170, there’s a chance it could revisit the weekly moving average of around $150 before potentially experiencing a significant upward trend, even reaching new record highs.

Is Apple Gearing up for an AI Revolution?

With Apple’s reputation for innovation and its recent moves in the AI space, the potential is vast and exciting. It’s clear that something big is brewing. Whether it’s a revolutionary iPhone feature or a smarter Apple ecosystem, Apple AI has the potential to break new ground and surprise the world. So, stay up-to-date with Doo Prime’s news and analysis, because the next Apple event could be a game-changer for AI stocks.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and the client should therefore be prepared to suffer significant losses when using such trading facilities.

Please ensure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to learn more.