Doo Prime CopyTrading Unveils Exciting Developments!

Doo Prime has always put its clients first, continuously breaking barriers and refining its services to create a dynamic and efficient trading community, Doo Prime CopyTrading.

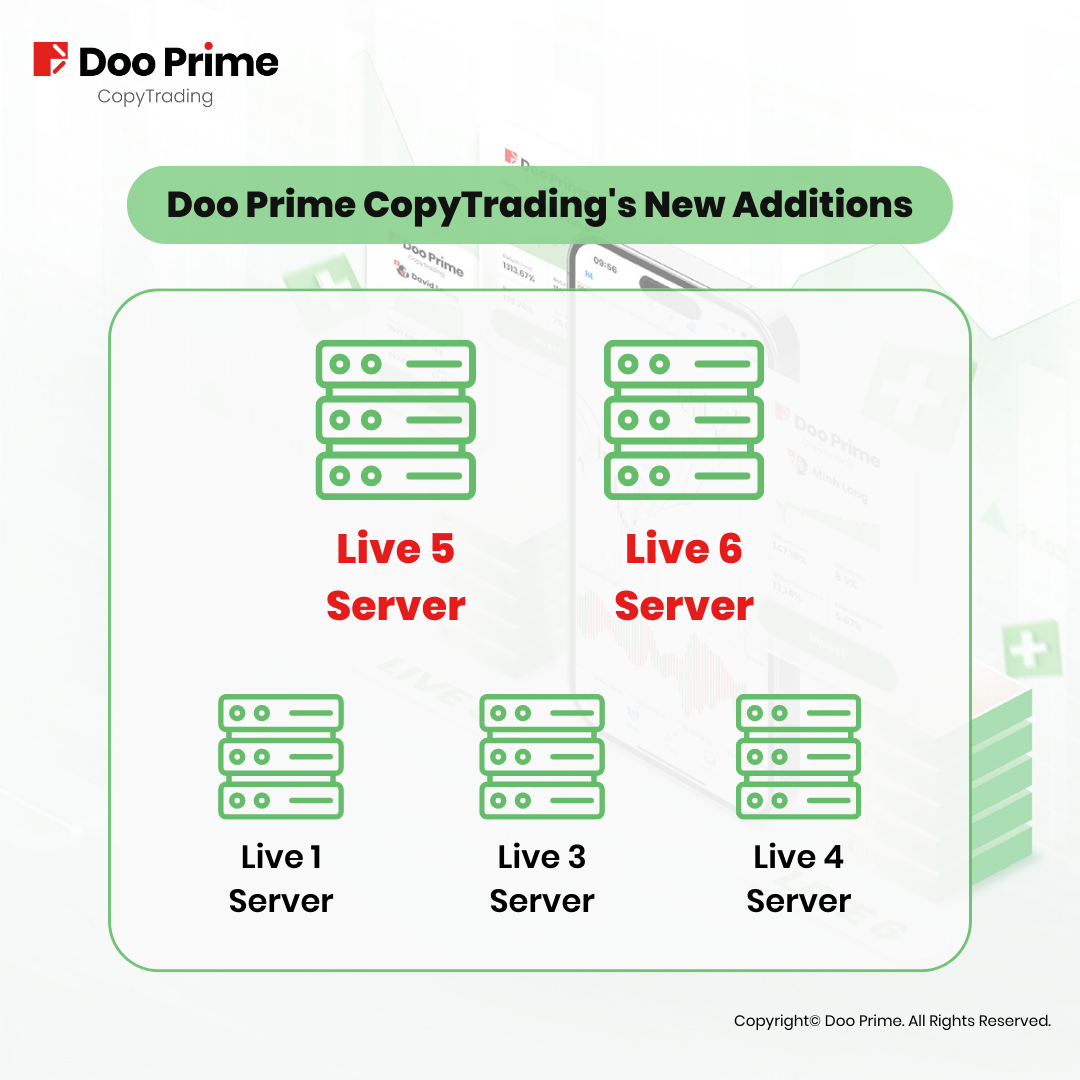

Following an outstanding month of profit since its May debut, Doo Prime CopyTrading officially introduced the ECN Account in June. And now, we are thrilled to announce that starting from July 31st, Doo Prime CopyTrading will be available on Live 5 and Live 6 servers!

With the addition of Live 5 and Live 6 servers, users from Live 1, Live 3, Live 4, Live 5, and Live 6 can now seamlessly interact and share trading strategies on the platform. Moreover, the convenience of publishing signals and copying trades will be extended to our three classic account types – STP Account, ECN Account, and CENT Account. This expansion also marks our first step towards catering to clients in the European region, offering a truly global and hassle-free trading experience.

But we are not stopping there. Our community-based copy trading platform, designed with a flexible profit-sharing feature, is now venturing into new territory by introducing cross-server copy trading. This significant development will break the barriers of server and account type restrictions.

Cross-server copy trading opens up a world of possibilities. Both STP and ECN account holders can now seamlessly share signals, allowing followers to replicate high-quality strategies across different account types. This advancement represents a paradigm shift in trading accessibility and provides an array of diverse opportunities.

Effortless Trading Made Possible With Doo Prime CopyTrading!

At Doo Prime, we not only strive to enhance the Doo Prime CopyTrading platform for optimal user experience but also share a series of articles about high-quality signals. These articles aim to help traders achieve significant profits by copying these signals.

In this edition, we bring into focus the signal provider “Wōniú yěyǒu àiqíng” (蜗牛也有爱情) or “Even Snails Have Love,” which epitomizes short-term trading and boasts the following key features:

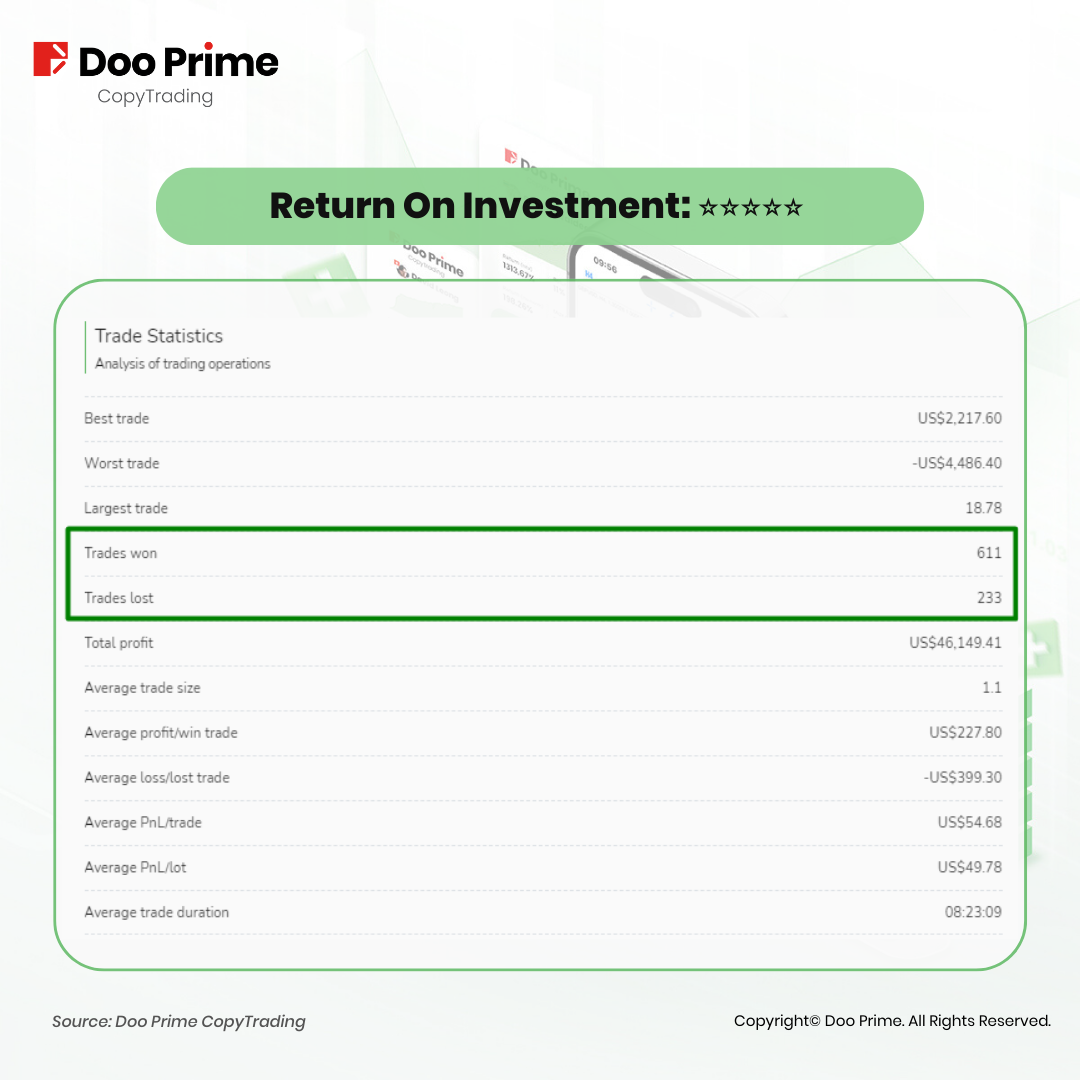

Return On Investment: High profitability with an impressive success rate.

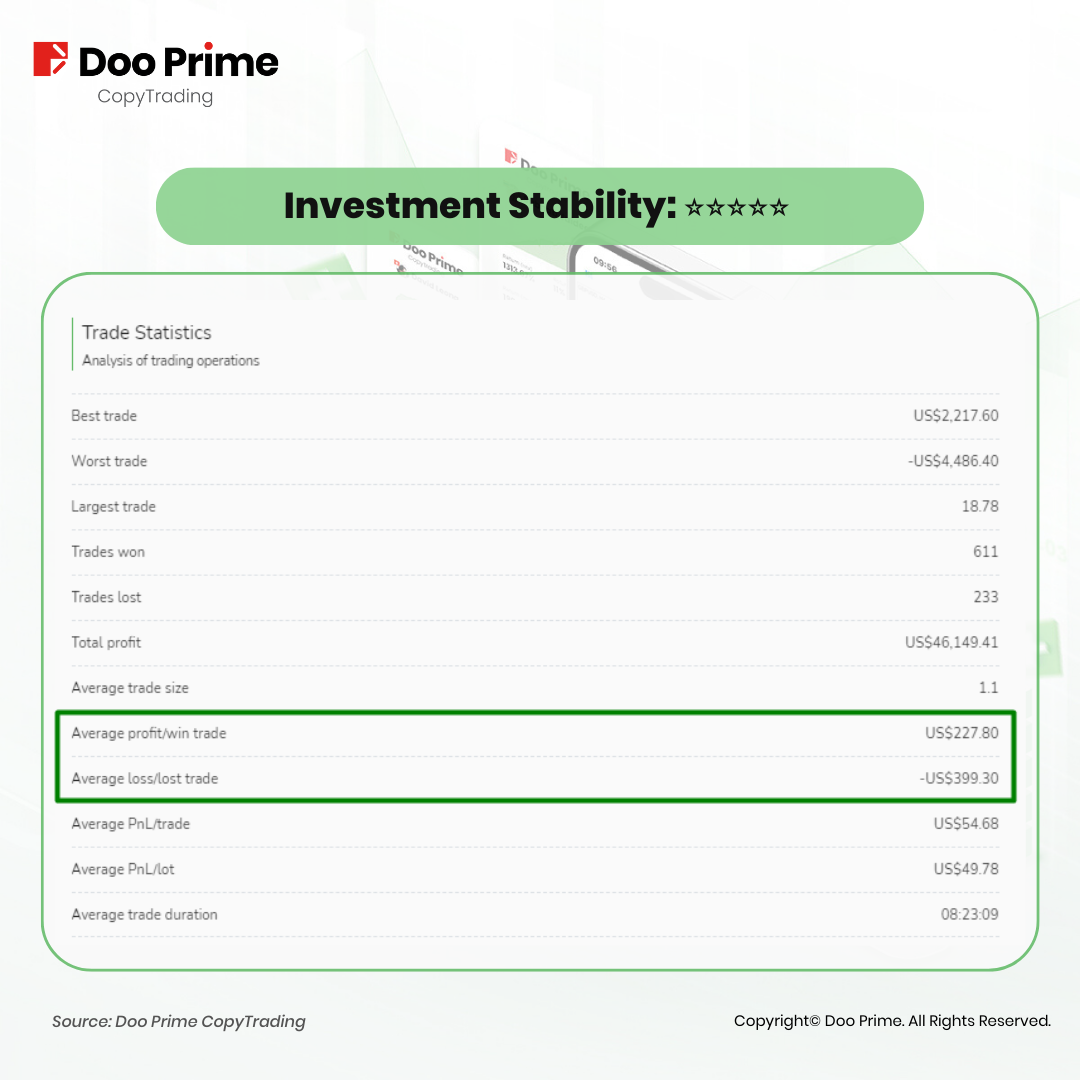

Investment Stability: Suitable risk-to-reward ratio with a well-implemented Martingale strategy for consistent gains.

Capital Allocation: Requires a substantial capital investment, and carries greater mental burden.

Return On Investment: ⭐️⭐️⭐️⭐️⭐

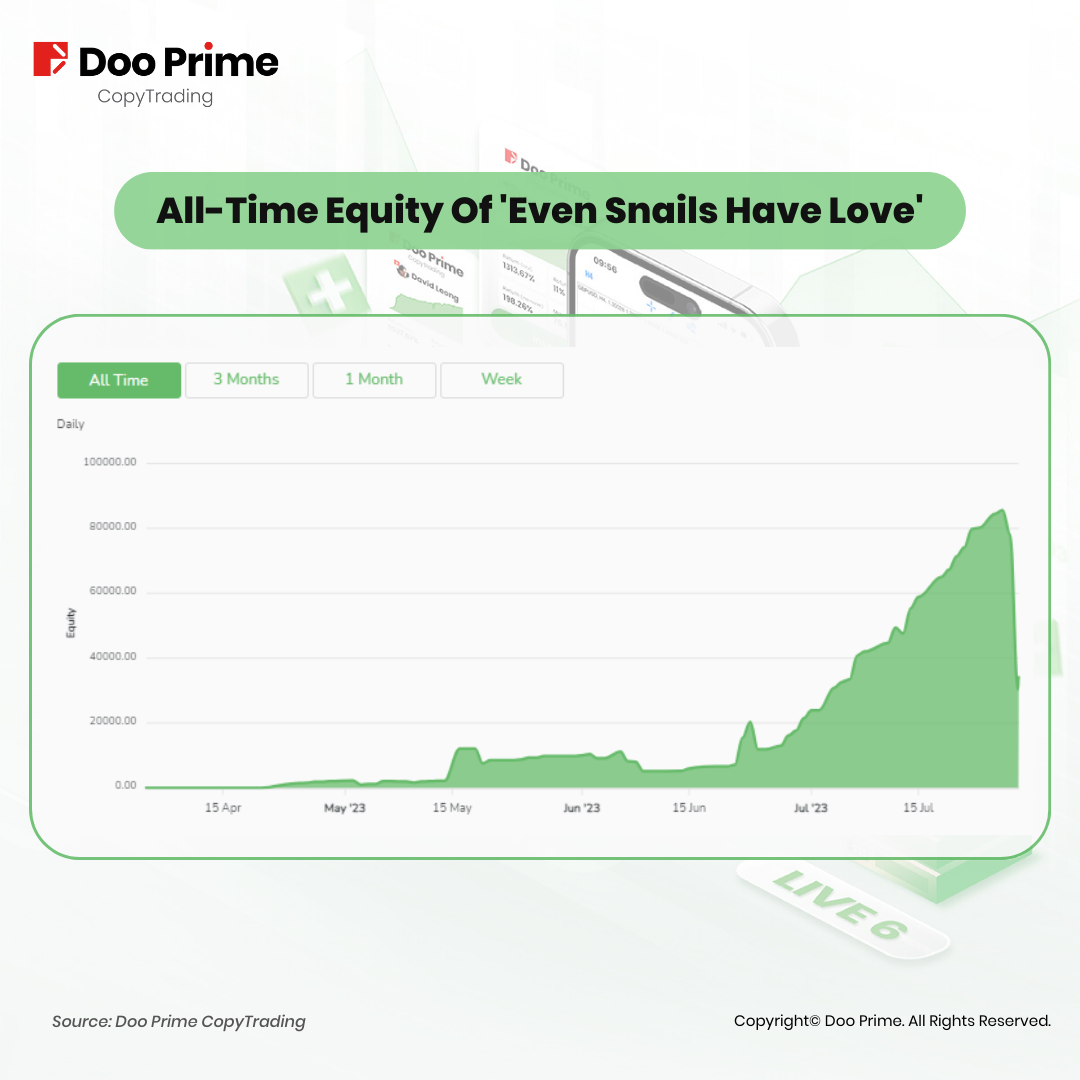

Created on March 24th, 2023, the signal provider “Even Snails Have Love” has achieved remarkable results, boasting a return of 800.53%, with the highest profit reaching an astonishing 4538.86%. Notably, the signal’s success rate stands impressively at 0.7.

Success rate refers to the proportion of profitable trades out of the total number of trades. For example, if out of 10 trades, 3 are profitable, the success rate would be 30% or 0.3. In the case of “Even Snails Have Love,” the success rate is calculated as “611/844.”

Investment Stability: ⭐️⭐️⭐️⭐️⭐️

A high success rate does not guarantee profits without proper risk and position management. To achieve profitability, investors have two options: they can either aim to increase their success rate or expand the risk-to-reward ratio.

It is worth noting that the success rate and risk-to-reward ratio are closely related. A higher success rate often comes at the cost of a lower risk-to-reward ratio, and vice versa.

The key to the “Even Snails Have Love” signal’s success lies in striking the right balance between its success rate and risk-to-reward ratio.

In addition to its remarkable 0.7 success rate, the risk-to-reward ratio (“Total Profit Amount/Total Loss Amount”) is greater than 1, indicating a favorable trade-off. Moreover, each order from this signal yields a profit of USD 54.68, and each trade earns USD 49.78, showcasing its stable and rewarding trading strategy.

Furthermore, “Even Snails Have Love’s” signal exhibits robust risk control by employing the Martingale strategy.

The Martingale strategy adopted by “Even Snails Have Love” involves doubling the order amount after each loss, aiming to exit the trade with a profit once the price rebounds.

However, it is essential to recognize that the Martingale strategy is not a guaranteed path to success in trading. Every trading strategy has specific backgrounds and market conditions to which it is best suited, and Martingale is no exception.

The recent rapid decline in returns from “Even Snails Have Love” serves as an example of its limitations. Just as profits and losses are interconnected, using the Martingale strategy during a strong trending market can lead to significant drawdown risks when positions need to be closed.

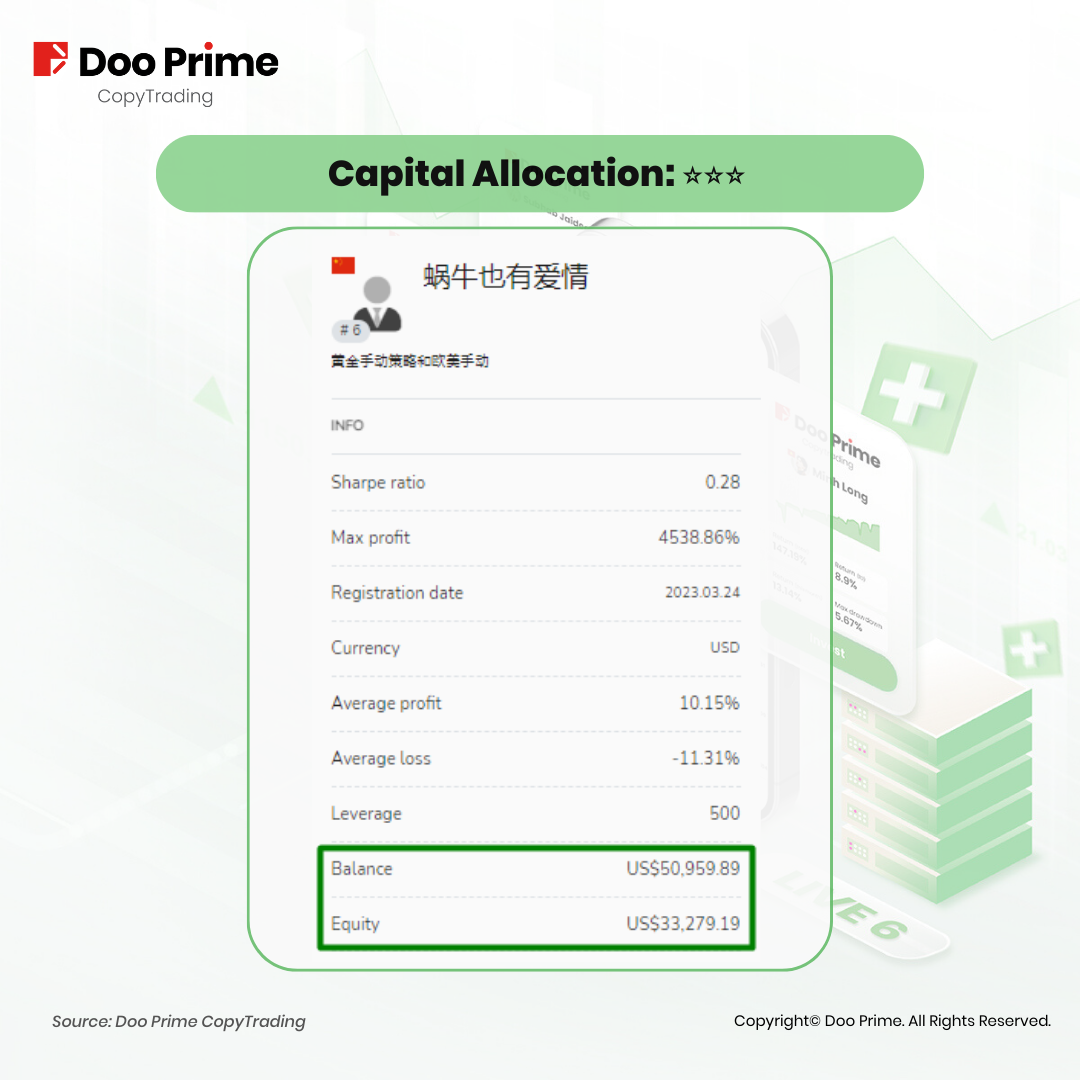

Capital Allocation: ⭐️⭐️⭐️

While larger capital investments often come from seasoned traders with higher credibility, it does present formidable challenges and mental burdens for novice investors. The “Even Snails Have Love” signal requires an investment exceeding USD 5,000, with the current assets totaling USD 33,279.19.

Overall Assessment Of The Signal Provider: ⭐️⭐️⭐

In conclusion, the trading strategy “Even Snails Have Love” not only boasts a high success rate but also maintains a favorable risk-to-reward ratio, making it an excellent choice for short-term traders looking to follow signals.

Are you an aspiring investor seeking to embark on a winning trading journey by following a high-quality signal?

If so, we invite you to click the link and sign up as a follower now and start enjoying the benefits of our quality signal provider.

Additionally, Doo Prime CopyTrading has introduced the Instant Profit feature that allows signal providers to share their profits instantly. If you wish to join our CopyTrading platform and earn more income, while leading novices to success, please click on this link and register as a signal provider today!

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime, an international preeminent online broker under Doo Group, strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 130,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively hold the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.