What Is The Non-Farm Payroll

Active investors and traders are always on the lookout for economic indicators that create volatility in the financial markets. Such indicators are crucially important for traders to interpret market opportunities regarding economic growth.

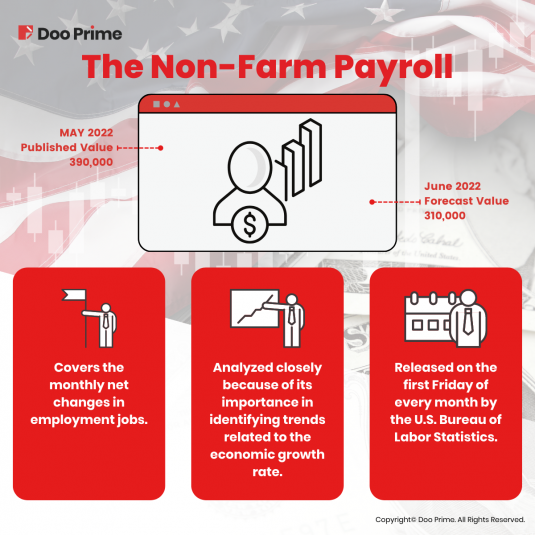

The non-farm payroll (NFP) covers the monthly net changes in employment jobs and is analyzed closely because of its importance in identifying trends related to the rate of economic growth.

That said, just like the inflation rate or the GDP, the NFP is one of the most-watched economic indicators of the U.S. economy and it is released on the first Friday of every month by the U.S. Bureau of Labor Statistics.

Analyzing The Non-Farm Payroll

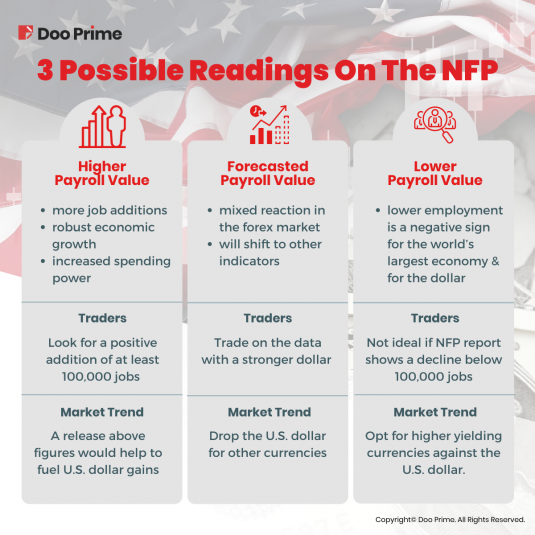

Let’s take a look at the 3 possible readings for the non-farm payroll data:

- A higher or positive data is overall a good sign for the U.S. economy. The higher payroll means that there are more job additions, and this contributes to a robust economic growth whereby consumers have spending power.

With this, forex traders and investors would look for a positive addition of at least 100,000 jobs per month as a release above that figure would help to fuel U.S. dollar gains. At the same time, a value better than the forecasted value would also have the same effect.

- A forecasted value of the payroll would result in a mixed reaction in the forex market. Thus, forex traders seeing a forecasted change in the non-farm payroll data will shift to other subcomponents or indicators to gain an altered direction or insight. These alternatives include the unemployment rate and manufacturing payrolls.

As a consequence, if the unemployment rate falls and manufacturing payrolls rise, forex traders will go along with a stronger dollar, which is a positive sign for the U.S. economy.

However, if the unemployment rate were to increase and the manufacturing jobs decline, traders will drop the U.S. dollar for other currencies.

- A lower payroll data would be detrimental to the U.S. economy. Like all other economic reports, a lower employment picture will be a negative sign for the world’s largest economy and for the dollar.

On the condition that the NFP report shows a decline below 100,000 jobs (or a lower than expected data), it signifies that the U.S. economy is not growing. Thereby, forex traders will opt for higher yielding currencies against the U.S. dollar.

How Does The Non-Farm Payroll Impacts Investors & The Markets

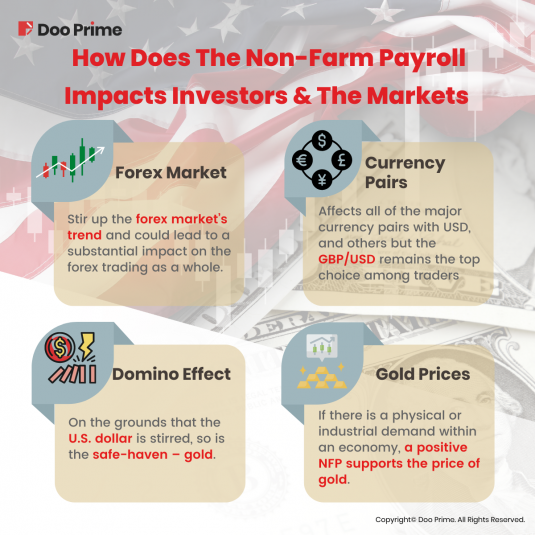

With the readings above, we could say that the non-farm payroll releases essentially stir up the forex market’s trend and could lead to a substantial impact on forex trading as a whole.

The reason why non-farm payroll data affects forex trading is that the job numbers are closely connected to the ups and downs of the economy. Ultimately, when the job numbers are increasing, market sentiment tends to rise as consumers have more disposable income to spend.

Over and above, the NFP mostly affects all of the major currency pairs, including EUR/USD, USD/JYP, GBP/USD, AUD/USD, USD/CHF, and others but the GBP/USD remains the top choice among traders.

On the grounds that the U.S. dollar is stirred, so is the safe-haven – gold. As the value of gold and the dollar share an inverse relation, it only makes sense that traders or investors will turn to gold during the downtime of the dollar.

In this case, should there be a sign of physical or industrial demand within an economy, a positive NFP supports the price of gold. On the other note, one can expect the prices of gold to move differently from the dollar according to the labor information.

Impacts Of The Non-Farm Payroll On The Market Trend

Analysts, traders, to investors – these are parties that study the NFP results. And even in the event that the result comes in line with the forecast, it could still cause large rate swings.

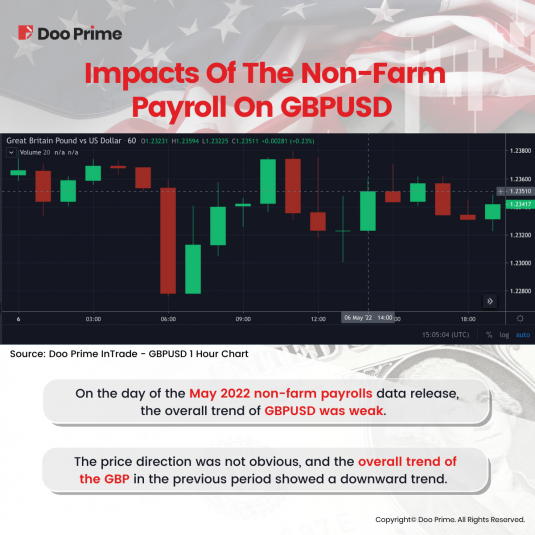

On the day of the May 2022 non-farm payrolls data release (6th May 2022), the overall trend of GBP/USD was weak.

The price direction was not obvious, and the overall trend of the GBP in the previous period showed a downward trend.

As a result, the GBP showed a weak bottom before and after the release of the non-farm payroll data.

This is due to both the strong employment data performance in the U.S. at the time to put pressure on the GBP to limit its upside, but also because the performance of the current economic situation in the United Kingdom is not ideal.

During this interval, the market generally expected the British economy will be under pressure to the downside.

As the uncertainty of future global economic development increases, the attractiveness of risky currencies is weakened.

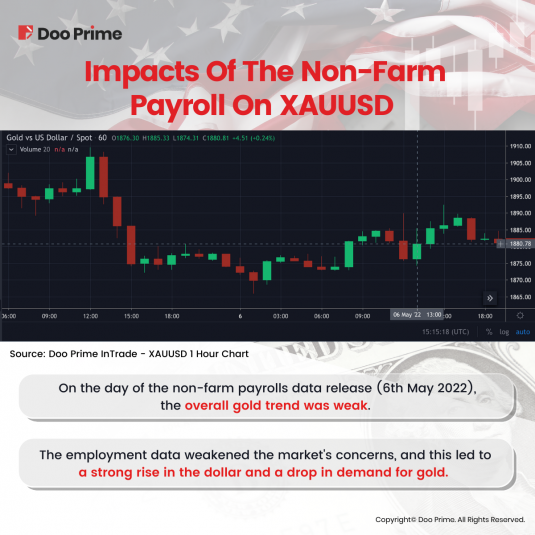

On the day of the non-farm payroll data release (6th May 2022), the overall gold trend was weak.

In the context of the Fed’s interest rate hike, the performance of the employment data weakened the market’s concerns about the negative impact on economic development after the interest rate hike. This has led to a strong rise in the dollar and a drop in demand for gold.

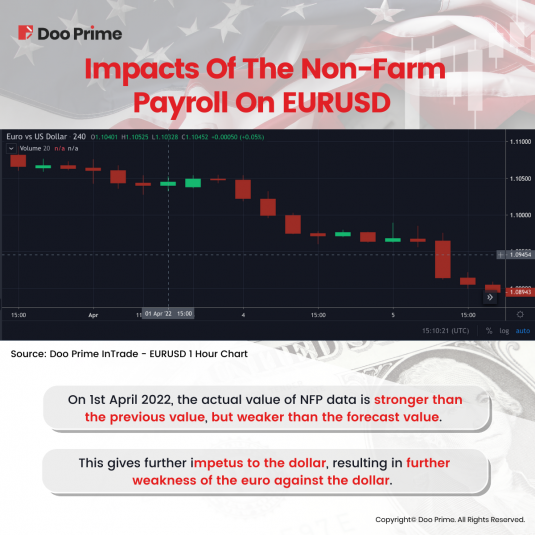

On 1st April 2022, the actual value of non-farm payroll data is stronger than the previous value, but weaker than the forecast value.

This indicates that the U.S. employment data performance is still relatively healthy. Overall, it is still under a positive growth trend, just enough to reach the forecast value. This gives further impetus to the dollar, resulting in further weakness of the euro against the dollar.

What’s Next

The May 2022 U.S. non-farm payrolls increased by 390,000. Although it exceeded expectations by 325,000, but it was the smallest increase since April 2021. The previous value was revised up from 325,000 to 436,000.

Through this, the U.S. dollar currency index (DXY)rose close to 29 points in the short term before falling back.

The forecast value for June 2022 non-farm payroll report is at 310,000 with a previous value revised to 436,000.

With this, will the June report see a better than expected value and continue its increase?

The release of the non-farm payroll creates an opportune environment for active traders as it provides a tradable window by speculating on the direction of the data.

With every NFP forecast and release, the report is unquestionably crucial monthly data that investors can use to gauge their trading decisions. However, it is one of the toughest to incorporate in trades.

Although it contains plenty of essential data, the information on wage inflation, job growth rates, and unemployment are the core elements that investors rely on.

Keep an eye on all of the non-farm payroll reports, forecasts, and updates on DooPrimeNews.com and plan a step ahead on your trades.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.