In the world of precious metals, gold is the king. However, its cheaper cousin, silver, is now making headlines as prices rallied more than 10% in a week.

This surge has ignited discussions about a potential “silver squeeze” similar to the move back in 2020.

It is extremely rare to see such momentum and relentless buying day after day. This usually means that something big is about to happen.

Silver has caught the attention of investors and market analysts alike.

This article explores the recent rise in silver prices, the risks and rewards of investing in silver, and if now’s a good time to buy.

A Bullish Run for Silver

Gold has undoubtedly been the star of the show lately, with prices climbing to new highs basically every day since the beginning of March.

However, the current gold-to-silver ratio sits at a historically high level of 84 to 1. This suggests that silver is significantly undervalued compared to gold, and there is potential for significant upside in the silver market.

This disparity presents a potential opportunity for investors who fear they’ve missed the boat on gold.

By investing in silver, they can still gain exposure to the precious metals market with a potentially higher upside due to the lower price point.

Another factor impacting the high demand for silver is rising inflation. Fueled by the recent years of aggressive quantitative easing by global central banks, this inflation erodes the value of traditional currencies, as explained by market analyst Fawad Razaqzada.

Is Inflation Coming Back?

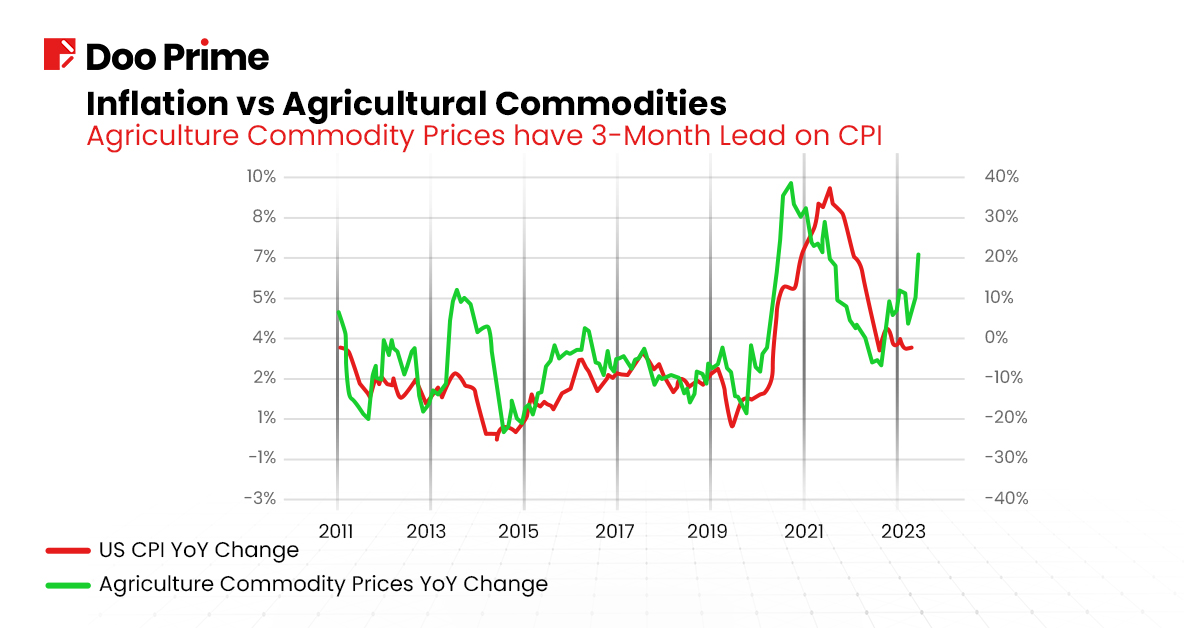

Agricultural commodities are now up 21% annually. Historically, it has a 3-month lead on CPI.

The recent surge in silver prices has the potential to significantly impact global inflation, leading to a substantial rise in food prices.

It’s worth noting that there’s a strong correlation between agricultural commodities and the equal-weighted commodities index. This suggests that the prices of other natural resources may also increase in a similar upward trend.

The battle against rising consumer prices seems far from over, and a potential policy change by the Fed could further intensify inflationary pressures.

There is a reason why gold recently spiked to record levels and silver is following the trend. And in our view, these bullish moves could be just the beginning.

Investing in Silver in 2024

While the recent price surge and talk of a squeeze are captivating, it’s crucial to approach silver investment with a measured and informed strategy. Here are some key considerations:

- Market Fundamentals: Understand the factors driving the demand for silver, both industrially and as a precious metal.

- Long-Term Perspective: Silver’s industrial applications, particularly in the green energy sector, suggest long-term growth potential.

- Volatility: Be prepared for price fluctuations. Silver is a more volatile asset compared to gold.

- Investment Strategy: Diversify your portfolio. Consider including a portion of silver alongside other asset classes.

- Physical vs. Paper Silver: Weigh the pros and cons of investing in physical silver or silver futures contracts. Physical silver offers tangible ownership but comes with storage costs, while futures contracts provide leverage but involve higher risk.

It is important to consider the risks associated with investing in silver. After such a strong run, there is always the risk of a shake-out, as investors take profits, and the market consolidates.

Silver Going to $50 in 2024?

Technical analysts point out that silver is currently overbought, which could lead to a short-term correction. Additionally, the silver market is relatively small and can be more volatile than gold, making it a riskier investment.

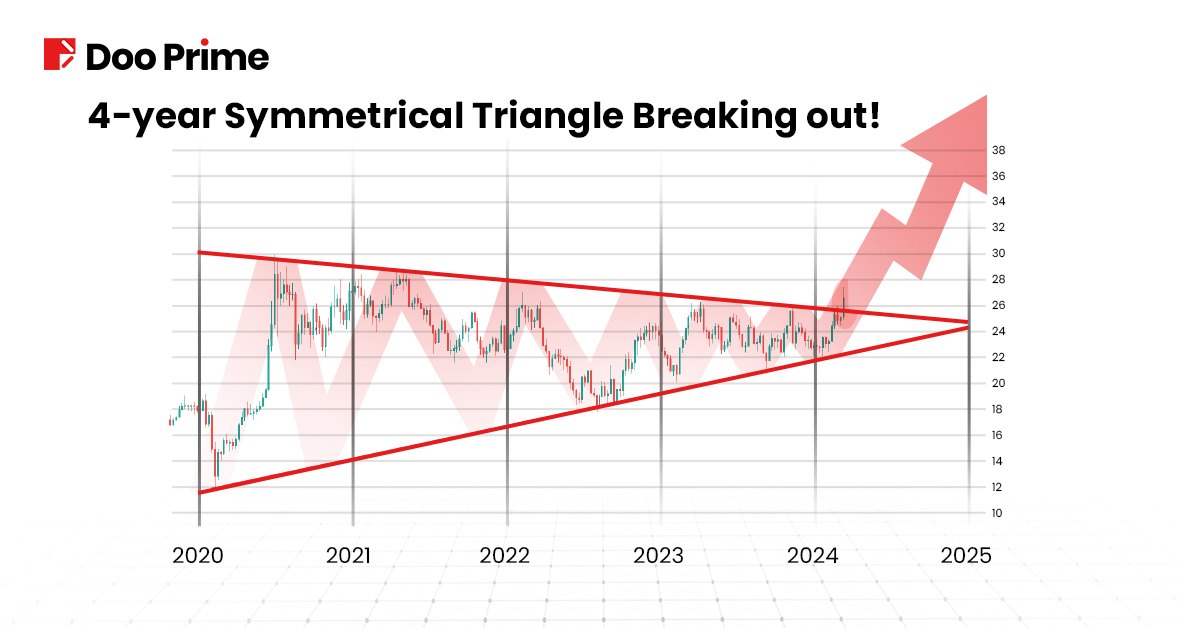

However, despite these risks, the long-term outlook for silver remains positive. The consolidation in silver prices since August 2020 has formed a symmetrical triangle pattern with a bullish breakout. This could support significant potential upside from here, with a lot of short-sellers getting squeezed. With gold also performing well, investors who are concerned about having missed the gold boat could consider silver as an alternative.

Once momentum picks up, we could potentially see the silver price rallying towards $50 and gold to $3000 by the end of this year.

In conclusion, while there are risks associated with investing in silver, the potential rewards are also substantial. For investors looking to diversify their portfolios and hedge against inflation, now may be the right time to consider adding silver to their holdings.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and the client should therefore be prepared to suffer significant losses when using such trading facilities.

Please ensure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to learn more.